Home • Articles • Trump Trade

Trump Trade

By Holly Mackay, Founder & CEO

15 Nov, 2024

The Trump Trade refers to the surge in US shares and the dollar which happened after last week’s win – and also happened after Trump’s first presidential win back in 2016. On both occasions, bank stocks shot up, with expectations of a light regulatory burden – and smaller companies did well on the hope of lower taxes and investment-friendly policy. Simply put, investors believe that Trump is good for corporate profits.

Over the last week, the US stock market has roared ahead. Things have cooled a little today, but in the days after his victory, many funds with large exposure to US growth and technology stocks were up around 5% in a week. Tesla, banks, the dollar and Bitcoin have also jumped. Trump has suggested a benign approach to digital assets and creating a strategic US stockpile of Bitcoin.

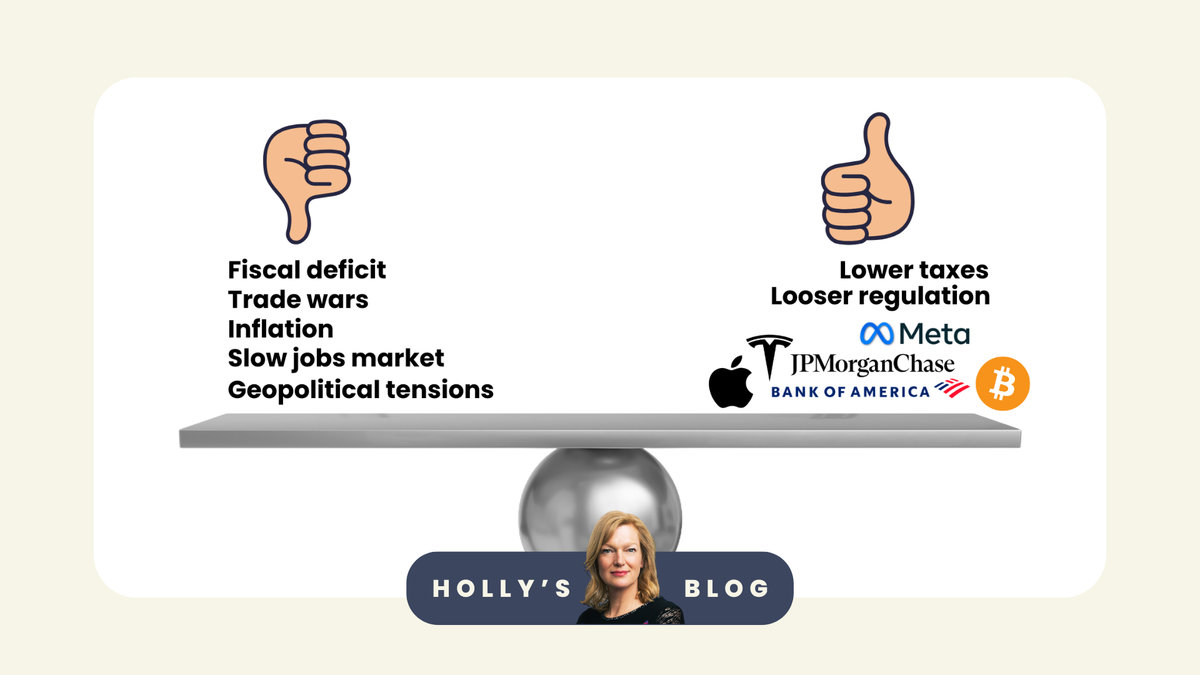

On the flip side, assets across the board look expensive and all this tariff chest-beating will almost inevitably fuel inflation. The jobs market is soft and the fiscal deficit (meaning the Government is spending more money than it's getting in) is huge. Traders are not yet sure whether the news seesaw will come down on the good or the bad side and 10 year Treasury Bonds (seen as a barometer of a country’s future economic health) are jumping around. For those interested, ‘yields’ are sitting at 4.43% at time of writing. It basically means you could invest a sum of money now, for 10 years, and get a risk-free return of 4.43% a year. The higher it goes, the more confident people feel about the economy.

This is because if investors think the stock market is going to go gangbusters, you have to give them more interest to persuade them to sit it out and stay in boring old cash or Government bonds.

So far, so good, but the question is how long can the Trump trade last? It’s hard to say. The US stock market is pretty expensive right now, so there is really not much gas left in the tank for a fresh rally. And with tax cuts and anticipated tariffs fuelling inflation, interest rates are likely to stay higher for longer. I suspect we will see ongoing volatility as things settle into a short-term new normal and we re-assess.

What are retail investors doing?

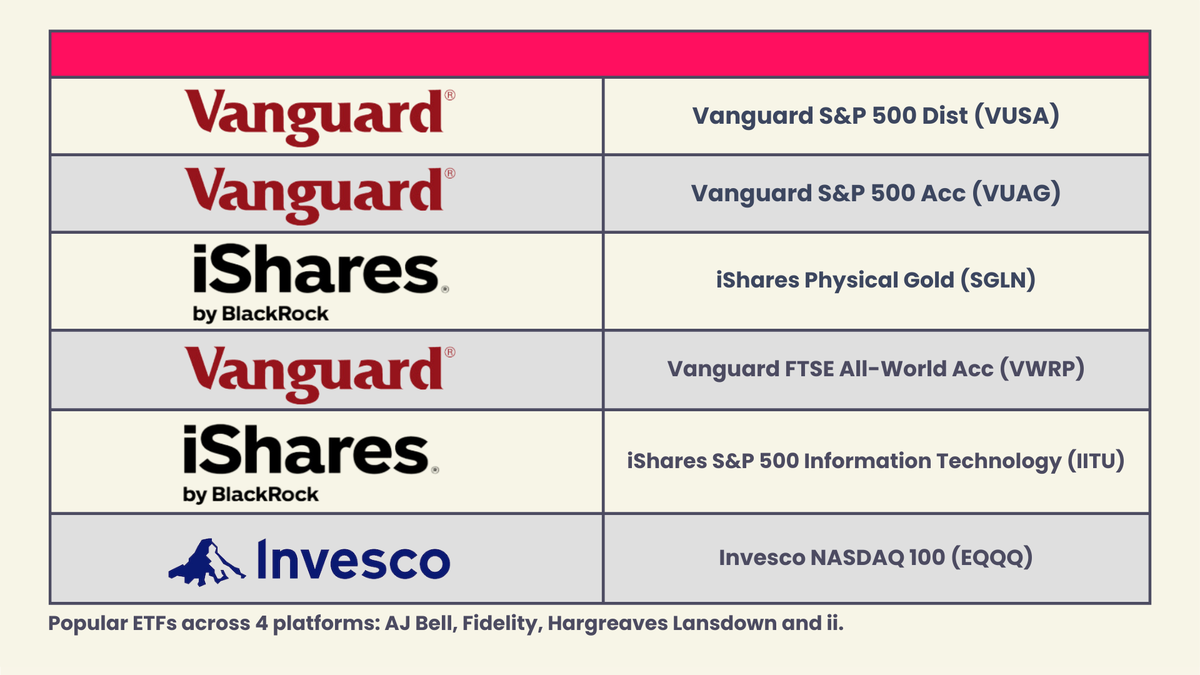

This week I reviewed the best-selling funds for October across major investment platforms. What were you guys buying in the run-up to the election? There’s a real herd mentality out there right now – we’re all buying the same things. For example the same 6 Exchange Traded Funds appear in the top-selling 10 ETFs on every platform we analyse. Covering America, global shares, technology and gold.

There are signs of investors looking to more defensive things – Royal London’s Money Market fund (a bit like cash, but works just a little harder) has returned to the most popular funds. At the same time, more focused, risky options such as Jupiter India are starting to slowly lose their broad appeal. During October, India's main stock market indices, the BSE SENSEX and the NSE Nifty, experienced their steepest monthly declines since March 2020 and I suspect these specific regional picks will fall in popularity as the Trump trade tickles the Greed part of investors’ brains, and broader well-diversified global funds, gold and cash tickle the fear part of our brains.

For those who look to their investments for income, there is a new piece written with input from the managers of the SAINTS investment trust on why some income-generating tortoises can be better than flashier hares. And we’ve also refreshed our top tips on saving for the kids with a Junior ISA section too.

Have a great weekend everyone. The tide timetable tells me I will be throwing myself in the sea at around midday on Saturday, when it's forecasted to be a balmy 9 degrees. I remain optimistically ‘convinced’ that this burns kilos of fat, removes wrinkles, regenerates my liver and turbo-charges my circulation, but it's getting harder and harder to maintain!

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login