Investment Focus: China

22 Nov, 2024

China joined the World Trade Organisation in 2001, after 14 years of negotiations. It triggered an astonishing expansion in its economy, from US$1.34 trillion to US$17.8 trillion today.[1] It now sits just behind the US, with 18% of the global economy. The nearest rival – Japan – has just 4.2% of the world GDP.[2]

Setting the scene

Its growth was built on its position as a manufacturing hub for global companies. Affordable, skilled workers, a strong business environment, and friendly tax rules made it a top choice for global companies. ‘Made in China’ goods became ubiquitous.

Its growth has had global repercussions. In the 2000s, the rapid industrialisation and urbanisation of China prompted unprecedented demand for certain commodities, creating a ‘super-cycle’ that saw prices soar. China's low-cost manufacturing filled the world with cheap goods. This lowered inflation and let countries like the US create large trade deficits.

It also created a new and exciting investment opportunity. Investors had been able to invest in Chinese companies through the Hong Kong market (‘H’ shares) since 1993. Trading is in Hong Kong dollars and the market is fully open to foreign investors. Since 2003, foreign investors with a qualified investor license can trade in the 'A' shares market.

These are Chinese companies that trade on Chinese stock exchanges such as the Shenzhen and Shanghai Stock Exchanges. These stocks trade in the Chinese yuan renminbi.

Alongside its prowess in manufacturing, China has built up significant technological know-how and expertise in certain technologies. Chinese companies have led the rest of the world on social media, electric vehicles, and battery storage.[3] China’s patent applications accounted for more than half the global total in 2021.[4]

China today

However, China’s growth has plateaued in recent years, and economists are debating whether this is temporary or structural. There is speculation over whether China is suffering from an economic phenomenon known as the ‘Middle Income trap’.

With a GDP per capita of $12,604, there is a question about its income level. It may be too high to compete as a low-cost manufacturing hub. However, it is not yet able to compete in high-value industries.[5]

However, there are other factors at work. The country’s property boom and bust has reverberated through the economy.

The crisis has roots reaching back to the Global Financial Crisis. Too much development and high debt from builders made the market weak. This led to the default of Evergrande, one of the country’s largest property developers, in 2021. Authorities stepped in, attempting to slow the market with as little economic impact as possible.[6]

This hasn’t been entirely successful. Consumers have lost confidence in the housing market and other developers have faced challenges.

People have paid deposits for homes that remain half-built and it continues to weigh on economic growth across the country. The government's actions, like easing rules for first-time homebuyers and lowering down payment and mortgage rates, have helped a bit. However, the housing market is still weak.

Covid has also weakened the Chinese economy. Its draconian lockdowns, which saw people confined to their homes and movement rigorously policed, prompted protests on the streets.

Consumer confidence has not recovered. Global companies re-routed supply chains, unable to deal with the disruption. This helped create the ‘China plus one’ trend in the post-pandemic world.

Many companies are now diversifying their supply chains beyond China, aiming to build greater resilience.

The other major problem for China has been geopolitical tensions. Since the first Trump presidency in 2016, relations between China and the US have fractured. The US no longer wants to give it free access to its large consumer markets.

Meanwhile, tariffs have been imposed by both Democrat and Republican administrations. Donald Trump won the recent US Election partly on the promise of hefty tariffs on Chinese goods that could reach as much as 60%.

China has also inflamed global tensions with its stance on Taiwan, claiming it as part of China rather than an autonomous state.

All in all, the US and China are each other’s main trading partners. This means that tough relations could harm both economies.[7]

Market | Trade (US$ Mil) | Partner Share (%) |

United States | 582,756 | 16.22 |

Hong Kong, China | 297,538 | 8.28 |

Japan | 172,927 | 4.81 |

Republic of Korea | 162,621 | 4.53 |

Vietnam | 146,960 | 4.09 |

Source: World Integrated Trade Solution, China's top 5 Export and Import partners

The stock market trajectory

Until 2021, China’s stock market had been a triumphant success story. The Shanghai Composite had risen from 1,800 at the start of 2001, to 3,568 at the start of 2020.

This came with a lot of ups and downs. The index reached as high as 5,772 just before the 2008 financial crash. However, it rewarded investors who supported it from the beginning.

Data provided by FE fundinfo, correct as at 19th November 2024

Within this, there was astonishing growth for China’s home-made technology giants such as Alibaba and TenCent. Between 2018 and its peak in January 2021, the TenCent share price moved from HK$261 to HK$588.[8] Domestic investors pushed the ‘A’ shares market higher.

The subsequent slump has been painful. It started with a government crackdown on tech companies in late 2020, with warnings about “barbaric growth” and “disorderly expansion of capital.”[9]

For investors, this signalled that their money was not safe. Trillions were lost in the share prices of China's tech giants, and the rest of the market followed.

The slump has been sustained by the broader weakness in the Chinese economy and poor sentiment towards the country. International investors have drawn money away from the region. The Financial Times analysed Hong Kong's Stock Connect data, revealing that about $29 billion left China-listed stocks in 2023.[10]

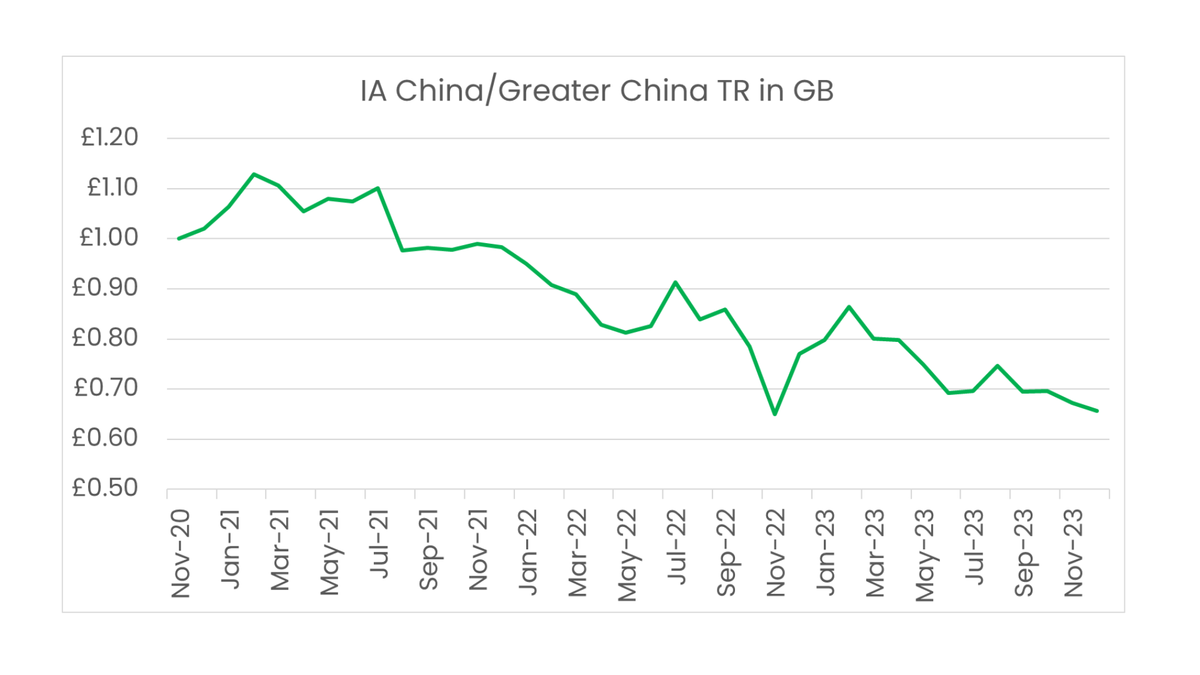

It has been a torrid time for investors in Chinese funds. The average fund in the IA China/Greater China sector dropped 10.7% in 2021, 16% in 2022, and another 20.2% in 2023. Some fund managers now consider the Chinese market uninvestable.

Data provided by FE fundinfo, correct as at 19th November 2024

Jason Pidcock, the manager of the Jupiter Asian Income fund, sold his last Chinese investment in 2022. He said:

I've become increasingly uncomfortable with the direction of domestic politics in China, as well as the souring of relations with other countries, in particular the US.

He has not revised his view since and continues to hold a zero weight in the country.

The stimulus

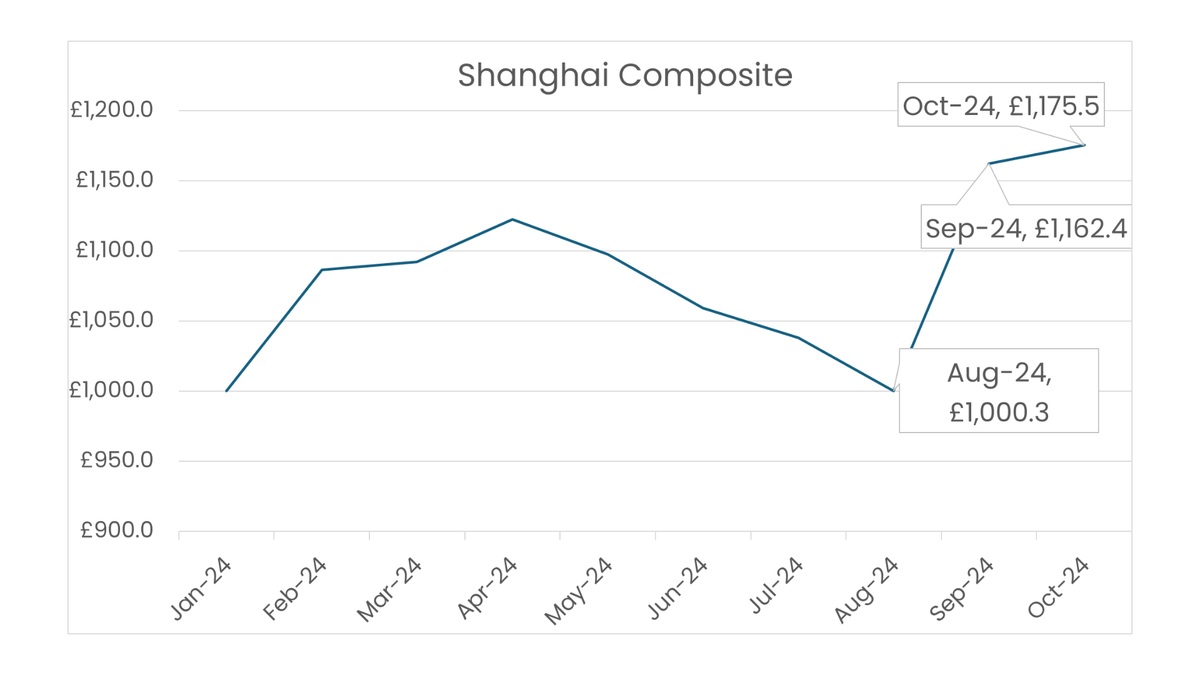

Yet the past two months have seen an astonishing turnaround in the Chinese stock market. The Shanghai Composite rose 27.5% from 20th September to 8th October.

Investors quickly returned to emerging market funds, hoping to join in on the action. A total of $40.9 billion went into Emerging Markets Equity Funds during the week ending 9 October.

Data provided by FE fundinfo, correct as at 19th November 2024

The immediate catalyst for this turnaround has been a stimulus package from the Chinese government. Victoria Mio leads Greater China equities at Janus Henderson. She says the stimulus package tackles three main issues for China:

For economic growth, the PBOC lowered the Required Reserve Ratio by 50 basis points. This move released approximately RMB 1 trillion ($142.5bn) worth of liquidity into the financial system, aiming to improve access to funding and support business activities.

To address the ongoing property sector slump, interest rates on existing mortgages will be cut by an average of 50 basis points, offering relief to 50 million households and potentially saving RMB 150 billion ($21.1bn) in interest expenses. This move should ease financial pressure on homeowners and stabilise the property market.

The last pillar, according to Mio, is a RMB 500 billion ($71 billion) swap facility. This facility will help brokers and funds buy stocks. The aim is to inject much-needed liquidity into the stock market and support prices. There were also measures to encourage companies to buy back their own shares, which should also be supportive.

Ongoing challenges

The woes for the property market may not yet be over. Oxford Economics said: “It is also too early to conclude the downtrend in the property market is behind us. The recent uptick in sentiment and home transactions have not translated into a significant boost to other property activities. Project completion and investment growth remained negative. Particularly, funding to the sector continued declining year on year.”

Chinese property remains optically expensive. In terms of income multiples, house prices are among the highest in the world. The IMF’s house price-to-wage ratio shows China has seven of the world’s top ten most expensive cities for residential property. This has led to a trend of de-urbanisation as young people are priced out and begin to move back to rural areas.[12]

Goldman Sachs warns that without help, property values could fall by another 20% or 25%. This drop would bring prices down to about half of their peak. The government's actions are positive and our researchers now believe that property prices may stabilise by late 2025.[13]

Aside from that, China faces a burgeoning demographic challenge. With an aging population and the legacy of its one-child policy, an estimated 300 million workers are set to exit the workforce in the next decade.[14] This massive shift threatens to significantly slow economic growth, particularly as many elderly lack adequate retirement support.

Simultaneously, de-globalisation and rising geopolitical tensions pose serious challenges. Protectionist policies, especially from the US, are constraining China's once-unrestricted global trade, potentially limiting its export markets and economic expansion.

Looking forward

The Chinese government maintains that it is aware of all these problems and is taking steps to address them. The question is really whether it is successful in doing so.

Banking group DWS says in its CIO Flash: “It has to be noted that previous market rallies on the back of significant stimuli plans have yielded equally abrupt market movements, even if considering just the last three years. In all cases, market excitement soon lost momentum as stimuli programs lacked follow-on programs. If the current measures fail to wake up the domestic consumer’s interest in spending savings again, the effect of the reforms might be short-lived."

That said, many of China’s problems are reflected in market pricing. DWS said again: “We consider the Chinese equity market to be optically cheap at a price-to-earnings ratio of just 9.5x for 2025 which leaves positive re-rating potential on the table as long as market optimism about additional reforms does not fade away".

Dale Nicholls, manager on the China Special Situations fund, agrees:

Valuations in China remain compelling relative to history and global peers. We believe there is still ample room for valuation multiples to expand further. While the earnings outlook for China in aggregate is adequate in a global context, with strong results in areas like technology, the general trend of earnings revisions has been downward. The hope would be that these policies can help drive a turn in economic fundamentals, leading to an improved earnings outlook. Such a virtuous circle would almost certainly drive a sustained improvement in market sentiment.

Investment actions to consider

1. Diversified exposure options

Global emerging markets funds offer a lower-risk entry point, with China representing approximately 25% of the MSCI Emerging Market index. [16] This approach allows investors to gain exposure while spreading risk across multiple markets.

2. Dedicated China options

Dedicated China ETFs will provide targeted exposure to the Chinese market. These will tend to be based on recognised indices such as MSCI China or FTSE China and the largest holdings will be the Chinese technology giants such as Alibaba and Tencent. The table below lists some examples of prominent dedicated China ETFs, their recent performance and Ongoing Charges Figure (OCF):

ETF | 1 year performance | OCF |

Xtrackers FTSE China 50 ETF (XX25) | 20.37% | 0.60% |

iShares China Large-Cap ETF (FXC) | 20.18% | 0.74% |

Market Access Stoxx China A Minimum Variance Index ETF (M9SV) | 18.38% | 0.45% |

JPM Carbon Transition China Equity ETF (JCTC) | 15.24% | 0.35% |

Amundi MSCI China ETF (LCCN) | 15.07% | 0.29% |

Franklin FTSE China ETF (FLXC) | 14.75% | 0.19% |

HSBC MSCI China ETF (HMCH) | 14.60% | 0.28% |

Xtrackers MSCI China ETF (XCS6) | 14.24% | 0.65% |

Invesco MSCI China All Shares Stock Connect ETF (MCTS) | 11.50% | 0.35% |

KraneShares ICBCCS China S&P 500 ETF (CHIP) | 11.12% | 0.55% |

3. Actively managed funds

Actively managed funds will aim to pick the best companies for long-term growth. There are areas where China has demonstrated real innovation and global leadership, including renewable energy, photovoltaics, battery storage, and electric vehicles. Active managers can tap into some of these themes.

Investors can choose open-ended funds or investment trusts. China has been out of favour, which has left investment trusts trading at 12-14% discount to underlying holdings. If the Chinese market recovers, investors would get a double whammy of rising markets and a narrowing of this discount.

Investors should look for fund managers who have proved themselves able to: Navigate complex market dynamics; Identify entrepreneurial and innovative businesses; Avoid slow-growing state-owned enterprises; And quickly move away from challenging market segments.

Risk mitigation

The Chinese market still has plenty of complexities. There are ongoing geopolitical tensions with the United States, demographic challenges such as an ageing population, and falling workforce participation. The property market also remains unstable and the market is volatile. That said, the market has fallen significantly and may present good value for investors with the skill to navigate it effectively.

---

[2] Worldometer

[3] Information Technology & Innovation Foundation, September 2024

[4] Our World In Data, November 2024

[5] Worldometer

[7] World Integrated Trade Solution

[8] Marketwatch

[9] South China Morning Post , November 2024

[10] Business Insider, December 2023

[12] Forbes, December 2021

[13] Goldman Sachs, November 2024

[14] BBC, Arpil 2024

[15] MSCI

[16] AIC

[17] Goldman Sachs