Sustainable sheep and what floats your boat?

By Holly Mackay, Founder & CEO

29 Nov, 2024

Sustainable funds have had a yo-yo time of it. During various lockdowns, as we flew less and guzzled less oil, these funds performed well and had demand, as we felt a global existential crisis and collectively questioned our way of life. Then Putin invaded Ukraine, oil soared, we all started moving around again and sustainable funds did less well. On top of that, people got fed up with everyone bleating about their sustainable credentials with no evidence to back it up. Greenwashing was rife.

The financial regulator (the FCA) was not too impressed with the over-enthusiastic claims of some, and introduced new strict naming and marketing rules which come into force on Monday next week.

The basic idea is that any fund that uses sustainability-related terms in its name could be misleading unless the fund is actively seeking out environmental, social or sustainability characteristics, themes or outcomes in a meaningful and substantive way.

Some tech funds, for example, might look good against environmental metrics because the Cloud doesn’t emit much carbon. But then passing yourself off as a sustainable fund is a bit suss. This is not the main thing that you're trying to achieve, just a fortuitous side-effect. It would be a bit like a sheep putting on a pair of Birkenstocks and saying “Ya, I’m a vegan”. You’re not a vegan, Shaun. You’re just a bloody sheep. Back in your box.

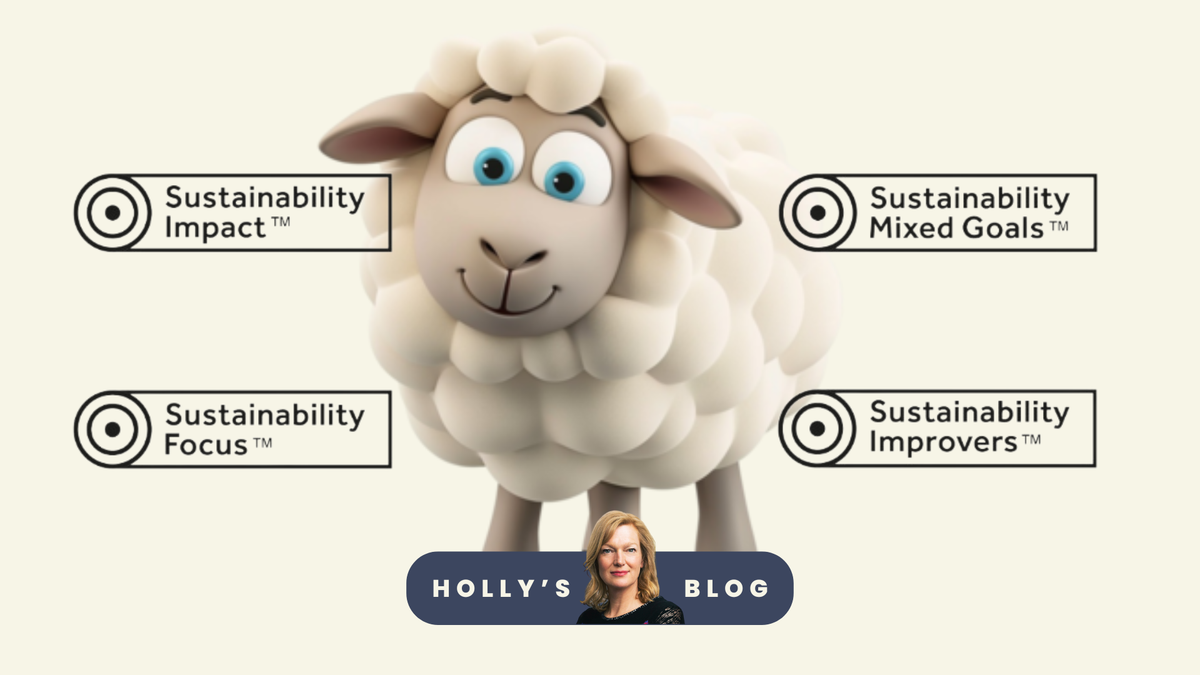

These new rules will give firms the opportunity to use one of four regulatory-approved labels, shown below, which will give consumers the confidence that the fund does what it says on the tin.

So what do they mean?

Sustainability Impact will initially have the most labels. This one is the easiest to prove because impact funds have real intentionality and there are no grey areas – they have to actively pursue positive environmental or social outcomes, and this is hard to fudge. This is wind farm or electric energy territory. M&G Positive Impact Funds, FP WHEB Sustainability Fund, Ninety One’s Global Environment Fund and Edentree’s Green Future Fund are examples of early adopters of this label. This label tells you there is no mucking around here – these products have the creds they claim.

Sustainability Focus is less pure play. Most things have to tick the sustainable box, but not all. At least 70% of assets have to be able to evidence they're environmentally or socially sustainable.

Improvers nods to the fact that many firms are in a state of transition. They might not be squeaky clean today, but they have a plan and there is money and intent to change.

Mixed Goals was a late-stage entrant, a slightly wishy-washy sustainable Combo Meal which covers a mixed bag of all three other labels.

What floats your boat?

These labels are so new, that there are not enough today to guide most of us. So, how else to sift, review and select? This week I reviewed the data on over 4,000 funds (thanks to global fund research house Morningstar for sharing). This allows me to filter funds by independent ratings, carbon intensity, adherence to the UN’s Sustainable Development Goals, exclusions of things such as tobacco and weapons, 5-year investment performance and more.

My aim was to create a shortlist of interesting funds for you guys, grouped into 7 different collections which map to the priorities of the 7 different customer groups our Research Team has identified when it comes to sustainable funds. From the committed, to the pragmatic, to those who curl their lip. For example, we call the largest group of UK investors segmented this way the Pragmatic Greens. People who care about the environment, but accept that transition will take time, and that some of those with the ability to bring about change might be some of the main offenders today.

For those interested, you can see the full fund shortlists for ideas and inspiration, or take the quiz to see which of the 7 ‘tribes’ you fall into, from Social Champions, to Pragmatic Greens or maybe the Pure Returns.

If this is not your thing, this week we have new pieces from Mid Wynd Investment Trust on the strategy of looking for growth over the long-term over quick wins, or JPMorgan who share their views on investing in Japan right now.

Next week I will be exploring the Santa Rally. And here’s an interesting fact to bore your friends with. According to the Nasdaq website, since 1950, the US stock market has risen in December, in a presidential election year, 83% of the time. Hmmm.

I end with a thank you and best wishes to John Delaney who retires as a financial planner today. I have never met John, but he has been reading my blogs since I started writing at my first business in 2008, and occasionally sends kind, generous messages of encouragement, thanks and support, which I have really appreciated. Thank you John – the most supportive person I have never met! I hope you have the happiest of retirements.

Have a great weekend everyone!

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login