The City of London Investment Trust: A portfolio built for uncertain times

14 April, 2023

Sponsored by Janus Henderson Investors

Written by Job Curtis, Fund Manager at Janus Henderson Investors

With its strong defensive growth qualities and attractive income, the UK stock market remains a vital component of a diversified portfolio. The City of London Investment Trust levers these qualities to help bring stability to returns in uncertain times.

With the ramifications of Brexit back in the headlines and a revolving door seemingly in need of installation at 10 Downing Street, confidence in the UK economy has dipped dramatically in the last few years. And, not surprisingly, this combination of volatile politics and pessimism around growth has dampened sentiment towards UK stocks and dragged down their returns against the rest of the world. But could it be that the doom and gloom is overdone, and that the UK market is, in fact, fairly well set to ride out the uncertainty that lies ahead?

Opportunity knocks

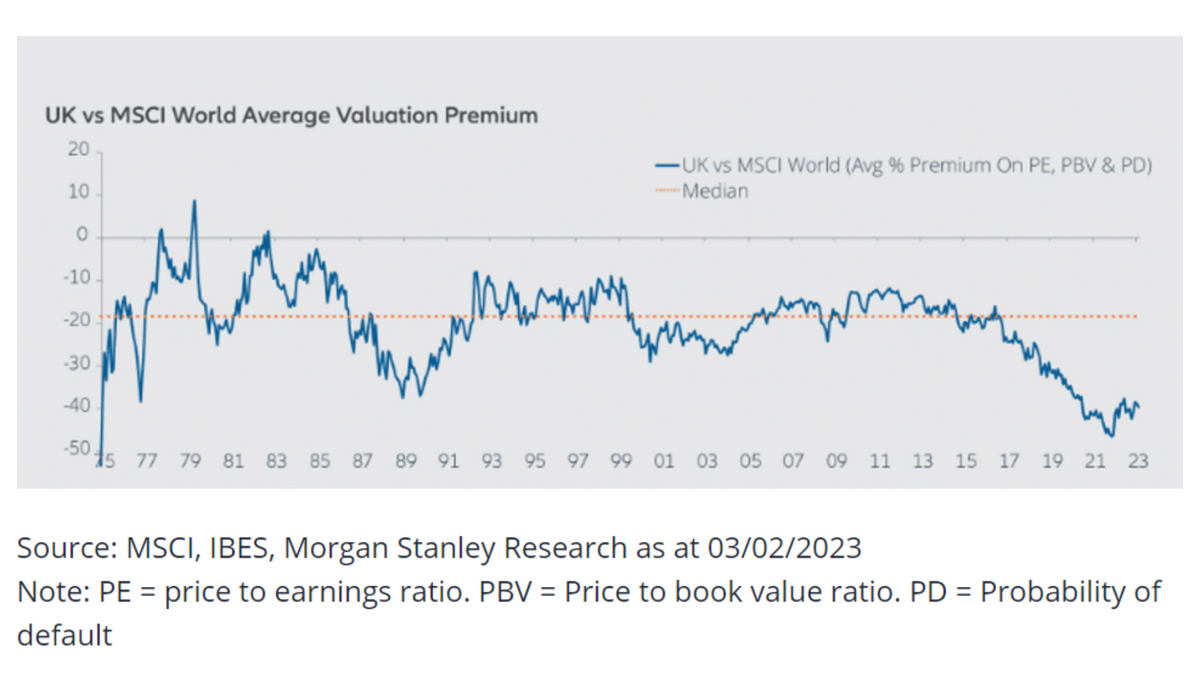

Despite their solid performance last year, UK shares remain relatively cheap and are attractively priced when compared to other leading players: the US, Europe, and Japan. In fact, as can be seen in the chart below [1], UK stocks are still trading at a 40% discount relative to their peers, partly reflecting its small technology sector. We believe this creates a ripe opportunity for investors to pick up cheap bargains whilst getting exposure to the many world-class businesses that reside in the UK.

As the global economy navigates recessionary headwinds and increasingly fraught geopolitics, having exposure to large companies which have solid balance sheets and are cash generative should insulate investors from volatility. One of the most important steps to building attractive long-term returns is finding value – the price you pay for a stock matters, and investing at price levels similar to today has historically proven to be a good approach.

You can never ignore the UK market

There are sound structural reasons for retaining exposure to UK shares, even during times of flux. First, it remains a hub for dependable cashflows. The UK is home to many long-established, world-leading ‘value’ companies with solid business models that post stable and reliable earnings year in, year out. This is key both when growth concerns are to the fore and when inflation is high and interest rates are rising. Moreover, these qualities are key in helping the UK retain its status as a leading destination for overseas investment. The many billions of assets that flood into the country annually not only underpin the economy but also help support share prices via the acquisition of UK companies.

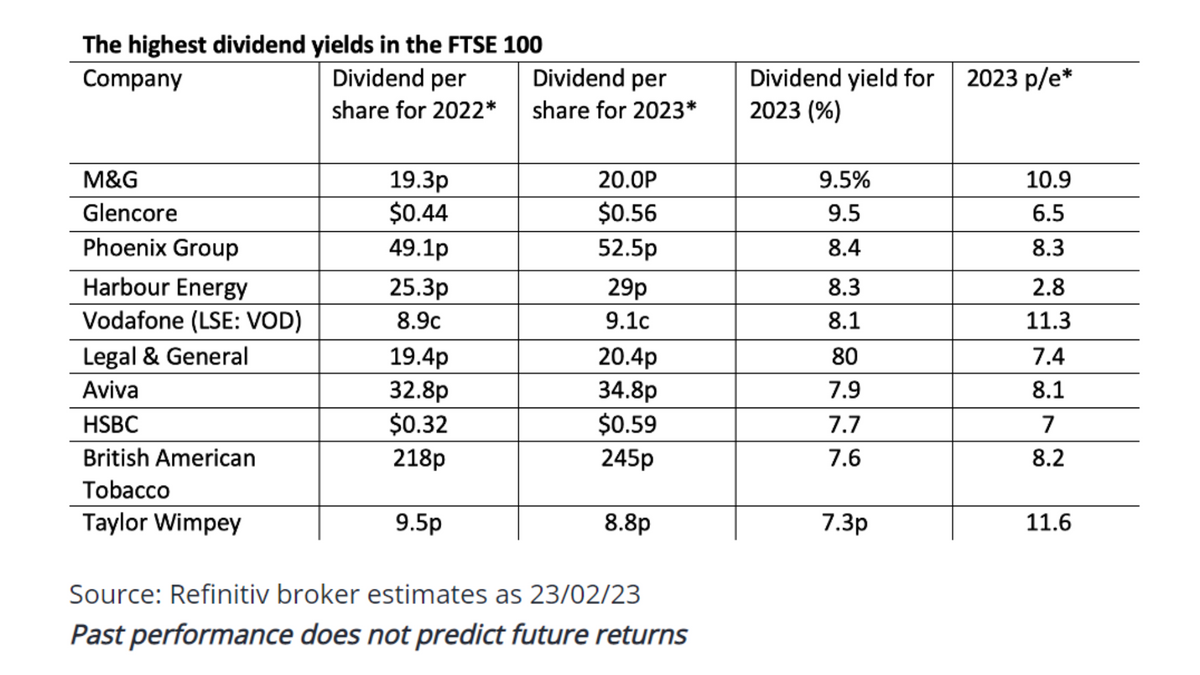

Second, the UK stock market has a history of paying investors highly competitive and growing dividends. And despite the volatility we have experienced over the last few years, the UK has remained one of the top dividend-paying regions and UK companies are forecast to pay the highest dividends in 2023: 4.1% [2]. In addition, though many of the country’s leading companies may be listed in the UK, they generate the bulk of their revenues from overseas, meaning they are less impacted by domestic uncertainty or volatility. This provides an important layer of diversification to their cashflows, thereby protecting their ability to pay dividends.

Third, the profile of the UK market has unique ‘defensive’ advantages that argue for it as a shrewd tactical play. A notable advantage is the market’s large representation in sectors such as health care and consumer staples – two steady, though unspectacular areas of the economy where earnings traditionally hold up well as recession bites. Financials also represent a significant portion of the UK market, and the higher interest rate environment should benefit their profit margins. And it is not just traditional banks that stand to benefit; insurance companies have been a reliable and resilient source of income, with Aviva Group, Phoenix Group and Legal & General forecast to be among the top dividend payers for 2023.

A portfolio for uncertain times

Given the numerous macro-economic unknowns in play, investors should be looking to provide ballast to their portfolio. With that in mind, The City of London Investment Trust (CTY) may be a compelling proposition in that it is a conservative fund but with an impressive record. It has outperformed its benchmark over the long term, and nothing argues more strongly for its dependability than its position at the top of the AIC’s Dividend Heroes list. It has raised its dividend for 56 consecutive years, the longest run of any investment trust.

A key benefit of CTY is that it levers the global profile of many of the UK’s largest companies. With its concentration in UK ‘large-caps’, it not only avoids the turbulence associated with smaller companies but also gives meaningful exposure to international streams of revenue. As around 70% of earnings of companies in the blue-chip FTSE 100 Index come from overseas, investors benefit from an added layer of diversification. So with CTY you ‘invest local’ but ‘get global’.

CTY also serves as a perfect complement for those investors with global or more risky exposure but want ‘ballast’ in their portfolio that can deliver a consistent and stable income as well as capital growth. The portfolio allocation is a testament to this, with key positions in defensive areas such as health care and consumer staples. However, the largest overweight is to financials, which currently represent a quarter of the portfolio. Holdings within the sector are diverse, with life insurance groups, financial services and 3i all included. High street banks also feature, which in particular have benefited from rising interest rates. So in terms of how it fits within an overall strategy, CTY can play a key anchor role.

Glass half full

With so many uncertainties hanging over the markets currently, investors should think long and hard before taking on undue risk. With its strong defensive credentials, CTY may be the ideal vehicle for those who want to get exposure to the unique growth and income benefits of the UK market but without having to accept excessive volatility. And with UK shares trading more cheaply than their main competitors and the economy showing tentative but tangible signs of recovery, the home market is primed for upside surprises.

Definitions

Balance sheet: A financial statement that summarises a company’s assets, liabilities and shareholders’ equity at a particular point in time. Each segment gives investors an idea as to what the company owns and owes, as well as the amount invested by shareholders. It is called a balance sheet because of the accounting equation: assets = liabilities + shareholders’ equity.

Cashflow: The term cash flow refers to the net amount of cash and cash equivalents being transferred in and out of a company. Cash received represents inflows, while money spent represents outflows.

Price-to-book (P/B) – ratio: Many investors use the price-to-book ratio (P/B ratio) to compare a firm’s market capitalisation to its book value and locate undervalued companies. This ratio is calculated by dividing the company’s current stock price per share by its book value per share (BVPS).

Price-to-earnings (P/E) – ratio: A popular ratio used to value a company’s shares, compared to other stocks, or a benchmark index. It is calculated by dividing the current share price by its earnings per share.

Volatility: The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. Higher volatility means the higher the risk of the investment.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Important information

References made to individual securities should not constitute or form part of any offer or solicitation to issue, sell, subscribe, or purchase. Holdings are subject to change without notice.

Not for onward distribution. Before investing in an investment trust referred to in this document, you should satisfy yourself as to its suitability and the risks involved, you may wish to consult a financial adviser. This is a marketing communication. Please refer to the AIFMD Disclosure document and Annual Report of the AIF before making any final investment decisions. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. [We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.]

Issued in the UK by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.