Nivea, Space NK and Deep Heat

By Holly Mackay, Founder & CEO

31 Jan, 2025

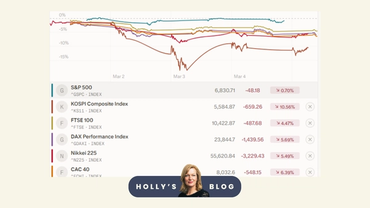

Good grief, a week is a long time in the stock markets! Did anyone else look at their portfolio on Monday night and feel a bit queasy?! This week has been like a bungee jump, with an alarming plunge on Monday, only to gradually come pretty much back up to where we started as I write today.

Let’s take a look at what’s been going on. On Monday, Nvidia’s valuation plummeted by nearly $600 billion and when a stone that large is thrown into the global stock market pool, there are some major ripples to contend with. Other tech stocks and energy stocks also took a big hit and markets across the world flashed red.

I have said the word Nvidia so many times this week that it has become a tongue twister. I actually found myself talking about Nivea to an Financial Times journalist. That was a good look. Almost as embarrassing as when I talked about Space NK to Bloomberg, instead of the unlisted SpaceX, a key component holding of the Edinburgh Worldwide Investment Trust. Well done me.

So. This week, markets were rattled as Chinese AI firm DeepSeek (which I will inevitably call Deep Heat soon, probably on live TV) claimed to be able to deliver similar results to US competitors, but at a significantly lower cost. Calling into question hundreds if not thousands of valuation assumptions, and causing panic across the globe. Were market darlings such as Nvidia as over-valued as many had begun to fear? The company's claimed advances in AI training and relatively small budgets have raised questions about the multi-billion dollar investments being made into AI infrastructure.

When I'm getting my head around all of this, I think it’s helpful to consider the potential around AI in 3 categories:

Retail investors are not giving up on the whopping enabler that is Nvidia and are holding their nerve, spending a massive $900 million on their shares this week with many taking the fall as the opportunity to buy some more. That takes nerves of steel!

The consensus view is that Monday’s fall was an over-reaction. Several analysts think the efficient training techniques DeepSeek employ may actually benefit Nvidia by reducing costs and accelerating AI adoption. For instance, software companies (providers) may be able to integrate AI features into apps without spending so much money to train models. But running the apps would still require hardcore chips, which could create more demand for Nvidia. Some Wall Street analysts have updated their forecasts since DeepSeek rattled cages last week and they think that Nvidia has further to go up.

On LinkedIn this week, Pat Gelsinger, former CEO of Intel, wrote:

The market reaction is wrong: lowering the cost of AI will expand the market.

Whatever your take, this week’s volatility did show how nervous investors are about current valuations. It’s always a good reminder to have your investment eggs in multiple baskets.

Those looking to diversify and take some tech exposure off the table could consider US small caps, for example, or investigate ‘equal weighted’ index funds. The FTSE 100 is going great guns and is on track for its best month since November 2022, assuming nothing odd happens this afternoon.

And finally, it’s a reminder for us all to make sure we prioritise having at least 3 months’ income in easy access cash and to have a clear timeframe for different investment pots. You may want to have some cash, some less spicy investments for a 3-5 year timeframe and then think about a more volatile collection for those longer-term goals.

We don’t need to have one single investment strategy for everything and one single pot. As long as you are not putting yourself in the position of needing to be a forced seller when markets are down, you should be fine!

Have a great weekend everyone. I have finally started watching The Traitors which is absurdly gripping. But no spoilers here for anyone yet to do so!

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.

i'm neutral

Alistair

31 January 2025