FTSE 100 hits record high: UK stock market analysis and investment outlook

30 Jan, 2025

While the focus has been on the volatility in the US stock market, the FTSE 100 has been quietly hitting new highs. It reached 8,500 in mid-January and has continued to trade higher ever since. As the UK government turns its attention to economic growth, could there be some hope that the long drought for the UK stock market may finally be starting to ease?

The immediate catalyst for the strength in the UK market has been a rise in the dollar in the wake of Trump’s victory. This may sound counter-intuitive, but many UK companies earn revenues in dollars and therefore get a boost to earnings if the pound weakens against its US equivalent. The UK market has also benefited from a shift in market mood, which has seen investors look beyond the US technology giants and into other markets. The relative cheapness of the UK market has helped it stand out against its peers.

Two of the UK market’s largest sectors – banking and oil – have also had a strong start to the year. The banking sector is benefiting from potential deregulation and higher-for-longer interest rates. The oil majors have seen a bounce from higher oil prices.

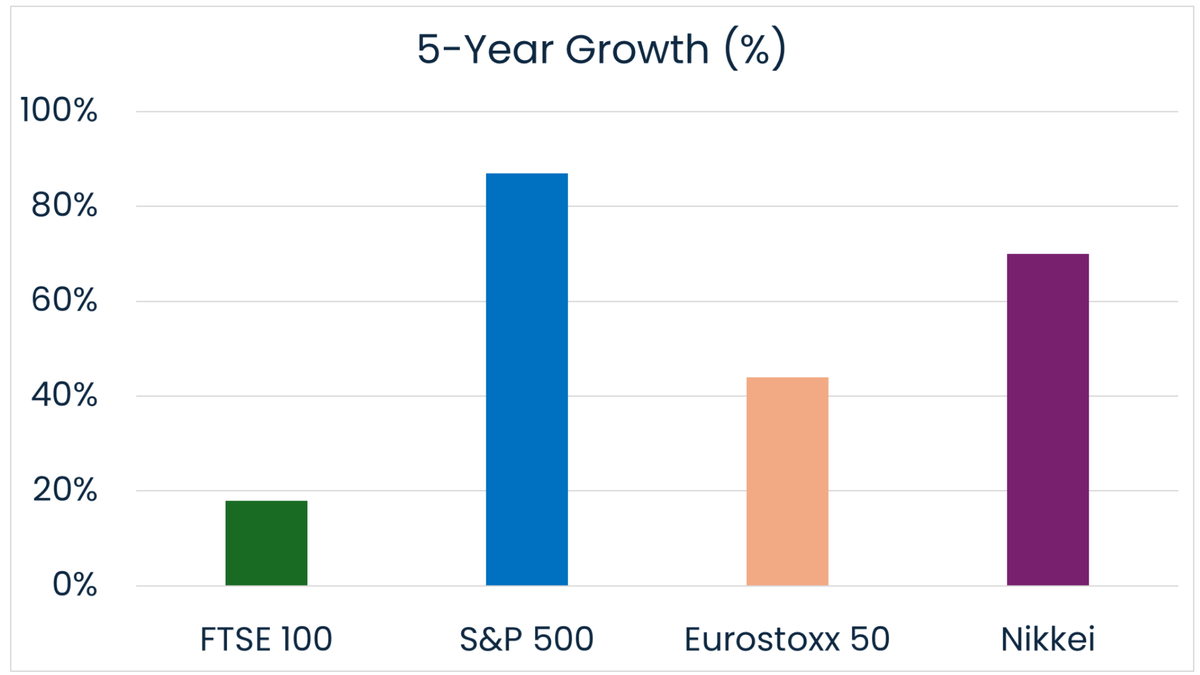

That said, the FTSE’s recent performance needs to be set in context. Over five years, the FTSE 100 is up 17.7%.[1] Over the same period, the S&P 500 is up 87.2%.[2] The analogy is perhaps a little unfair: the S&P 500 has benefited from the astonishing growth of a handful of technology companies. However, even the boring old Eurostoxx 50 is up 44.4%[3], while the Japanese Nikkei is up 70%.[4]

The weakness of the UK stock market has had a number of contributory factors. The uncertainty surrounding Brexit was undoubtedly important. It triggered outflows from UK assets that continue to today. Data from Morningstar in 2023 estimated that around £80bn had flowed out of the UK market since Brexit[5], and that weakness has continued into 2024. Last month saw another £280m leave UK All Companies funds.[6]

The nature of the UK stock market has also played a role. The FTSE 100 is heavily weighted to ‘value’ areas such as banking, mining, or oil & gas. These have been unloved at a time when investors have been far more interested in technology innovation.

Dividends and more

Bashing the UK stock market has become a national pastime, so it is worth saying that there are still plenty of things to like about it. First, it has an astonishing dividend yield – currently 3.5%.[7] This is higher than any other major market. The FTSE World index has a yield of just 1.8%. That dividend yield looks pretty safe: dividend cover (the extent to which dividends are covered by a company’s profits) is currently around 2x.

Even the UK smaller companies have a strong dividend yield. The FTSE Small Cap currently has a dividend yield of 4.2%, and the FTSE 250 of 3.4%. This means that for dividend investors, the UK remains a compelling place to invest. It is worth noting that outflows from UK equity income funds have been slower than for other parts of the market.

Bid activity

Equally, the UK is proving popular with international trade buyers and private equity investors. They recognise that the UK market is cheap, and businesses are going for a song. This has seen merger and acquisition activity in the UK market hit new highs. According to data from investment bank Peel Hunt, in 2024, about 5% of all companies listed on the London stock market were either sold or bid for in 2024.[8] That equates to around £49bn in recommended bids.

AJ Bell analysis shows that those bids included five FTSE 100 companies and 19 stocks in the FTSE 250 index. Well-known names coming under the hammer included Anglo American, Hargreaves Lansdown, Currys, Direct Line, Rightmove and DS Smith. Not all have been successful, but it has helped support the prices of UK equities.[9]

Adrian Gosden, manager of the Jupiter Multi-Cap Income fund, says:

We think the pace of corporate activity in the form of mergers and acquisitions can maintain a healthy pace. This reflects the low valuations of good companies as well as well as a stable economy and government. We would expect that overseas companies, trade buyers, and private equity firms will want to do more deals to acquire UK assets at attractive premiums.

Companies have also started to buy back their shares. This reduces the number of shares in issue and should, in theory, help support share prices. Gosden adds:

The pace of share buybacks in our market also is likely to remain robust. We expect 2024 to be the third consecutive year with buybacks in total of around £50 billion, well above the historic run rate. Premier Inns owner Whitbread (£100 million buyback) and HSBC ($3 billion program) are among the those recently announced.

A bigger question is whether sentiment could turn for UK equities. Thomas Moore, investment manager on the abrdn Equity Income Trust says the backdrop is relatively strong, with household cash flows in good shape and savings levels high, but, he adds:

After a long period of political uncertainty, investors are looking for signs of a pick-up in economic activity before allocating to domestic stocks.

This is the million dollar question. UK equities are cheap, but they have been cheap for a while. Buybacks and merger and acquisition activity can support prices in the near-term, but the UK market really needs confidence to return. For that to happen, investors will need to see that the UK economy is on a better path.

Here, the growth agenda of the UK government may help. Most of the projects announced by Chancellor Rachel Reeves are long-term, and will take time to have an impact on the economy. However, the hope is that they create a sense that the UK is open for business, ready for investment and has a long-term economic plan.

The UK is still a little wobbly, but outflows are slowing, and it wouldn’t take significant changes to move the dial for the country’s stock market. New highs for the FTSE 100 may be the start of a shift in sentiment. Now if we could just get some of that elusive growth…

---

[1] Google Finance, January 2025

[2] Google Finance, January 2025

[3] Google Finance, January 2025

[4] Google Finance, January 2025

[5] Financial News, December 2023

[6] Theia.org, November 2024

[7] Financial News

[8] The Times, December 2024

[9] AJ Bell, December 2024

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.