Lesson 6: Why ISAs are the no-brainer for most of us

The below 8 minute audio file will tell you everything you need to know about an ISA to get started with confidence.

ISAs are lovely! They keep your savings tax-free. We can all put from £1 (in some) to £20,000 a year into a cash and/or stocks and shares ISA each year.

Don’t forget the pension too

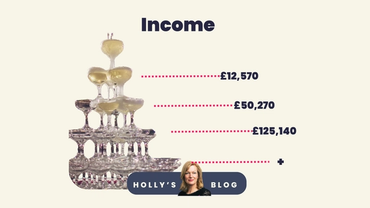

If you want easy access to your money, and have no material investments elsewhere, ISAs are the no brainer account for beginners. Although do consider the benefits of a pension alongside the ISA – sure your money is locked away till you are 55+ BUT you get nice freebie top-ups from the Government in a pension. For example, a basic rate taxpayer will get 20p from the Government added to their pension account for every 80p they pay in. There are Ts and Cs attached so read up on this but pensions are a compelling saving vehicle for those with longer timeframes – especially higher or additional rate payers who get even more generous tax relief.

ISA – your flexible friend

The ISA versus a pension is not an either or decision. Any money you can set aside until you are 55+ could go to a pension. And ISAs give you that access and flexibility for money you might need sooner.

Listen in for details, facts and some cunning tips.