11 Dec, 2020

Lesson 3: Meet the Robo Adviser

Robo advisers may sound a bit off-putting but they are actually a fantastic way for beginner investors to set up an investment account with minimum fuss. And with support from investment experts so you can’t go too far wrong.

The basic idea is that the investment teams at the robo advisers put together a range of investment packages. Which are all designed to behave a bit differently.

Some will be less volatile and a smoother ride – but won't have the potential to make so much in the long-run.

And others will jump up and down more – but will be expected to make you more over the long-run.

This is what is meant when people talk about your ‘risk profile’.

Risk profile mapping

The big idea of the robo advisers is that most of them have tools to help guide you into the right sort of package. They will ask a range of questions – all fairly simple and there are usually about 5-15 questions – and this will help them to suggest the right package for your needs and preferences.

Risk profiles usually range from something which should be mild – this is normally called Defensive or Cautious. And moves up to a mid-range option called Balanced or Medium. And ends up at the higher end of the spectrum in a portfolio typically called something like Adventurous or Aggressive.

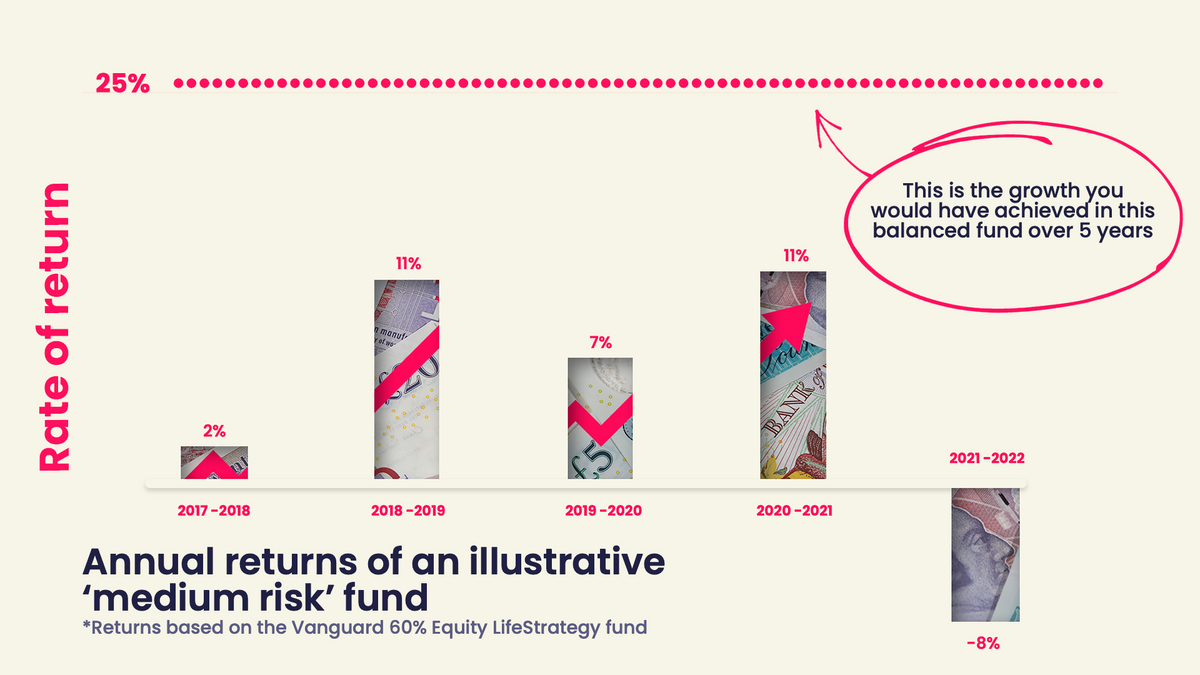

Annual returns of an illustrative ‘medium risk’ fund *Returns based on the Vanguard 60% Equity LifeStrategy fund

If you are comfortable with what they propose, then you accept the suggestion and they go off and make it all happen for you.

So you end up with an investment portfolio which will be spread around thousands of individual investments, with a good blend of regions and sectors, and someone else picks, manages and tweaks things on your behalf on an ongoing basis. It’s the investment equivalent of getting a nice ready-meal – rather than needing to pick out and blend all of the ingredients yourself.

Flavours

In recent years, many robos now offer sustainable versions of the portfolios. These can be called anything from Ethical to Socially Responsible to Sustainable. There is little consistency about this so do your reading. It can seem complicated – for example some portfolios will have oil stocks in them. This disappoints some eco-warriors. But some investors argue that by holding the shares, they can hold these companies to account and force them to set up and communicate transition programmes of change to cleaner energy.

The point is that you need to dig under the bonnet with these to check that they are prioritising the things you care about.

Tax wrappers

Most robo advisers will now offer ISAs and pensions. Sometimes these DIY pensions are called SIPPs (self-invested personal pensions). Some will offer Junior ISAs for the kids. And others will offer Lifetime ISAs for those under 40 saving for a first property – these give you Government top-ups but have penalties attached to withdrawals too, so do your homework.

As always the trade-off between stocks and shares ISAs and pensions is that ISAs are flexible and you can take the money out whenever you want. But pensions give you Government top-ups so they really boost your savings – but you can't access the money till you’re in your late 50s. You can have both open and slowly build both.

ISAs are generally the best starting account for beginners as they are tax-free, easy to access and simple.

Performance

We publish robo advisers’ performance in detail here.

In fact, 2022 was a bad year in markets and pretty much every portfolio fell in value. Because of technical issues which were exacerbated by that chaotic mini-Budget, bonds (usually less volatile) had a crazy year and so the low-risk portfolios mostly did worse than the high-risk portfolios. This is very unusual.

If the world follows the investment rule book, we would expect the medium risk portfolios to make around 4%ish every year after all charges. Averaged out over time because there will be good years and bad years.

IIn 2020, the best high risk robo returned 7.52% (Vanguard LS 80). It was 21.28% (Moneybox Adventurous) in 2021, and -3.52% (AJ Bell Adventurous) in 2022, in the 9 months to September.

Costs

This service will typically cost anywhere from about 0.6% to 1% a year – including all investments, tech, accounts and management. That’s between £6 and £10 every year for every £1,000 invested this way. Pretty fair for an all-in service.