The UK Retirement Story: Five Pension Points for 2025

By Boring Money

22 Aug, 2025

As we hurtle towards Back To School season and parents spend some time ‘getting their life in order’ with the children out of their hair, we’re reflecting on what we know about how Brits feel about their pensions.

September is Pension Awareness Month - a nationwide campaign aimed at highlighting the importance of saving for retirement. At this time of year, you may encounter a tsunami of pension-related articles, webinars, and clinics plastered over your social media and/or email inbox, designed to educate you about how pensions work and how you can use them to set yourself up for a comfortable retirement.

Every year, our research team pick the brains of thousands of UK savers and investors to get a better understanding of what they’re doing with their retirement savings for our annual Pension Report. We've pulled out five of the most interesting insights below.

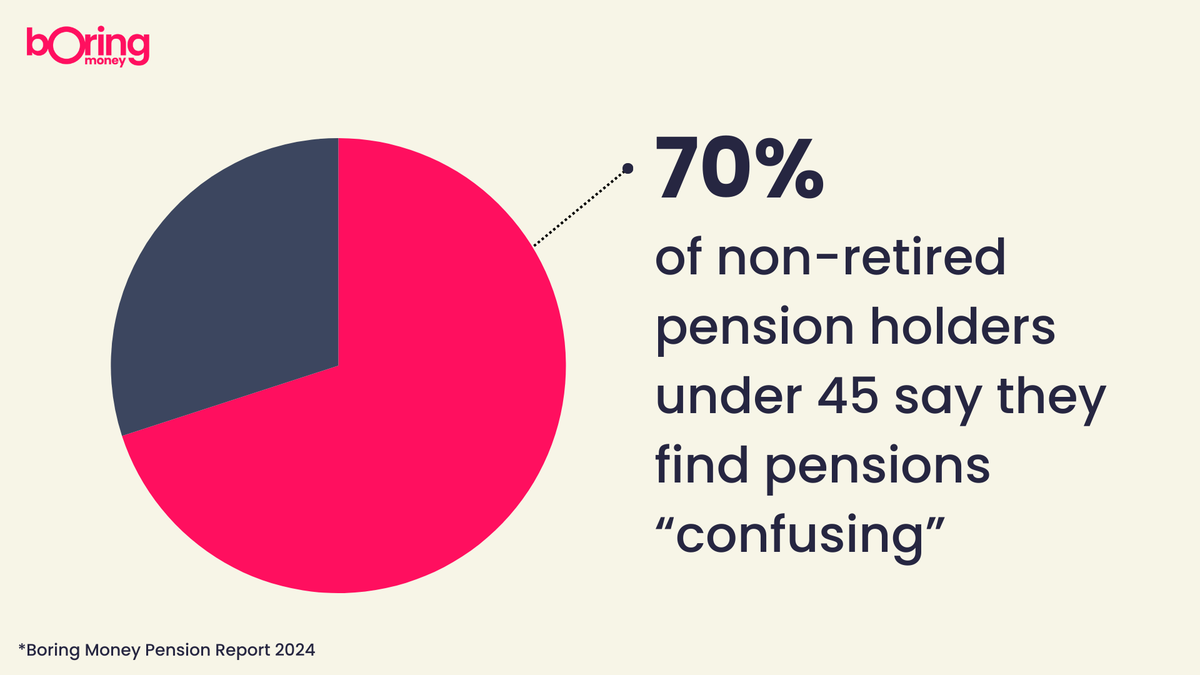

1) Majority of young people find pensions confusing

7 in 10 non-retired pension holders under the age of 45 told us they find pensions "confusing", showing the extent to which pensions are seen as complex and daunting products to those early on in their retirement saving journey. Older respondents recorded a slightly higher level of confidence, but just under 6 in 10 of non-retired over-55s still agreed that pensions confuse them.

Preparing for retirement is rarely as straightforward as we’d all like it to be. Sadly, the complexity of our pensions system exacerbates the issue, with changing policies, excessive jargon and insufficient government support leaving savers in the dark as they prepare for the future.

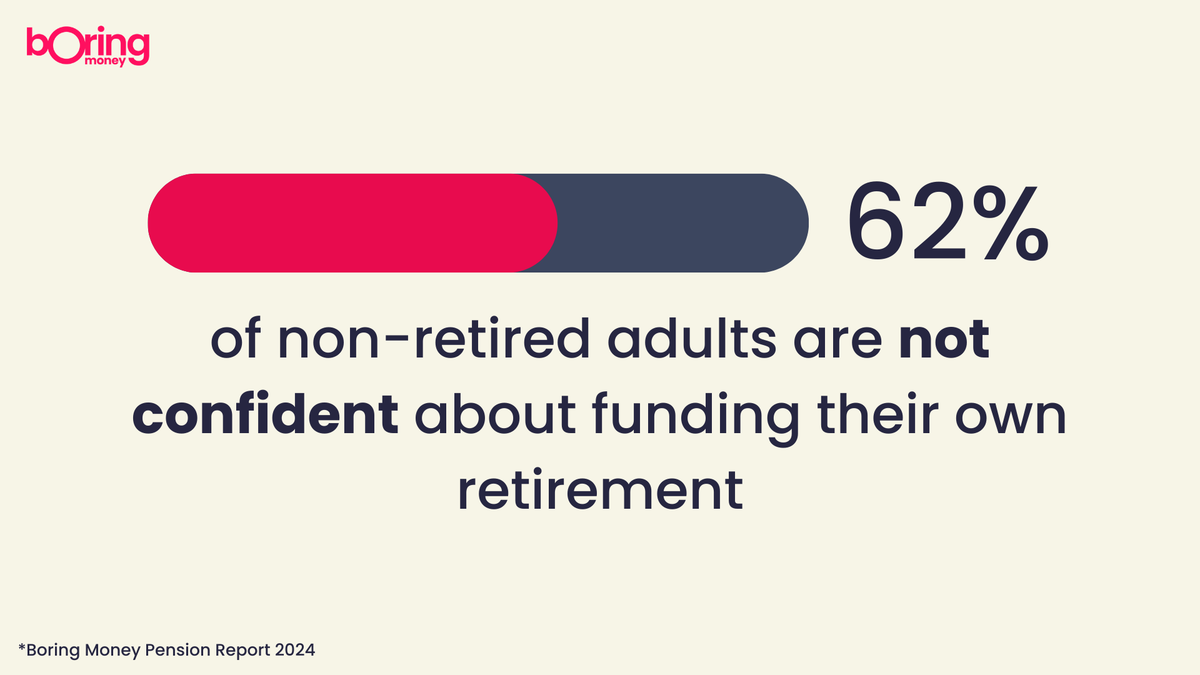

2) Almost two-thirds not confident about their retirement plan

Unlock this article to continue reading

Unlock this article to continue reading

Already have an account? Login