Bah humbug as Vanguard rolls out the Scrooge

By Holly Mackay, Founder & CEO

13 Dec, 2024

News out yesterday from Vanguard about a Scrooge-y increase in their charges from January next year has ruffled many feathers. Vanguard has a huge, almost cult-like following of those who like the low-cost approach for which they're famous. You never really had to think about costs with Vanguard – you knew they would pretty much always be amongst the cheapest.

Not any more – if you have less than £32,000 invested with them. Bah humbug! Let’s look at who might be better options in the new revised pecking order.

From January, for those who pick and choose what to have in their ISA, there will be a minimum annual fee of £48. (unless you pick their Managed ISA. This is the ‘ready meal’ option where you have no choice and basically tell the folks at Vanguard to get on and do it all for you. If you want this option, it’s still pretty cheap at 0.51% all-in. With no minimum).

What’s going on? A few years ago, everyone was charging around shouting about Free this, and Lowest that, and No Charge gimmicks over here. But then someone miserable up the food chain coughed and observed that this wasn’t a popularity contest and someone had to actually make some money. And Vanguard has realised it has been the cool kid with all the girlfriends… but no money to actually take them out. So up go the fees.

Some readers will be considering a move in response. Here’s an example of the sort of mail which landed in the Boring Money mailbox yesterday:

Having been a Vanguard fanboy for a while, I’m disappointed to see their charges increase – this will affect smaller investors disproportionately. I’m not affected but it has changed my view significantly (I have recommended countless people to start investing even small amounts with Vanguard). I’m currently now actively looking at splitting holdings out of Vanguard and would value a BM review of different providers in light of the new charges.

Your wish is my command.

The first and increasingly important question we all really need to ask when choosing a place to invest is how much choice we want to have. Here’s my multi-choice which will help you to work out where’s best for you.

OMG, I just want to watch the Strictly final/Day of the Jackal and would rather die than pick and manage a collection of investments.

I’m quite keen to pick some low-cost index funds or ETFs to spread my investments around things like the S&P 500, a global index, maybe some emerging markets and a few sector picks.

I want a mix of shares and funds from a selection of the world’s leading fund managers.

If you picked a) and just want someone to do it for you, Vanguard’s Managed ISA remains a good option. I also think that Monzo and Nutmeg are worth a look, particularly for accounts with less than £30,000.

If you’re b) and want to pick a blend of low-cost tracker funds and ETFs, and have a smaller portfolio, then AJ Bell and Barclays are low-cost choices. InvestEngine are worth a look for ETF fans as they don’t charge core admin fees for these. Also – to be clear – if you have more than £32,000 invested with Vanguard, there is no cost reason to change.

And for beginner investors, or those with smaller accounts, who want some choice from a range of managers (not too much) and low fees, have a look at AJ Bell’s Dodl. Those with larger accounts (£100k +) who want to trade ETFs will still find InvestEngine, Trading212, iWeb, Freetrade and Halifax low-cost options and then chuck interactive investor into this mix if you want funds and decent research too, or Saxo if you want the trader experience.

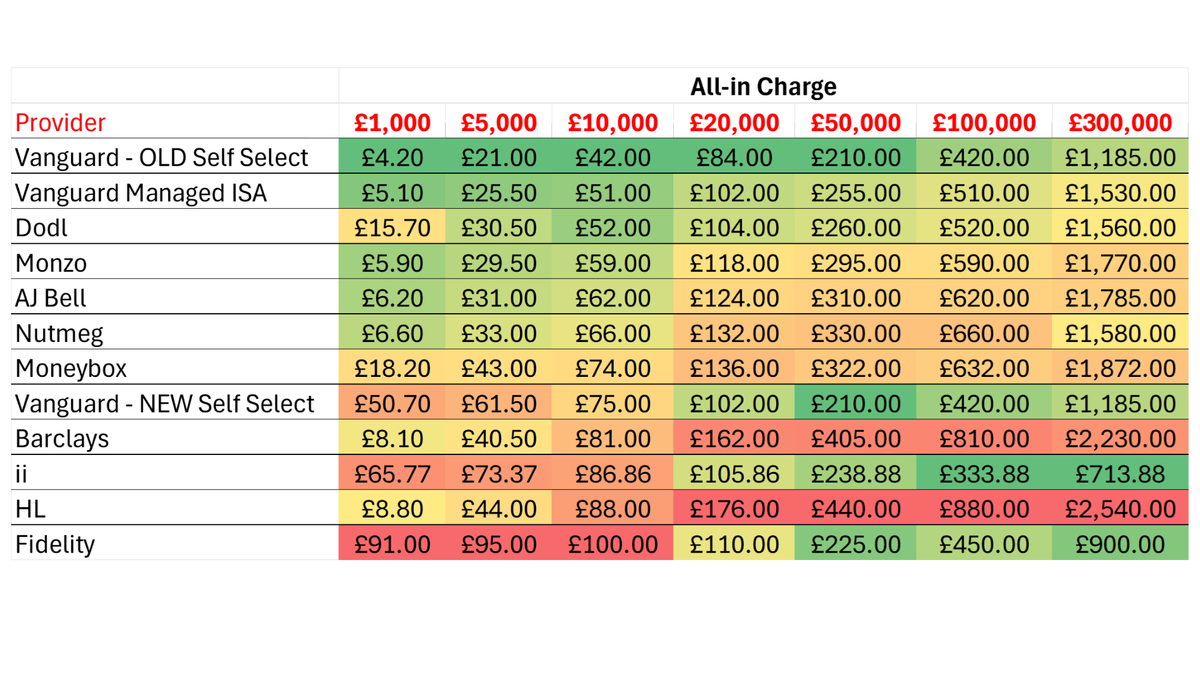

The picture below shows the revised pricing landscape for people choosing investment ‘ready meal’ ISAs from providers – the all-in options, which include investments and admin for those picking option a) above. We’ve a fuller write-up including details of the precise options modelled here or you can read our detailed review of any of the providers mentioned here in our ISA comparison tables.

All-in annual costs for a ready-made ISA

If you don’t want the ready-meal and prefer to blend your own, we have content this week on Japan from JP Morgan and a new article on the investment outlook for 2025, with a focus on tech and AI trends. Or you can learn more about ETFs which hit record levels in 2024 as they become increasingly popular with investors.

Over and out for this week, folks. I will be entering a mild start of panic about the lack of Christmas shopping done, and wondering if breaking the Boring Money Christmas tree at our party last night equates to 5 million years of bad luck?! I will also watch the Strictly final having been a very distant observer until now, and of course there is Day of the Jackal to dive into tonight. Time to start eating chocolate, watching TV and guzzling wine in earnest. FAB.U.LOUS!!!

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login