Trump Dump Slump and Pump

By Holly Mackay, Founder & CEO

23 Jan, 2026

Led by the cute older Silver Fox that is Canada’s Mark Carney (is it just me, readers?!), the Western world has had to question its strategic alliances this week. The existential crisis gripping us all is - are we Team Brooklyn or Team Victoria?

Aside from the Beckham’s family drama, Trump’s tariff threats on Truth Social last weekend created yet another volatile week in the stock market.

The malaise started on Monday after European companies – including big brands such as BMW and luxury goods maker LVMH – fell when markets opened. These companies all do big business in the US and stood to lose out if Trump went through with threats of 25% tariffs on eight European countries from June.

When US markets opened on Tuesday, Trump’s threats saw markets slump and gold soar to fresh new highs, as some dumped shares and sought out the financial comfort blanket that is gold.

However, once POTUS was on the ground in Davos, things pumped back up on Thursday, as it appeared the tariff threat had disappeared again, Trump ruled out the use of military force, and global leaders superficially kissed and made up.

Why investing is actually pretty easy…

Lots of people are made to feel dumb about money by the pointless jargon and gobbledygook used by the industry. However, this week makes a classic case for what I’ve always felt. Namely, that behind all the Billy BS, the core drivers of markets are not rocket science to understand, and are often more about human emotion than Maths.

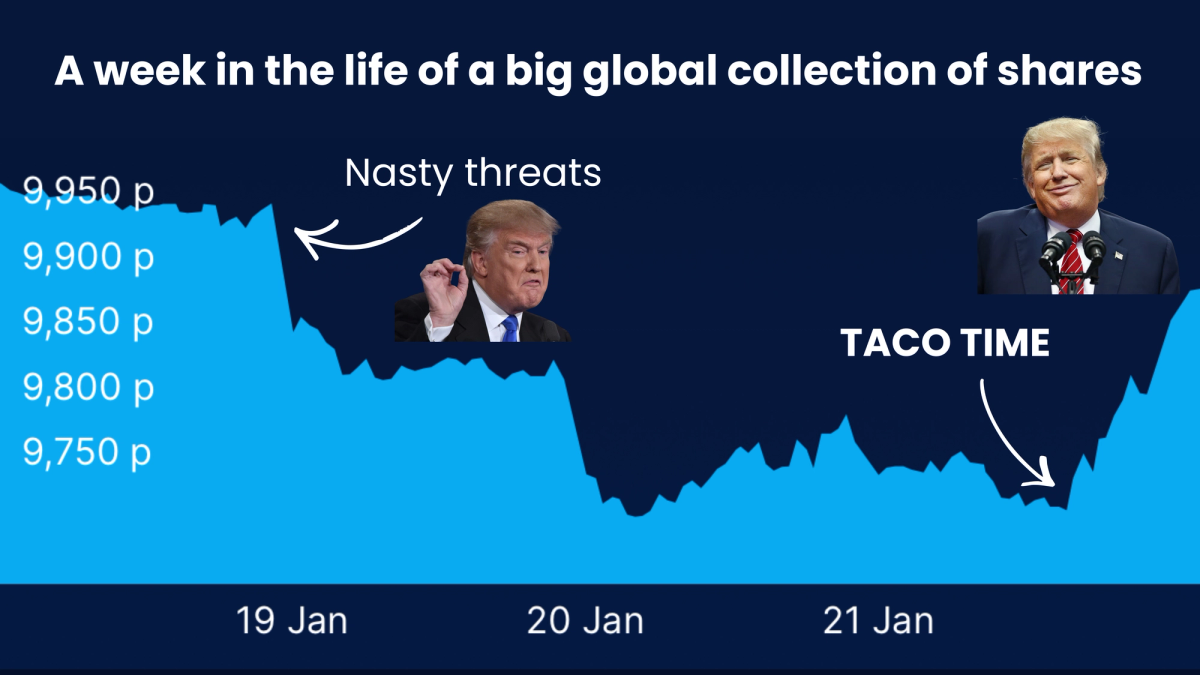

Have a look at the graph below to see what I mean. This shows what happened to a Pick’n’Mix of the world’s biggest shares (known as the MSCI World Index) this week.

Trump gets narky over the weekend. Global stock markets have a panic attack and fall. Then Trump Chickens Out on Wednesday and Thursday in Davos, and everyone says, “Oh, good, it’s all going to be fine again. ”And markets go up. It’s just a big old barometer of sentiment, which gains momentum on the ups and the downs.

The chart this week for gold was almost a mirror image in reverse. Trump gets narky. Yikes. Don’t like him, don’t trust capitalism, it’s the death of the old world order. Sell shares on Monday and Tuesday and buy reassuringly tangible gold. Gold jumps to a fresh high.

The very different behaviours of gold and shares are why people like me bang on about diversification. So, when one thing tanks, hopefully another thing goes well, and we smooth out the ups and the downs of any one thing. And behind all the Wizard of Oz curtains and cloaks, that’s basically all that anyone in portfolio management does.

To the Kospi Kreme of markets…

As gold nudges $5,000 an ounce, another standout performer has been South Korea’s Kospi Index, which I covered a few weeks ago. This grew by nearly 2% again this week, breaching the 5,000 mark for the first time yesterday. Why? Think AI – South Korea is home to pivotal chipmakers Samsung Electronics and SK Hynix.

Tax Time

On a final note, a reminder for any higher rate taxpayer readers. The self-assessment tax deadline is next weekend. Joy. If you have made any private pension contributions, you need to pro-actively claim back tax relief by filing a return. It does not automatically happen. If in doubt, you can learn more here. And do check it – you can also go back for up to four years.

A new job for Trump?

I think Donald Trump has missed his calling as the Gina Ford (bossy baby ‘guru’) for teenagers. This weekend, I’m going to start deploying his tactics at home.

I’m going to tell my teens that I will sing and dance to the Macarena and put up baby photos of them in the hallway every time they have mates around, unless they empty the dishwasher daily, clean the car, and cook me supper twice a week. Then I will back down if they empty the dishwasher once. Genius.

Have a great weekend, everyone.

Holly

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.