Will gold continue to glister in 2025?

By Boring Money

25 Nov, 2024

This content is a paid promotion and has been created in collaboration with VanEck. It is an advertorial designed to promote VanEck gold ETF products. While we strive to ensure the information provided is accurate and relevant, it reflects the views and messaging of the sponsor.

Gold is having its moment in the sun. In our September round-up of the best-selling exchange-traded funds (ETFs) of the month, the precious metal made an appearance in the top 10 most-bought ETFs on four of the UK’s largest investment platforms.[1]

Boring Money’s Founder & CEO Holly Mackay commented on the trend, saying: “Gold is back in town, perhaps predictably as global tensions soar and this safe haven grows in appeal. People have always liked something you can touch, hide under the bed, or hold when the world around us goes a little mad and we lose faith in the Powers That Be”.[2]

Gold’s safe haven appeal proves enduring

Gold has a rich history as one of the most treasured and sought-after commodities in global history. Whether a primitive trading tool, fashioned into fine jewellery or used to back major currencies through the “gold standard” system, the yellow metal has proven eternally useful across the ages and around the world.

But what exactly makes it so appealing? The Royal Mint, the UK’s official coinmaker, says its enduring popularity ultimately comes down to its rarity: “The very nature of what makes gold precious is the rarity and scarcity of the metal, something which has continued to fascinate people to this day. But just how rare is gold? Consider this, gold is so rare that the world produces more steel in an hour than it has poured gold since the beginning of recorded history!”[3]

Demand for gold, and the motivating factors behind it, also differs in different corners of the globe. For example, in Asia - particularly in India and China - gold retains special cultural significance. It is commonly used as part of luxury items and jewellery, which make up roughly half of annual gold demand.[4]

In Western nations, on the other hand, it is more commonly used to manufacture coins and bars. However, gold is not just limited to jewellery and currency. These days, it also plays an important role in industry, where it is used to make everything from mobile phones to electric cars.[5]

This multi-pronged and perennial demand has led to gold traditionally being viewed as a “safe haven” asset. That is, it has historically performed well during times of stock market turmoil, making it a useful asset to incorporate into a diversified portfolio to help hedge against volatility.

This distinction has proven valuable during previous periods of stock market instability. For example, let’s say you had invested in gold bullion (the technical term for physical gold) shortly before the “dot.com crash” that sent markets tumbling at the start of the millennium. While equities plummeted, BullionVault notes that gold maintained its value and emerged as one of the best-performing asset classes over the following years, at times even outpacing the S&P 500.[6]

That being said, investing in gold can also be a labour of patience. Surges in the price of gold are often followed by long periods of stagnation, so it can take a while before you reap the rewards for faith in this precious metal.[7]

Global unrest helps to bring sparkle back

Turning our attention to more recent history, what has been happening in gold markets lately? Though often overlooked in favour of more exciting assets such as equities, the yellow metal has quietly been delivering impressive returns over the last few years – returns are up over 60% since November 2021.[8]

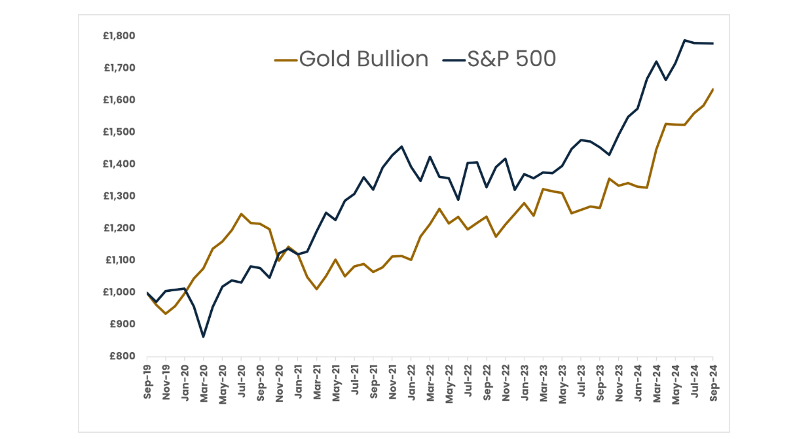

Looking back a little further during the peak of panic early in the Covid-19 pandemic, when stock markets took a tumble, the performance of gold bullion once again (albeit briefly) overtook that of the S&P 500 - illustrating the famed “safe haven” appeal of the precious metal once more.

The graph below charts the performance of a single £1,000 investment in gold bullion and in the S&P 500 over a 5-year timespan. See how gold overtakes the S&P 500 in mid-2020, dips around the time that mass vaccination drives were rolled out worldwide and markets got a puff of optimism, before settling into a mimicking pattern (albeit tracking slightly behind) to date.

Performance of gold vs S&P 500 over the last five years

Source: FE FundInfo. Data correct as at October 2024.

In 2024 specifically, in the midst of a summertime wobble in major stock markets – from fears of a recession in the US to the largest one-day fall in Japanese markets since 1987 – and now in the face of the escalating conflict in the Middle East, the volatility-hedging characteristics of gold continue to attract investors and have helped gold to quietly break records. The price of gold bullion reached an all-time high of $2,524.64 at the close on 27 August and, in total, it is up 111% over the last 10 years.[9]

Meanwhile, central banks around the world have been stocking up. According to the 2024 Central Bank Gold Reserves (CBGR) survey, which was conducted between 19 February and 30 April 2024 with a total of 70 responses, 29% of central banks said they intend to increase their gold reserves in the next twelve months.[10]

The rise in demand extends beyond central bank reserves too. Gold’s usage in the manufacturing sector, particularly for electronics and renewable energy, saw an 11% year-on-year increase to 81 tons in Q2 2024, according to data compiled by the World Gold Council (WGC). This can be attributed in part to the surge in demand for semiconductor chips, commonly used for AI and high-performing computing products.[11]

However, it is not just bullion itself that has been bullish so far this year. Physically-backed gold ETFs – a type of fund which invests in gold bullion on investors’ behalf - registered a fifth consecutive month of inflows in September, according to the WGC.[12] Many of these ETFs offer leveraged exposure and so have recorded double-digit returns in 2024 to date.[13]

Gold mining companies have also posted positive financial results, with around 80% beating or meeting consensus estimates for Q2 2024.[14] This no doubt contributed to the positive performance of gold-themed funds which invest in companies directly involved in the mining process. These have performed especially well this year, with the top performers booking returns of over 29% year-to-date as at October 2024.[15]

It is also possible to invest in raw material miners, mining resources other than gold - such as silver, copper, nickel and lithium. These firms, PWC says, “are helping feed the world while lighting the path to a low-carbon future and providing materials for infrastructure development and consumer needs”.[16]

Dazzling expectations for 2025 and beyond

The Federal Reserve’s bumper 50 basis point (bp) interest rate cut in September was also a significant catalyst for the recent price surge. Expectations of a further rate reduction in November, and another yet in December, have investors increasingly looking to gold in the closing months of the year.[17] This is because as US Treasury yields decline, other non-yielding assets such as gold become more appealing.

Looking ahead to 2025, major banks expect gold’s bull run to continue, buoyed by a combination of factors: interest rate cuts by the Fed; gold purchases by emerging market central banks; and potential geopolitical shocks in respect to the wars in Ukraine and the Middle East.[18]

Researchers at CitiBank say: “Gold is expected to remain strong, as the US economy is clearly late cycle - with further labor market deterioration anticipated... and numerous central banks remain keen buyers. Gold should also benefit in the scenario that oil spikes on near-term Middle East escalation.”[19]

Here at Boring Money, our Research Manager Mahdi Shabir acknowledges the recent record-breaking performance of gold makes a compelling argument to invest, but also urges investors to bear in mind it is best suited to long-term investment ambitions:

“Over the last 50 years, gold prices have increased by roughly 15x, which highlights the attractiveness of the asset as an investment opportunity. However, when analysing these returns in more depth, there are periods of significant surges often followed by drawbacks, and there have been long time periods where prices have stagnated,” Shabir says. “It took roughly 25 years for gold to recover back to the record highs of 695 USD per oz which it saw in 1980, and there was close to a decade of drawdown duration between highs during the Arab Spring and the Covid period in 2020.

“Whilst the market and geopolitical tensions may seem primed for gold to continue its upwards trajectory over the past 5 years, where it has increased in value by 75%, both timing and diversification remain important. A key distinction between timing and diversification is that we have limited control over one and complete control over the other. One way to reduce the risk of investing at an inopportune moment is to use 'dollar-cost averaging' techniques, where you slowly build up with equal investments in regular intervals, instead of investing erratically with large lump-sums that make up a significant proportion of your assets in a given moment”.

Whether you're seeking shelter from market storms or you’re looking to cash in on its glittering future, gold continues to prove that all that glisters can indeed be a golden opportunity.

Please note that past performance is not a guide to future performance and should not be the sole factor of consideration when selecting an investment.

---

[1] Boring Money, September 2024

[2] Boring Money, September 2024

[3] The Royal Mint, October 2024

[4] World Gold Council, October 2024

[5] The Royal Mint, October 2024

[6] BullionVault, October 2024

[7] BullionVault, October 2024

[8] Goldprice.org, October 2024

[10] World Gold Council, June 2024

[11] World Gold Council, July 2024

[12] World Gold Council, October 2024

[13] Boring Money, September 2024

[14] VanEck, August 2024

[16] PWC, June 2024