Woodford Woes and the tastiest Ready-Made Portfolios

21 April, 2023

This week it’s all about stubborn inflation, Woodford and the best-performing ready-made portfolios for DIY investors.

Woodford Woes

Yesterday it was confirmed that a deal will be put to Woodford fund holders which – if accepted – would see those long-suffering 300,000 investors stuck in this fund paid out 77p for every £1.

Not much about the Woodford saga is straightforward. The core error was labelling a Vindaloo as a Korma, as retail investors piled into something which was mislabeled and riskier than many appreciated.

Is it a good outcome? I think it’s OK. This has dragged on forever. People will argue for years to come about whether the fund should have been suspended, who was at fault and what the redress should have been. But it’s a bit like a bitter divorce settlement. The only people who come out happy are the lawyers. You’re just glad it’s ended and try to remind yourself that it could have been worse. And mentally order 10 tons of camel poo for next day delivery!

A final note for all those affected. This is just the offer, not completion. There’s still a road ahead and it’s going to be months before any wonga actually hits any account.

The most delicious Ready-Made portfolios?

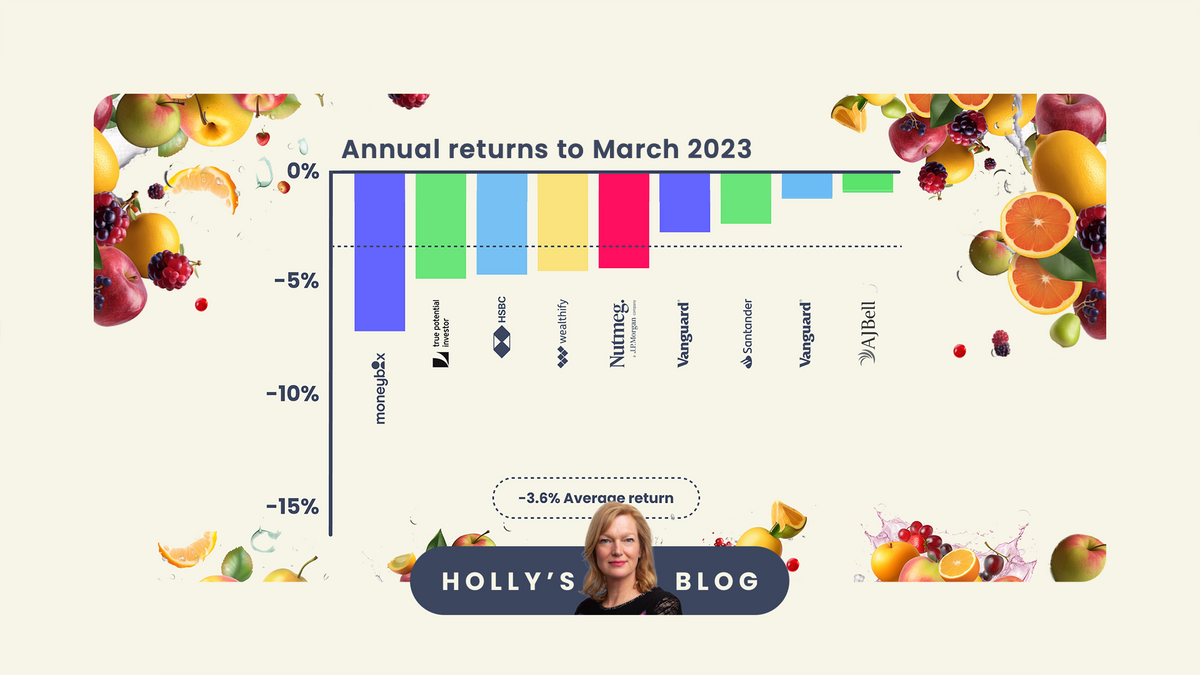

Each quarter we collect the performance data of the UK’s leading ‘ready-made’ portfolios for investors. And dig into performance after costs.

After a pretty torrid 2022 (when the mini Budget sent ‘low risk’ options nosediving) the first 3 months of 2023 have provided welcome relief. Global stock markets are more buoyant and people have actually made money this year. Oooooh!

Here are some snippets:

The best performers in the high-risk category over the last three months were Vanguard – their LifeStrategy 100% equity option returned 4.1% over the last three months – and Nutmeg, which also posted decent returns

Average returns in a high risk portfolio for the last 12 months have been -3.6%

There’s at least a 6.5% difference between the best and the worst performers in each category over the last 12 months so it’s worth doing your homework

The best performers in the medium-risk category over the last three months were again Vanguard – their LifeStrategy 60% fund returned 3.6% - with Nutmeg also posting decent returns

And the best performers in the low-risk category were Vanguard LifeStrategy again, with Santander having an OK quarter after a brutal 2-year period

But average returns in this category still have the Kwasi-Truss-Bond-Nightmare hangover and are -5.9% for the last 12 months

Of course three months is interesting, but not a guide to long-term skill. When we look back at quarterly returns over the last 2 years, across all three risk categories AJ Bell has been in the top 3 providers more than any other provider, with Vanguard also consistently strong.

In final news

Inflation remains stubbornly high, which of course drives talk of potential higher rates still ahead before the consensus falls later in the year. That said, our most recent consumer survey found sentiment at higher levels than we’ve seen for a while. You’re particularly upbeat about the UK economy. There’s a recent piece by the esteemed City of London investment trust gang on the outlook for UK markets here.

If you’re retired or look to your investments for income then do check out the highlights of our webinar this week with the Association of Investment Companies. Lots of very helpful stuff on income-paying trusts – some of whom have come through the Boer War, Great Depression and more, still paying out income every year. Impressive stuff.

In another upcoming event, we’ve a few spots left in our upcoming adviser-led workshop on retirement planning for women with no kids – you can book your place here.

And if you’re looking for inspiration, then this piece from Martin Currie reviews the world for megatrends and exciting investments which float their boat!

Phew! Over and out people. A particularly happy weekend wish to all readers who observed Ramadan. Every year I admire your commitment and strength. Enjoy the feasts!

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login