Moving from cash savings to investing: What's holding people back?

By Boring Money

23 Jan, 2026

This section is a paid promotion created in partnership with BlackRock. The views and information presented reflect the sponsor’s messaging and may not represent the independent opinions of Boring Money. While we aim to ensure accuracy and relevance, this content should not be considered impartial advice.

BlackRock set out to understand the behaviours and attitudes towards saving and investing in the UK. With many savers holding back from investing, they commissioned some research to find out what’s stopping people from investing and what could help them take those first steps.

Their findings echo what we've seen in our own Boring Money research: the barriers fall into three camps.

First, there's fear and lack of knowledge – people are worried about losing money, don't really understand investment risk, or simply don't know where to start or who to trust.

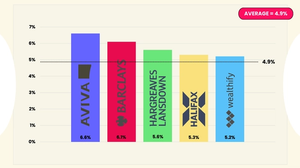

Second, there are practical concerns – people want easy access to their cash, are reasonably happy with current savings rates, or think investing is too expensive.

And third, it's about priorities – some just aren't that interested, don't think they have enough spare money, or haven't got round to figuring it all out.

While the UK has strong growth in investment participation in recent years, BlackRock’s Bridging the gap: From saving to investing report shows 62% of adults (34 million people) do not invest, highlighting substantial untapped potential among non-investors.

Here's the thing: around 12 million UK adults say they're open to investing in the future. And within that group, there are over 4 million "regular cash savers" who are already putting away an average of £273 a month – pretty much the same as what current investors save (£344).

These people are already doing the hard bit: consistently setting money aside each month.

Why it matters

Investors are nearly twice as likely as non-investors to feel confident about their long-term financial security and reckon they'll have enough for a comfortable retirement. With nearly half of working-age adults under-saving for retirement, helping even some of these regular savers start investing could make a real difference to their futures.

What's getting in the way?

Here's the interesting bit: these regular cash savers are motivated (most say they "should probably invest more", 60%) and curious (they'd like to understand how investing works, 58%). But several key barriers are holding them back:

1. Not knowing enough – Over a third, 35% simply don't feel they know enough about investing to feel confident getting started. Fair enough. There is, however appetite to understand how investments work, with over half (58%) saying they would like to know more.

2. Fear of losing money – Completely understandable, but this overlooks how inflation steadily chips away at cash savings. Here's a striking example: if you'd started investing just £1 in the S&P 500 in 2000 and added £30 each month, you'd have over £33,000 by 2025 – nearly triple what you'd have in a savings account doing the same thing.

3. Thinking you need loads to start – Many people overestimate what's needed to begin. While some (29%) know you can start from £1, plenty of others (31%) think you need at least £100 or even £250+. The reality: a lot of platforms now let you start with smaller amounts of £1 - £50.

4. Worrying about accessing your money – There's a lot of confusion here. Some think their money would be locked away for years (18%); others believe there are hefty exit penalties (36%). In reality, Stocks & Shares ISAs and general investment accounts are much more flexible than people think.

5. Focusing on the short term – Regular savers tend to prioritise immediate needs like emergency funds or saving for something specific, while investors are thinking more about long-term growth and retirement.

What would actually help?

When asked what would encourage them to invest, regular savers were refreshingly practical. They want low costs and low minimums to get started, the flexibility to withdraw money if needed, everything explained clearly and simply, and some proper step-by-step guidance.

The ISA opportunity

Here's something interesting: According to Boring Money Research, 22% more UK adults hold a Cash ISA compared to those who have a Stocks & Shares ISA.

If you're already using a Cash ISA, you're familiar with how ISAs work – the tax benefits, the annual allowance, the flexibility. A Stocks & Shares ISA works in exactly the same way, except your money is invested rather than sitting in cash. You can access it when you need to (though ideally you'd leave it for at least five years to ride out any market wobbles), you can start with small amounts, and many platforms now offer ready-made portfolios if you don't want to pick individual investments yourself.

The gap between saving and investing might feel big, but if you're already putting money aside regularly, you're closer than you think. It's just about taking that first step.