First ISA Guide: How to Open Your First ISA in 3 Steps

By Boring Money

2 Jan, 2026

Congratulations… you’re reading this, which means you’re already considering the all-important first step to becoming a proud ISA owner. That stands for Individual Savings Account, by the way – a type of savings account that allows you to save cash or invest without incurring tax. What’s not to like? If an ISA sounds right up your street but you don’t know where to start, this guide will show you what you need to do.

First things first, why should you get an ISA?

Do you want to find a way to make your money go further? Do you wish there was a way you could keep more money for yourself and not have to carve out chunks of your income for the taxman? That’s where the ISA comes in.

ISAs (Individual Savings Accounts) allow you to save cash or invest in the stock market without having to worry about tax – so at the end of the day, you can keep more of your money in your pocket.

First things first, if you're reading this before April, you still have a good few weeks to get your ISA up and running in order to take advantage of this year’s ISA allowance. Leave it much later, though - past the 6th of April to be exact - and you risk losing it.

What does all that mean? Every tax year (that’s 6 April to 5 April the following year), every adult in the UK is allowed to put £20,000 into their ISAs, and any money earned from these accounts is tax-free. So any interest on cash, or returns or dividends from investments, is free from Capital Gains Tax and Dividend Tax, which could otherwise eat away at your profit. Nifty.

If you invest outside of an ISA, for example, higher rate taxpayers could end up paying as much as 20% of investment returns back to the taxman in Capital Gains Tax. Or if you have a Cash ISA and you earn more than £500 in interest, the amount over this threshold could be added to your taxable income and would be liable for Income Tax.

Maybe you’ve inherited money, been paid a bonus from work, or regularly have some money left over after your outgoings and could set up a monthly direct debit from your current account. if so, now would be a great time to get organised and cross off the ‘ISA’ entry on your to-do list.

Our article here explains more about the benefits of investing rather than just stashing your money in a savings account.

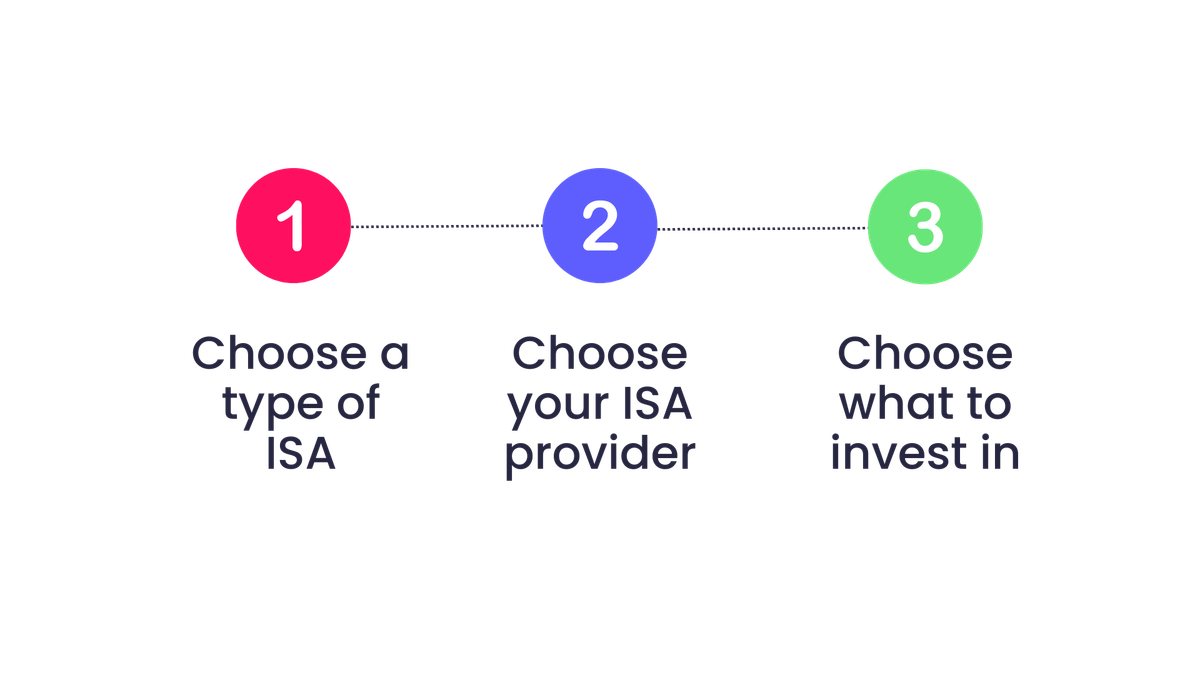

If you’re ready to open your first ISA, there are a few rules to get your head around. But don’t fret, it’s super easy! Let’s get started.

1. Choose a type of ISA

The type of ISA that’s right for you will be different depending on your financial needs, such as who and what you’re saving for and when you’re going to need to access your money. There are four main types of ISA, each of which works in a different way and is designed for a different purpose.

Unlock this article to continue reading

Unlock this article to continue reading

Already have an account? Login