10 tips to save money and sort out your savings

By Holly Mackay, Founder & CEO

5 Jan, 2024

A very Happy New Year to all our readers. I have started this year on a high, successfully completing Dry January 1st. Feeling very proud of myself. Continuing with the ‘winner’ theme, I’m sharing 10 things here we can consider to save money and get our money into better shape. From tax to mortgages; stock markets to pensions. Here goes.

1. Online Tax Time – don’t be late

Deep joy. If you complete an online return don’t forget this is looming. Returns can be submitted online until 31 January 2024 and fines start from a cheery £100 if you are just one day late, with further penalties the longer you delay. If you are a higher rate taxpayer, read the pensions stuff below for how you can get a tiny feeling of victory and reduce your bill this time next year.

2. Be Scam Alert - try not to let yourself be rushed

Scammers are alert to the 31st Jan deadline. We immediately become more vulnerable to scammers shouting at us to do things now before we get fined or put in the stocks. Pause, phone them back from numbers published on known websites, breathe. Is it really HMRC behind that text?

3. Mortgages – is it time to get a quote?

Rates have already fallen this year and over 10 providers have announced lower deals this week. As an example, TSB popped into my inbox yesterday offering 4.44% for a 2-year fix for a remortgage. And HSBC is the first ‘Big Six’ lender to offer a 5-year fix at less than 4%. With 1.5 million households on a fix coming to an end this year, get a broker to shop around for you and consider getting no-obligation quotes six months out.

4. What’s in your ISA or pension – a well-groomed collection or a ragtag bag o’ spanners?

If you manage your own collection of funds or shares, we should all consider three things:

A) What are my timeframes? What is this savings pot of money for? Will I need the money sooner or later? And if so, do you need to dial up the ‘safer’ cash-like assets OR dial up the exposure to shares? Very loosely, if you’re saving for 10 years plus, you should have the majority in shares. And if you will need the money in 3 years’ time, it should mostly be in cash or cash-like things such as bonds.

B) What is your asset allocation? Roughly. 2023 was a strong year. Bonds did well; 7 large tech firms with AI wind in their sails drove the US market higher; India soared. A key point is that things moved. A lot. So the % allocations in the average ISA today will be very different to how they were 12 months ago.

Why? Well, if you own 4 things each worth a fiver, and then one becomes worth £10, that becomes a proportionately bigger slice of your wealth pizza. So you may be more reliant on it than you’d like. Is one slice of your wealth pizza now too big?

C) Have you got any dodgy funds? I find it helpful to use an independent research site like Morningstar to check the ratings of funds I hold. Or to read the latest research notes on investment platforms. The question here is not just ‘Has it gone down?’ because every sector will have a bad year. But ‘Has it gone down more than its peers for no justifiable reason?’ and that’s what fund analysts can help you to suss out.

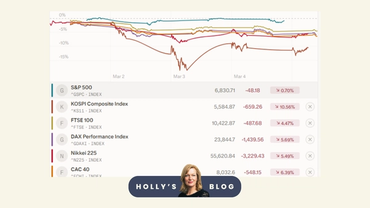

5. Are you in the right sectors – what will do well in 2024?

In terms of what sectors to favour, the main bets we make will be whether to ease off on the US or not. Is the UK going to shake its reputation as a dull, low-growth market? Which regions might add spice? Japan’s improving corporate governance is driving some strength and India is having a surge. China remains unloved and it’s not clear to see when things might turnaround.

Here's unloved in numbers. Since January 2019, US large cap stocks have gone up by 107%. Chinese equities have fallen by 17%. Contrarians may like a long-term bet on China if you’re patient.

And bonds became unusually hot in 2023. If we lend money to the US Government for 10 years today (a US 10-year Treasury bond), it's paying 3.9% a year AND if interest rates fall as expected, the price of these should go up too. When economists talk about ‘extending duration’ (as they will at the moment), they just mean getting more of these long-term bonds and ditching some of the shorter-term ones.

I can’t be bothered to try and keep up with all this – I’m no bond trader. If you want someone else to worry about all that duration wibble and timeframes for you, pick a ‘tactical’ or a ‘strategic’ bond fund and leave it to them. I have the Invesco Tactical Bond fund which does a decent job.

6. Don’t be afraid to sell any rubbish – sometimes you have to cut your losses

We’re all guilty of it. “Oh I’ll just wait till it’s worth what I bought it for, then I’ll sell it.” I know. But think ‘opportunity cost’, my friends. What are you missing out on instead as that old wheezy dog sits there? I gave myself a stern talking to in about October, ditched a China fund, switched it into India and it’s up 10% as the China fund fell by 10%. Fiddling around like this is not always a good idea as you can spend your life chasing yesterday’s winner. But if something is just languishing, one thing I do know: momentum is powerful in stock markets and when something is moving, it moves. If something is stagnating, it stagnates.

Waiting for something to get back to what you paid for it can be like waiting to get back into the jeans you wore 20 years ago. Dream on, baby.

7. Don’t pay more tax than you need to – love your ISA and pension

Despite a National Insurance reduction this month, the tax squeeze is ongoing. And it’s not just income tax threshold freezes. From 6th April, the amount of gains that can be realised tax-free each year will be halved to just £3,000 (down from £6,000 this year) and the amount of dividend income that can be received tax-free will be cut to just £500 (down from £1,000 this year). This does not apply to money sheltered in ISAs or pensions.

If you have investments outside an ISA and pension, remember you can do something odd called a ‘Bed and ISA/Pension’ which basically means selling the assets and shoving the money over into the lovely tax-free ISA (or pension) and buying them back. So you can use your allowances without needing any cash. And minimise any future tax whammy. Ask your investment platform if they’ll do it for you and just keep an eye on any capital gains tax this might incur.

8. Can you use any of your unused annual pension allowance to cut next year’s tax bill?

Raid the kids’ piggybanks. Look under the sofa. Transfer cash savings or shares into a pension? Marry a 128 year old oligarch?

You can save up to your annual earnings or £60,000 (whichever is the lowest) into your pension every tax year. However, if you have any unused allowance from the previous three tax years then you can also make use of this. The best case scenario for those with a spare wheelbarrow of cash – you could pay up to £180,000 into your pension and benefit from tax relief – as you would be making use of this year’s annual allowance of £60,000 and the previous three years where it was set at £40,000.

9. Higher rate taxpayer? - don’t forget to actually claim tax relief on any pension payments

Higher earners. If you pay into a pension, you MUST claim back relief in your tax return or you won’t get the second slice of this. But the onus is on you to claim this so don’t forget!

The first slice – basic rate tax relief will usually be added by your provider when you pay into the account. This applies to all taxpayers at any level. So £80 becomes £100. Ta da. Second slice – if you are a higher or additional rate taxpayer, you probably need to claim the extra 20% or 25% tax relief through self-assessment – if your pension is set up under what is known as ‘relief at source’, so check. This is where the £80 (now £100 – ta da) will reduce your tax bill by another £20 or £25. Higher rate taxpayers can read more on this and other tax saving tips.

10. Is your spouse’s tax allowance the hottest thing about them?

A married couple has two sets of allowances which can be used – two ISAs, two capital gains exemptions, two Personal Savings Allowances, and two dividend allowances. Tax savings can be made by transfers of cash or investments to the lower earning partner. For example, under the annual Personal Savings Allowance, basic rate taxpayers don’t pay tax on the first £1,000 of interest received on their savings accounts each year, whereas higher rate taxpayers can only receive £500 of interest tax-free.

However, do bear in mind that when your transfer assets to your spouse, they become the full legal owner of those assets and can then run off with the tennis coach.

Phew! There you have it. 10 ideas for cutting tax and sorting out your savings, to get you off to a flying start in 2024.

Have a great weekend everyone,

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login