Home • Articles • Schroders Capital Global Innovation Trust: Capturing opportunities in artificial intelligence

Schroders Capital Global Innovation Trust: Capturing opportunities in artificial intelligence

Where will the AI winners be found?

19 Dec, 2023

Sponsored by Schroders

With fewer than 15% of US companies with revenue over $100 million listed on the stock market, there are clearly abundant opportunities for investors in private equity to target. Investment trusts represent an ideal way for private investors to access private equity markets, because they can bring liquidity to an otherwise illiquid asset class. Nevertheless, the share prices of many private equity investment trusts, the Schroders Capital Global Innovation Trust among them, sit at a significant discount to their net asset value, which potentially makes the current environment an interesting time to consider allocating capital to this exciting part of the market.

Playing to Schroders strengths

Schroders Capital has more than 25 years’ experience in the private equity asset class, having launched its first technology investment programme back in 1997. During this time, the team has developed a significant network of relationships with many of the world’s best venture capital investors. This places Schroders in an exceptional position to view new, innovative technologies – and the investment opportunities that arise from them – from multiple different angles. In turn, this has helped the team to craft an excellent performance track record in venture capital, delivered through a variety of different market conditions.

The Schroders Capital Global Innovation Trust aims to achieve long-term capital growth by investing in a diversified portfolio of highly innovative companies on an upward trajectory, wherever they may be in the world. All opportunities are united by certain attractive characteristics, as co-portfolio manager Harry Raikes explains:

“At a high level, there are four characteristics that we look for in all the innovative companies in which we invest. First, they must offer best-in-class products, services or technology. We are looking for businesses that are clear leaders in what they do. Second, we want to see significant growth ahead of these businesses, underpinned by well-established structural trends. Third, they will be managed by world-class management teams that are aligned to us as investors. And fourth, we look to invest alongside other high-quality venture capital investors that can offer complementary skills to our own”.

Innovation themes

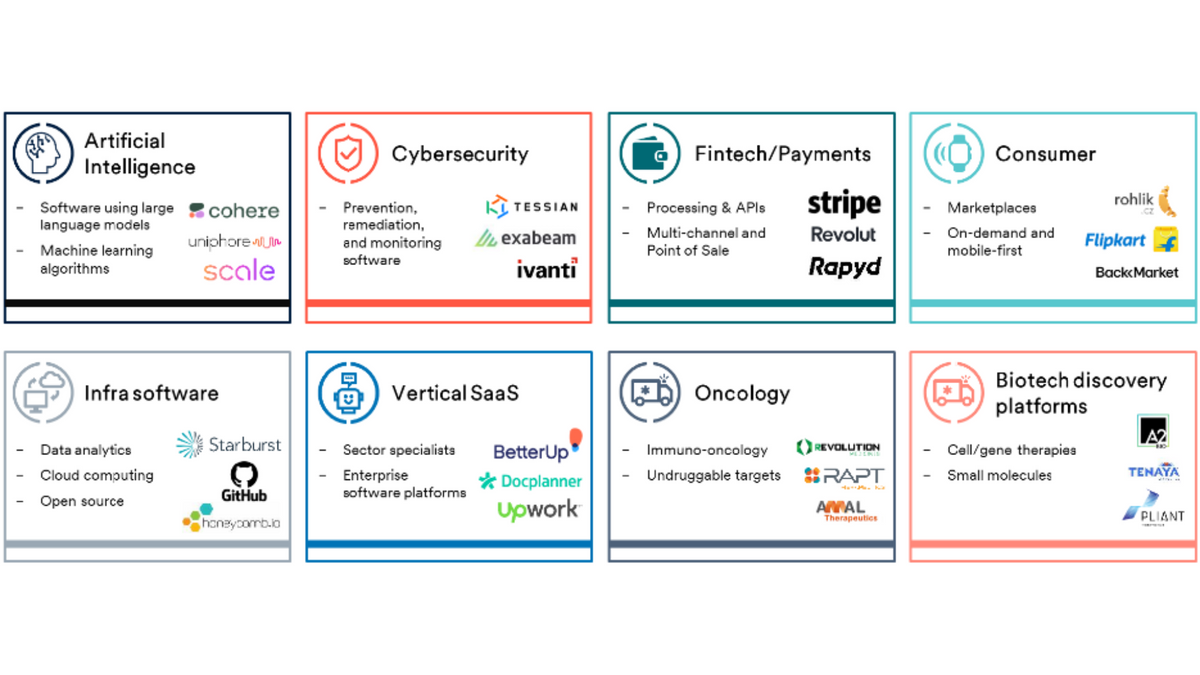

Harry and Tim, in collaboration with the wider Schroders Capital private equity team, have identified eight key innovation themes for the Schroders Capital Global Innovation Trust to focus on, as outlined below. Two of these themes are healthcare-related, but the other six are applicable to a range of sectors. Overall, this allows the managers to build an attractively diverse portfolio.

Source: Schroders Capital, 2023. The companies are presented for illustrative purposes to show past and present Schroders Capital investments (across co-investments, direct investments and look-through exposure). They should not be viewed as a recommendation to buy or sell. Logos are the property if their own respective entities and do not indicate endorsement by or with Schroders Capital.

Opportunities in artificial intelligence

Each of these themes is exciting in its own right but, perhaps unsurprisingly, the team is currently paying particularly attention to developments in the field of artificial intelligence (AI). The advent of generative AI [1] has led to a significant amount of interest from the investment community this year, as Harry explains:

“One of the early leaders, OpenAI, the firm behind ChatGPT, reached 100 million monthly active users within two months of its launch, which is exceptionally fast penetration when compared to breakthroughs that preceded it. For example, Uber took six years to reach that milestone, and the internet took seven years. More importantly, the arrival of generative AI paves the way for a much broader wave of innovation and disruption on a scale comparable to the introduction of email, the internet and the smartphone. Consequently, we are spending a lot of time currently working out where the value of this innovation is likely to accrue”.

Inevitably, this level of interest is having an impact on valuations for AI companies and Harry therefore emphasises the need to approach the theme with caution. Nevertheless, he is confident the team is well positioned to capture the opportunity in generative AI as it unfolds. Schroders Capital, through both its funds and direct portfolio, has historically invested in nine of the top ten AI start-ups by value, including OpenAI.

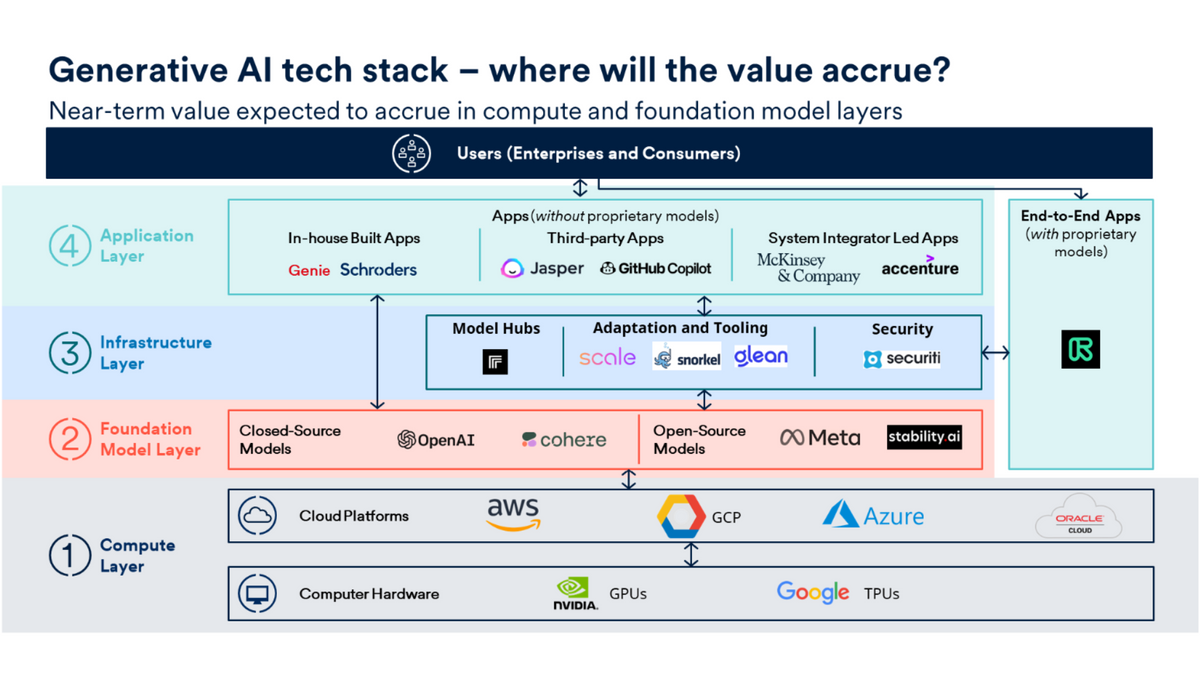

The team approaches generative AI by analysing each layer in the “technology stack” of the elements required to build AI tools and applications, as visualised below. At the bottom, the key compute layers are dominated by very large established players, which reduces the scope for genuine innovation. Further up the technology stack, the foundation model layer is moving at a very fast pace currently, but Harry and the team are most excited about the prospect of finding opportunities in the infrastructure and application layers.

Source: Schroders Capital, 2023. Views shared are those of Schroders and may be subject to change. Companies shown for illustrative purposes only. Logos shown are the property of their respective entity. Forecasts and estimates may not be realised.

Indeed, earlier this month the trust announced an investment in an early leader in an emerging application of AI software. For confidentiality reasons, the team is unable to name the company, but believes it represents a highly complementary addition to the portfolio. The team is also actively seeking to invest in other innovative AI businesses, as and when it finds suitably exciting and attractively-valued opportunities. These may be found across a wide range of different sectors, as businesses apply AI technology to accelerate their growth and generate operating efficiencies.

An evolving portfolio

Among the trust’s other recent new investments are US-based cybersecurity company, Securiti, which enables the safe use of data and generative AI, India-based vendor digitisation business, Bizongo, and Memo Therapeutics, a Swiss biopharmaceutical company that is developing novel therapeutic antibodies for patients with viral infections and cancer.

Meanwhile, the trust has also announced its exit from Tessian, the innovative email cybersecurity company which was one of its first new investments back in May 2021. Tessian is in the process of being acquired by Proofpoint, but details of the transaction have not been publicly disclosed.

It is clear that the Schroders Capital Global Innovation Trust portfolio continues to evolve and take shape, as its managers position it to capture the opportunities across the eight identified themes.

“More than 30% of the portfolio’s net asset value is now in new investments or cash,” explains Harry. “Our direction of travel is clear, and Tim and I are very confident that we can capture the global innovation opportunity that lies ahead of the trust and its shareholders”.

Fund risk considerations

Gearing risk: The company may borrow money to invest in further investments, this is known as gearing. Gearing will increase returns if the value of the investments purchased increase in value by more than the cost of borrowing, or reduce returns if they fail to do so.

Investment risk: Long-term outcomes are more binary – extremely attractive rewards for success but some businesses will inevitably fail to fulfil their potential and this may expose investors to the risk of capital losses.

Overseas investment risk: The trust may invest in overseas securities and be exposed to currencies other than pound sterling – as a result, exchange rate movements may cause the value of the trust, individual investments, and any income paid to decrease or increase.

Private companies risk: The trust may invest in unquoted securities, which may be less liquid and more difficult to value, because they are generally not publicly traded – the lack of an open market may also make it more difficult to establish fair value.

Share price risk: The price of shares in the trust is determined by market supply and demand, and this may be different to the net asset value of the trust. This means the price may be volatile in response to changes in demand.

Small companies risk: As it can take years for young businesses to fulfil their potential, this investment requires patience.

Young companies risk: Young businesses have a different risk profile to mature blue-chip companies – risks are much more stock-specific, which implies a lower correlation with equity markets and the wider economy.

This is a marketing communication.

Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rates may cause the value of investments to fall as well as rise. For help in understanding any terms used, please visit address https://www.schroders.com/en/insights/invest-iq/investiq/education-hub/glossary/.

Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions.

Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy.

We recommend you seek financial advice from an Independent Adviser before making an investment decision. If you don't already have an Adviser, you can find one at www.unbiased.co.uk or www.vouchedfor.co.uk Before investing in an Investment Trust, refer to the prospectus, the latest Key Information Document (KID) and Key Features Document (KFD) at www.schroders.co.uk/investor or on request.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.