Trump fever and the best ready-made investment collections of 2024

By Holly Mackay, Founder & CEO

24 Jan, 2025

Well, my friends, I tell you who else liked Trump’s inauguration this week apart from Elon Musk and Melania’s milliner. The stock market.

On Thursday, the S&P 500 closed at a record high, beating the former peak in December 2024. The drill-baby-drill mentality is giving markets a sense of optimism about what they will be able to do over the short-term. Words can move markets and after Trump said he would “demand that interest rates drop immediately”, the 2-year Treasury yield in the US (which tends to track short-term interest rates) edged down and shares picked up.

Rhetoric is one thing. Facts are another. People can demand things about interest rates all they like, but it’s the 12 members of the Federal Reserve’s Open Market Committee who call the shots. Nonetheless, there is a sense of giddy optimism that we’re all going to get AI pilots to fly us to Mars on expeditions paid for by meme-coins. And markets are like toddlers – they like optimism, happy music and short-term gratification.

Not to be outdone, the FTSE 100 has also hit a record high this week. BP and Shell are riding an oil price boom (new sanctions on Russia, so there is less oil and the price goes up), mining stocks are up (there are positive signals coming from China) and so are banks (riding the waves of assumed lower regulation).

Who did well in 2024?

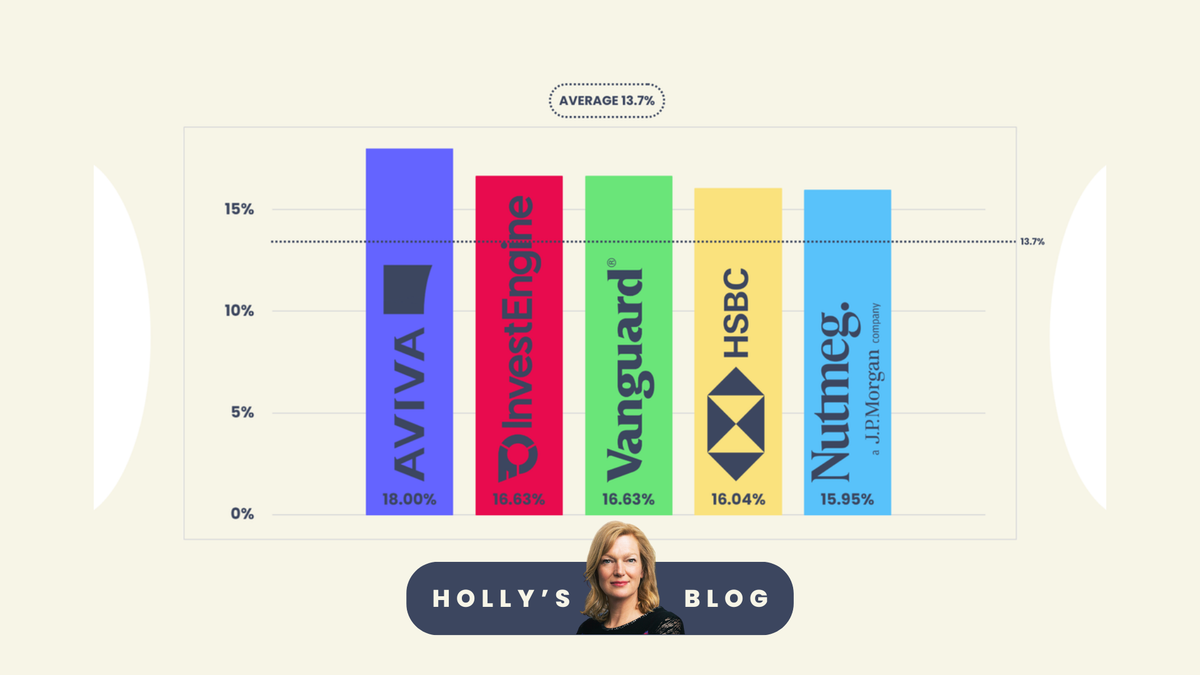

This positive start to 2025 continues the pattern of growth we saw in 2024. We recently published the 2024 performance of all major ready-made investment solutions in the UK – those groups which do all the heavy-lifting for us, and assemble collections of investments in a single and simple account.

All robo adviser customers need to choose what is called a ‘risk profile’. Although this sounds like some odd game of chicken, it's just weird financial speak for establishing how much volatility you can take. At one end of the spectrum, high risk, Level 5 out of 5, 100% equity, Ambitious, Aggressive – whatever it’s called – is usually 100% in shares. It jumps up and down and can have great years and bad years. In 2024, the average high risk portfolio went up 14%. If we look over the last 2 years, 6 out of the 14 ready-made solutions we track have made more than 30% for their customers.

At the other end, low risk, Level 1 or 2 out of 5, 20% equity, Cautious, Defensive – there are lots of names – is usually around 20% to 30% in shares. With more in cash. It jumps around less. In 2024, the average low risk portfolio went up by 4%.

You can see which robo advisers performed the best in high, medium and low risk categories. I was struck that Aviva, HSBC, Nutmeg and Vanguard had decent years across most risk profiles, whilst Santander struggled with heavier allocations to bonds which didn’t pay off.

What’s your attitude to risk? And, are you sure... ?

Getting the risk profile question wrong is probably the second biggest financial mistake I see most people with fairly straightforward affairs make. (The biggest, since you ask, is sitting in cash with money we don’t need in the short-term. Cash Junior ISAs for 2-year-olds who won’t access that money for another 16 years. A 40-year-old with an inheritance leaving it all in the bank. For years. A 50-year-old with pension money in cash or Government bonds).

Back to risk profiles. If given a choice of 1-5, most people will pick the middle one. It’s like picking the third cheapest bottle of wine on a menu or the 4th toaster out of 10 on John Lewis. Not cheap and nasty, but not too flash either. Because no-one likes the sound of risk when it comes to money. But if we re-name this ‘opportunity’ instead of ‘risk’, it frames the decision in a different light.

If you're picking the ‘middle one’, that could be a very sensible choice if you have a timeframe of say 5 years. Or, if you're saving for a flat deposit and you might buy in say 2 years, I wouldn’t be anywhere near the stock market and would stay in a decent savings account. But if you're one of the people I talk to every week who has picked the Medium choice simply because it sounds less scary, even though this is money you will not need for 10 years or more, then I’d suggest you do some more reading and ask why you have made this decision and make sure it is the right choice for you.

So here’s my very deep concluding thought for the day. Taking risk with our investments (when it comes to how much in shares we have) is not the same as being a cavalier berk. It can sometimes be the most sensible thing to do. Beginners might like our guide to asset allocation, which will help you to get your head around this.

And finally, those readers who sit in the wonderful intersection of the Venn diagrams that are Boring Money and Grazia (hi!) can read my feature piece on investing in Grazia this week, including tips on ready-made solutions and risk, as well as brush up on Lily Allen, new leggings from Spanx and Pammy’s second coming. Happy days.

Have a wonderful weekend everyone. I did manage a swim in the sea yesterday morning at dawn. The water was 7 degrees. I have to confess it was not an entirely happy experience, but it doesn’t half wake you up!

Holly

PS: Hot off the press. A reader wrote in yesterday, worried about their exposure to Big Tech. Lots of you are worried about this. If so, you can find collections of shares which are purposefully dampening down the domination of these companies. You might like to investigate something like an ‘Equal Weighted’ Exchange Traded Fund for the S&P 500. Which owns all 500 companies in equal measure, rather than having a huge dollop of our money allocated to the usual suspects like Apple, Microsoft and Nvidia, and mere dribbles for everyone else. Will write more on this in coming weeks.

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.

Thanks for the article! I will try out these solutions for my own business tax services UK.

David

24 January 2025