Holly's Blog: Am I being rinsed?

22 Nov, 2019

This week in the blog there’s a detailed look at what you should expect to pay for financial services and products, and an early prediction on the results of our important national poll.

Fund manager blues

Another blow this week for the collective reputation of fund managers, as Janus Henderson is fined nearly £2 million for not treating retail customers fairly.

The group had two funds, both of which used to have an element of ‘active management’ – a human making decisions to try and beat the pack. But in 2011 a decision was made to change the management style to entirely passive.

Passive management removes the ‘clever’ humans and reverts to the robots and algorithms, which just buy the largest shares in proportion to their relative overall size within an index. So – for example – as at today, Microsoft is the largest US listed firm and is 4.4% of the S&P 500 index. So if you invested £100 in a passively run US shares fund that tracks the S&P, essentially £4.40 of that would be spent on Microsoft, regardless of whether the fund manager in question thought it was a good, bad or indifferent investment.

Because algorithms don’t have expensive tastes, they are paid less than active managers and so should theoretically be cheaper. But here’s the rub. The Janus Henderson retail investors kept paying the old and higher fee amounts on the Henderson Japan Enhanced Equity and Henderson North American Enhanced Equity funds for nearly five years after the style had been changed. Institutional investors were kept in the loop and did have their fees lowered. But retail customers didn’t get the same treatment. Almost unbelievable.

Am I being rinsed?

People ask me all the time what they should pay for financial services and products. Of course everything has its nuances but I thought it would be helpful to share some rules of thumb. Here goes. (Disclaimer: Life is complex. Products vary. So does service. This is illustrative!)

Investment funds (active) – a bog standard average amount to pay for an ‘active’ shares fund is about 0.80% in what is called an OCF (Ongoing Charges Figure). This pays for the fund manager’s brainpower and all administration costs of running the fund.

On top of the OCF are transaction fees which vary wildly depending on who is managing the fund and where the money is invested. It could be 0.1%. It could be 10 times that.

Here's an example. The Lindsell Train UK Equity fund, which has relatively few shares and where the manager doesn’t tweak and fiddle much, has transaction costs of 0.08%. Whereas the First State Global Listed Technology fund has higher transaction costs (which kinda makes sense) – these are 0.37%.

Investment funds (passive) – a simple UK passive shares fund shouldn’t really cost more than 0.1% – that’s what you’d pay for L&G’s UK 100 Index fund.

A passive fund which is a mixed bag of assets from all around the world – known as a passive ‘multi-asset’ fund – will cost about 0.2% - 0.25%. For example, the Vanguard LifeStrategy 80% fund costs 0.22%.

If you have a fund which is described as passive or even ‘enhanced’ – or one which pretends to be active but in fact exactly maps to the wiggly line of its ‘index’ on a factsheet over a few years – then you should question it if you are paying above 0.25%.

Investment platform/administration – if you’re a DIY investor, as well as paying for any funds (per the above) you will also pay a platform fee. This is like paying to access the shop which carries the (commission-free) products on its shelves. Fees will typically range from 0.35% - 0.50%. Some now charge a fixed annual £ amount which is better for those with more than about £50,000 – from a pure cost perspective.

Robo advice – this is where you get both the administration and investments rolled into one. All managed for you like a ready-meal. Costs will typically be about 0.8% - 1%.

Financial advice – expect to pay about 0.75% - 1% for ongoing financial advice a year. This is on top of administration/platform fees and the fees for any funds used.

If you use what is known as a discretionary investment management service (The ‘Big Boys’ like St James Place, Quilter Cheviot, Brooks Macdonald, Brewin Dolphin etc) then expect to pay about 2% all-in every year. This includes financial planning, administration/platform and investment management and funds.

You’ll pay more for Year One as the planner will typically do a lot of work in reviewing where you are and what you have today, and setting up your account and plan. Initial advice fees can be around 3%. St James Place has exit fees which it calls something else. I don’t like these and don’t think they are fair.

Finally – one of the things I think is most disgraceful at the moment is the amount some of these guys are charging for transaction fees. Have a look at your statement. If you are paying amounts like 0.75% for transaction fees (which I’ve seen on a statement just this week), challenge it. If you are buying bog standard stuff on bog standard stock markets, and not Guatemalan coffee or complex Vietnamese infrastructure assets, then in this tech day and age those sorts of transaction fees are simply a fudge. Ask for an explanation of why it costs them so much to buy and sell things.

I hope these are helpful rules of thumb. If you have any more questions, feel free to send them in (mailto:info@boringmoney.co.uk) and we can tackle your questions in future articles on this.

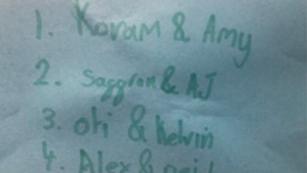

As a final thought, it’s getting close to that time of year when we get the results of that most important national ballot. The chance for us Brits to have our say. Yes, the Strictly Come Dancing winner. There’s debate and dissent in our house – here’s what the ‘Rug Rats’ think.

I’m going for Karim. And the lady with huge eyebrows in the Apprentice. And as for that other national competition – ooooooooof #wordsfailme #letssavethatforanotherweek

Holly