Budget Time - winners, losers and the tax drag

By Holly Mackay, Founder & CEO

8 Mar, 2024

For those of you who have been hanging out on the moon, it was Budget week. The Chancellor wanted to buy the electorate a flashy meal with truffles and champagne, but only had twenty quid in his pocket.

In short, the ‘winners’ were middle-income earners, parents earning between £50k and £80k, higher rate taxpaying second homeowners, and investors who already max out their ISAs. The losers were owners of holiday lets, ‘non doms’, the very wealthy and pensioners. Here’s my take of what you need to know.

Who will be better off?

National Insurance cuts for workers – Although this is the poor relation to Income Tax in Budget popularity competitions, another 2p was shaved off NI. For someone on £40,000 that delivers a saving of £549 a year in addition to the cuts already seen in January. For higher rate taxpayers it’s a saving of £754. If we add January’s cuts to this week’s cuts, the average earner will save about £1,000 a year. This cut will benefit middle earners more than lower earners. And for the highest earners it will be entirely negated pretty quickly by the impact of frozen tax thresholds (more below).

Child Benefit boost for some - If any adult in the household earns over £50,000, your child benefit is gradually reduced and cuts out at £60,000 completely. The system is blatantly unfair – two parents could each earn £49,000 and get the full child benefit, and a single parent who earns £60,000 would get zilch. From 6th April, this threshold will increase to £60,000, so if the highest earning parent gets less than this, you will get full child benefits. And you get some benefit (but progressively less) up to £80,000. And then nowt. You can read more here.

Mega important point – if you are not currently working, and your partner is, make sure you are claiming any child benefits in your name. Claiming child benefit gives you an important National Insurance credit if your child is under 12, and this is a ‘token’ towards a future State Pension.

Higher rate taxpayers planning to sell a second home – The capital gains tax will fall from 28% to 24% from 6th April this year.

Who will be worse off?

Pensioners – Those who are drawing a pension and not working are impacted by Income Tax, not by National Insurance, and there were no breaks here. However with the ‘Triple Lock’ leading to an increase of £17.35 a week to £221.20 in the full new State Pension from April, there is a bit more money on the horizon.

Non-doms - Whilst I have some sympathy with the argument that non-doms throw fistfuls of tenners in their wake and add money to our economy, and we don’t want them to have a massive strop and move elsewhere, it is time this was modernised. The concept of a ‘domicile’ is like something from a BBC period drama. From April 6th 2025, the new regime will start to tax residents on income and gains in trusts after they’ve been resident for 4 years.

Those with holiday lets – From April 2025, there will no longer be tax allowances for spending on furniture and no tax relief on mortgage payments. Expect to see sales in Newquay’s Furniture World boom this winter as people do a final spruce-up before the changes. I also think this will be the final straw for some who will sell up.

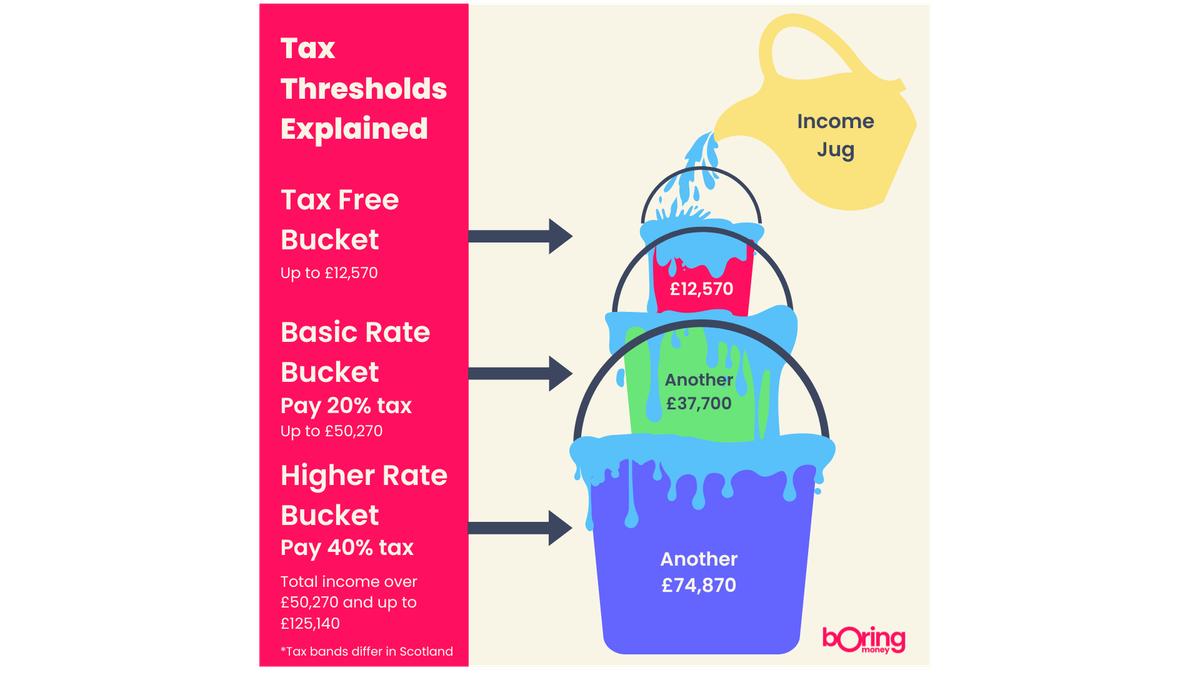

All taxpayers – This, my friends, is the unpalatable truth of tax threshold freezes until 2028. This sounds so dry and boring, it allows politicians to get away with it to some degree, but it will have more impact on our money than almost anything else. I’ve made a little picture below to illustrate this. Inflation will increase our income jug over the next 4 years. But the size of the buckets won’t change. So we’ll gradually all end up with more in the lower buckets. And pay more of our income in tax. (Apologies to readers in Scotland whose numbers are different but I couldn’t fit all your buckets into one image! The concept is the same).

And what else is looming?

A NatWest float heading our way... this means we will be able to buy shares in the bank as the Government say “Bye-bye, we don’t want to own you anymore”, after bailing out the lender in 2008. It all depends where they set the price as to whether this is good or not. Watch this space.

Readers may have heard about the British ISA which is being sketched out. It’s basically another different ISA account we will be able to put up to £5,000 into a year and buy UK-listed shares in. This will theoretically boost British businesses. But most people don’t get near their existing £20,000 annual allowance into an ISA anyway; ISAs are already head-bangingly confusing with yet another flavour adding to the choice headache; I spend my life banging on about not putting all your eggs in one basket so why should we just buy British shares which are mostly doing relatively badly? AND it just means the richest will just buy global shares in the ‘normal’ ISA and buy the British contingent in the British ISA. It won’t be a British ISA, it will be an Overflow ISA. I have a genius idea – why not just up the ISA allowance to £25,000 and be done with it?

The Chancellor did share an OBR view that inflation would soon fall under the 2% target. This is really good news for everyone with a mortgage or debt and should see interest rates fall this year as forecast.

You can read our fuller digest on the Budget and the points raised above here.

In final news, Happy International Women’s Day to all our women readers. Especially to my favourite lady, Mum. I love you and I wished you were the Speaker during the Budget because one effortless “Enough!” glance from you, or even a few choice words, would have shut the rude muppets up properly!

We released new data today confirming the Gender Investment Gap in the UK is a blistering £567 billion. That’s about the same size as the GDP of Poland or Argentina. It starts early – just 9% of women aged 18-24 invest compared to 22% of blokes. The best thing us older and more confident investors can do is to help younger men and women to open their first Stocks & Shares ISA – even if only with a tenner – and start the habit and ‘learn on the job’. Our Best Buys for Beginners 2024 are a really good place to start.

Have a lovely weekend everyone,

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login