Pockets of opportunity within the high yield bond market

12 Dec, 2022

Sponsored by Invesco Bond Income Plus Limited. Written by Rhys Davies, Fund Manager and Senior Credit Analyst at Invesco.

Q. Financial markets in 2022, and the last couple of weeks in particular, have been extremely volatile. How have conditions been for you as a bond manager?

The volatility in financial markets this year has been relentless. There has been a big sell-off across government, investment grade and high yield bond markets. The moves have been dramatic, and it has really felt as if there was nowhere to hide for bond investors.

Fortunately, we came into the year with a fairly defensive portfolio in the Invesco Bond Income Plus Trust (ticker: BIPS). We had a bias towards shorter-dated and higher quality bonds than we might typically hold, and we’ve been able to add bonds as they have got cheaper. However, prices have continued to fall, so even when we have bought into weakness, we’ve seen prices go lower.

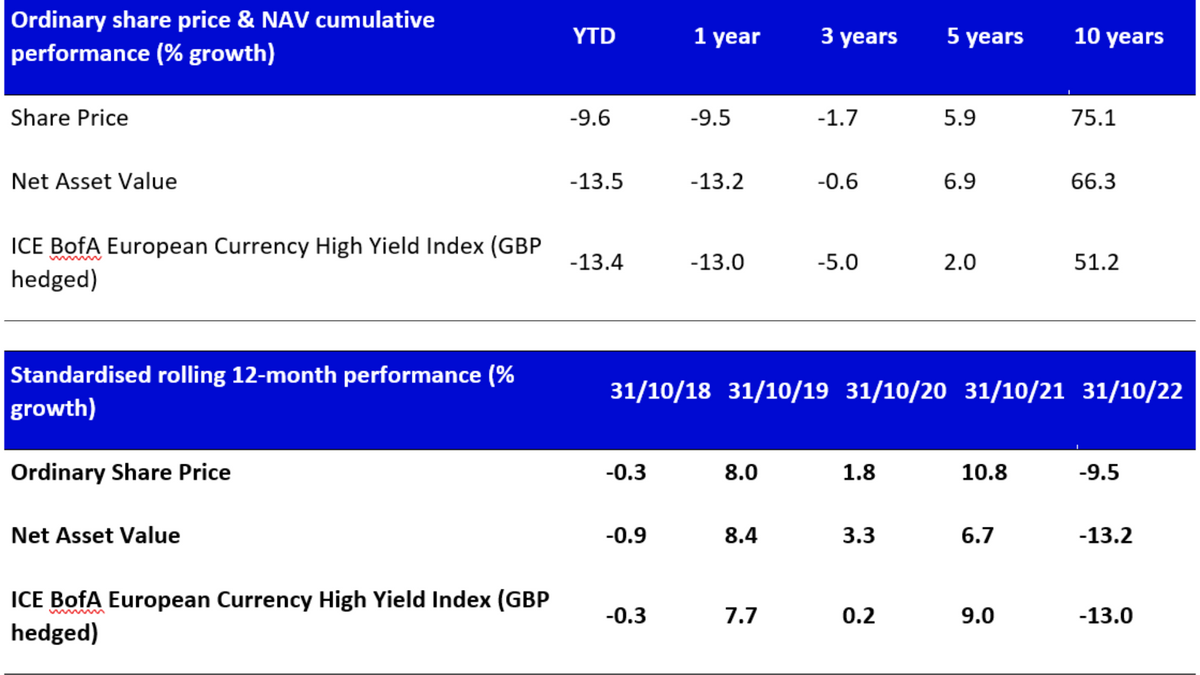

The Net Asset Value of the portfolio has fallen as markets have moved lower this year. On a relative basis, performance has been okay. To the end of September, our Net Asset Value return is in line with the ICE BoA European Currency High Yield Index (GBP hedged), which we often reference. And that’s net of our costs, and despite a portfolio holdings bonds with lower credit ratings, on average. However, while we are pleased with relative returns, it has been a bad year for absolute returns.

Source: Morningstar. All performance figures are in sterling as at 31 October 2022, unless otherwise stated. Ordinary share price performance figures have been calculated using daily closing prices with dividends reinvested. NAV performance figures have been calculated using daily NAV with dividends reinvested. The NAV used includes current period revenue and values debt at fair. Past performance does not predict future returns.

A very important feature of bonds is that they return to a price of par, or 100, provided they do not default. To try to ensure that it mitigates loss of capital through defaults, BIPS will continue to maintain a well-diversified portfolio with a strong focus on credit analysis. Furthermore, the active rotation of the portfolio during the year from lower yielding bonds into higher yielding bonds means that levels of income in the portfolio have been rising. One of the key benefits of active fund management is the ability to respond to changing markets in this way.

Q. Following all this weakness, what are you thinking about now?

I’m looking for opportunities. Given the level that the market is at now, I am seeing lots of bonds that I think are attractive.

In BIPS, I have a mandate to use leverage and I’ve done this to increase exposure to higher yielding bonds by about 10% over the course of this year. It has been great to be able to invest in this weak market.

Leverage is currently about 20%. I could add more but I don’t want to do that yet. I am waiting for signs that the outlook for credit is improving. I am not seeing those yet. I’m still cautious. But I can exploit opportunities when I am ready.

Q. What worries you most?

One thing that lingers in my mind is Jay Powell’s speech [in November 2022], where he said that the US Federal Reserve had to deal with inflation and that there would have to be ‘pain’ in doing that. I worry that economies have yet to experience that sort of pain. In the world of high yield bonds, further economic weakness could well lead to credit stress and defaults. So, I’m still cautious about the bonds I hold. I am tending to avoid companies in sectors that are typically more sensitive to the level of economic growth, where this pain might be felt more acutely. I am favouring businesses with strong balance sheets which I think can weather some economic weakness over the next couple of years. Luckily, there are lots of bonds now with pretty good yields, issued by companies that we know well and where we are comfortable in the credit story, even with a tough outlook.

Q. What are the prospects for income and income investment from here?

As you can imagine, new issuance has been low in the high yield market this year, whereas 2021 was a record year. Interest rates were low then and corporate bond yields were low too, so conditions were very favourable to borrowers. European currency high yield issuers (according to JP Morgan data) issued €150bn (€88bn net). To the end of September this year, they have issued just €23bn gross (€3bn net).

When issuers have come to the market this year, they have had to issue bonds in an environment which is tougher for them but better for lenders like us. They have had to pay significantly higher coupons, which is something we have been waiting a long time to see.

One very good recent example is Verisure, a European provider of alarm and security systems. In September, they came to the market to refinance their May 2023 3.5% bond. They managed to do this, but their new 2027 maturity bond has a significantly higher coupon of 9.25%.

I think Verisure is a good business. I was happy to participate in this new bond because I think they can afford to pay this coupon. But I also think (and as an income investor, I hope) that this is an example of an important shift in the markets. That is, a shift towards a higher-yielding environment where bondholders can get a better deal. In the very low interest rate world of the last few years, corporates were able to finance cheaply, and equity holders have benefitted from that. Perhaps we are entering a period where bond yields are higher now.

Another bond I was happy to buy recently was the Centrica 7% 2033. This bond was originally issued, at a price just below 100 in 2008 (the volatility in the market at that time helps to explain the high coupon). Since then it has traded up to a peak above 160 but the price is back close to 100 now. This is an investment grade bond, so it’s not a typical holding for us. But it was offering a good yield, that we were very happy to have for such a strong credit. It’s another indication of the changed income environment.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

When making an investment in an investment trust you are buying shares in a company that is listed on a stock exchange. The price of the shares will be determined by supply and demand. Consequently, the share price of an investment trust may be higher or lower than the underlying net asset value of the investments in its portfolio and there can be no certainty that there will be liquidity in the shares.

Invesco Bond Income Plus Limited has a significant proportion of high-yielding bonds, which are of lower credit quality and may result in large fluctuations in the NAV of the product.

Invesco Bond Income Plus Limited may invest in contingent convertible bonds which may result in significant risk of capital loss based on certain trigger events.

The use of borrowings may increase the volatility of the NAV and may reduce returns when asset values fall.

Invesco Bond Income Plus Limited uses derivatives for efficient portfolio management which may result in increased volatility in the NAV.

Important Information

All information as at 13 October 2022 unless otherwise stated.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

For more information on our products, please refer to the relevant Key Information Document (KID), Alternative Investment Fund Managers Directive document (AIFMD), and the latest Annual or Half-Yearly Financial Reports.

Further details of the Company’s Investment Policy and Risk and Investment Limits can be found in the Report of the Directors contained within the Company’s Annual Financial Report.

If investors are unsure if this product is suitable for them, they should seek advice from a financial adviser. For details of your nearest financial adviser, please contact IFA Promotion at www.unbiased.co.uk.

Issued by Invesco Fund Managers Limited, Perpetual Park, Perpetual Park Drive, Henley-on-Thames, Oxfordshire RG9 1HH, UK. Authorised and regulated by the Financial Conduct Authority.

Invesco Bond Income Plus Limited is regulated by the Jersey Financial Services Commission.