Metaverse fatigue

By Holly Mackay, Founder & CEO

26 April, 2024

How jolly I felt yesterday to see a headline reporting on what former Trump pal, White House ‘stradegist’ and far-right sweetie pie Steve Bannon had to say. According to The Sun (another bastion of kindness and reason), Mr Bannon reckons that “Nigel Farage will be Prime Minister after Keir Starmer is swept away by a financial crisis”. At which point I want to curl up in a ball, draw the curtains and plug in the gin intravenously.

However, before Mr Farage apparently leads us to the ‘sunlit uplands’, let’s look at the implied freezing tundra we're on today.

The main story this week (as it will be for pretty much every week until an election is called) was AI and Mark Zuckerberg’s Meta has taken a pounding. Even if you don’t think this matters much to you, unless you live in a cave in Tibet, chances are you own Meta shares via your pension.

Meta (the artist formerly known as Facebook) makes up about 2% of the top 500 shares in the States. And for those of us not yet near retirement, it’s not daft to suggest that £400 in every £1,000 of your pension could be in these 500 shares. Or in other words, £8 of every £1,000 of your pension could be backing Meta.

If you add all the other Magnificent Seven tech stocks to the mix (such as Apple, Microsoft and Nvidia), that would be about £108 of every £1,000 in your workplace pension. So the performance of these guys impacts pretty much all of us.

So what’s up chez Meta? Put simply, they plan to spend a shed load of cash on AI. Despite announcing earnings of $36.5 billion in three months (pause for a gasp), they also told the market they planned to increase their annual spending on ‘capital expenditure’ from $37 billion to $40 billion. On AI.

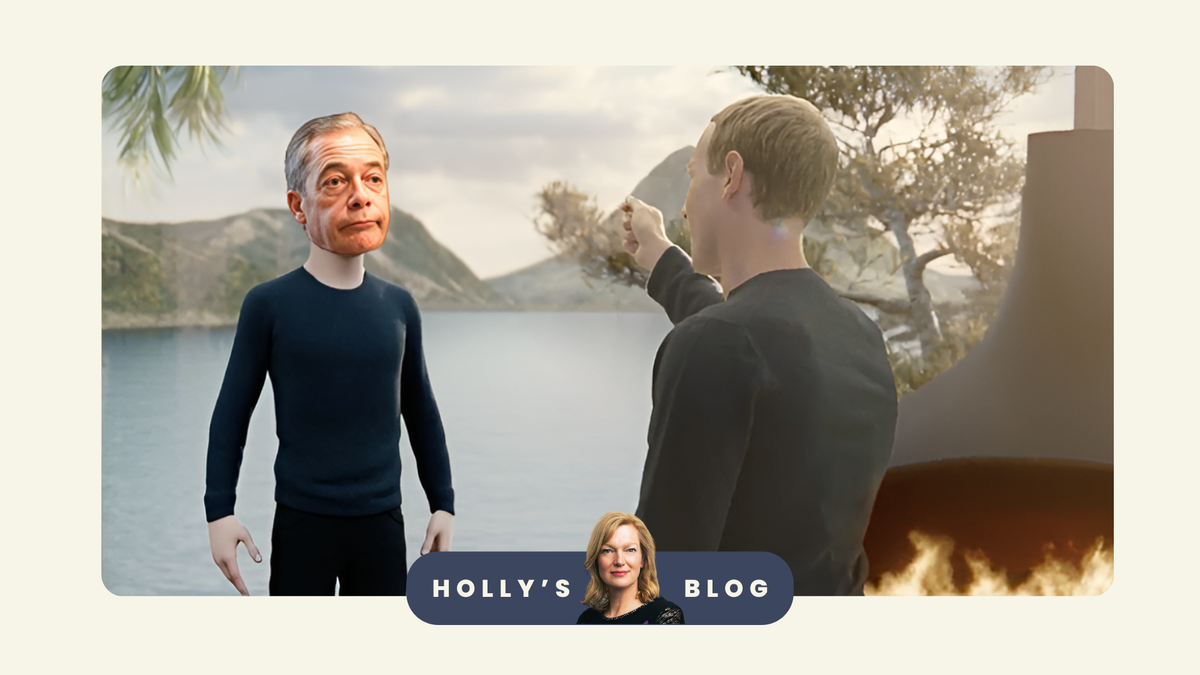

Mr Zuckerberg is still ploughing on with his longer-term ambition to build an avatar-filled metaverse, and our passport to this hell will be smart glasses with an embedded AI assistant. Maybe we could send him and Bannon/Trump/Farage to the metaverse and let them willy waggle together in a competitive frenzy as the rest of us get on with our lives in the boring old normal universe?

In other results, Alphabet (Google’s parent company) is set to surge past an almost incredible $2 trillion valuation as its first quarter revenue jumped by 15%. Yesterday, the firm announced its first ever dividend of 20 cents per share. Tech firms don’t normally pay dividends (sharing a fraction of a profitable company’s cash with its shareholders) because they're ploughing it all back into development or buying smaller interesting companies. Shares went up by up to 13% in after hours trading and should be strong today once markets open.

Microsoft also announced first quarter results and grew revenue by 17% in the quarter.

It’s a conundrum for investors. On the one hand, it’s blindingly obvious we are in overheated market territory. After the euphoria of 2020 and 2021 when things soared, we had bad markets in 2022 as people realised that inflation was going to rage and interest rates would have to jump (the S&P fell by about 20%), and then from January 2023 we went back to the party (the S&P 500 jumped by 24% and has been going up in 2024 too). But things don’t go up forever. There is also the grey shadow of regulators and lawmakers hanging over these firms.

The flip side to this logic is both FOMO and also the argument that maybe the growth prospects are genuinely bigger than they’ve ever been before, so our valuation rules need to change. Whilst Steve Bannon’s shrieks of impending crises are a touch dramatic, I also am cautious. This article on ‘Good stocks for hard times’ from BlackRock makes the point that the number of UK companies going bust hit a 30-year high in January this year, and reminds us of the broader tough environment we are in, aside from the AI fanfare.

And so what? Diversify my friends and don’t have too many eggs in the undeniably exciting AI basket. Make sure we build a cash buffer of at least 3 months’ salary so we don’t have to be forced sellers if we need some cash when markets are rubbish. And let’s start crowdfunding for one-way tickets to banish Trump ‘n’ Pals to the metaverse?

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login