Aviva Workplace Pension Provider Review

Independent review by Boring Money

8 Jan, 2026

Overview

Aviva is a very big and established pension provider. With 21 million customers across the UK and Ireland, and a staggering £119 billion looking after people's retirement savings. That's £1 billion flowing into Aviva pensions every single month.

Size isn't everything, but it does mean something. Aviva has a bigger customer base than every UK bank except Lloyds. They're not going anywhere, which matters when you're trusting someone with decades of your retirement savings.

Aviva is a big, solid pension giant which has a huge team of people supporting on the phones, online, and in workplaces. Their huge corporate presence supports responsible investment, a net zero carbon emissions target by 2040, and strong customer service, which will go above and beyond in supporting more vulnerable customers. Although the in-app content is plentiful and helpful, it can be difficult to navigate, and there are times when less would be more. Fair costs, investments are fine, but the digital experience could be more user-friendly.

*This is the view of investment expert Holly Mackay based on her first-hand customer experience as a test account holder. This does not constitute regulated advice. You can read more about Holly's investments here.

Key strengths

Investment Offering

Most people in a workplace pension scheme will be enrolled in the default fund. Aviva's main default is called My Future Focus. It uses a 15-year "glide path" - which is pension-speak for gradually moving your money from adventurous investments (shares) to boring-but-safer ones (bonds and cash) as you get closer to retirement. They have recently reviewed the glide path, extending it from 10 to 15 years and have increased the risk profile of their default funds with an aim to improve future performance for their customers.

What If You Don't want the Default fund?

Aviva offers seven alternative pension pathways, including different retirement income strategies (annuity, cash, drawdown, universal), ethical/ESG options, Shariah-compliant investing, and a higher-risk private markets version. If you want to pick your own investments, you get access to 30-250 funds, depending on which Aviva product your employer chose—enough choice to be meaningful without being overwhelming.

Investment performance

📈 Performance overview

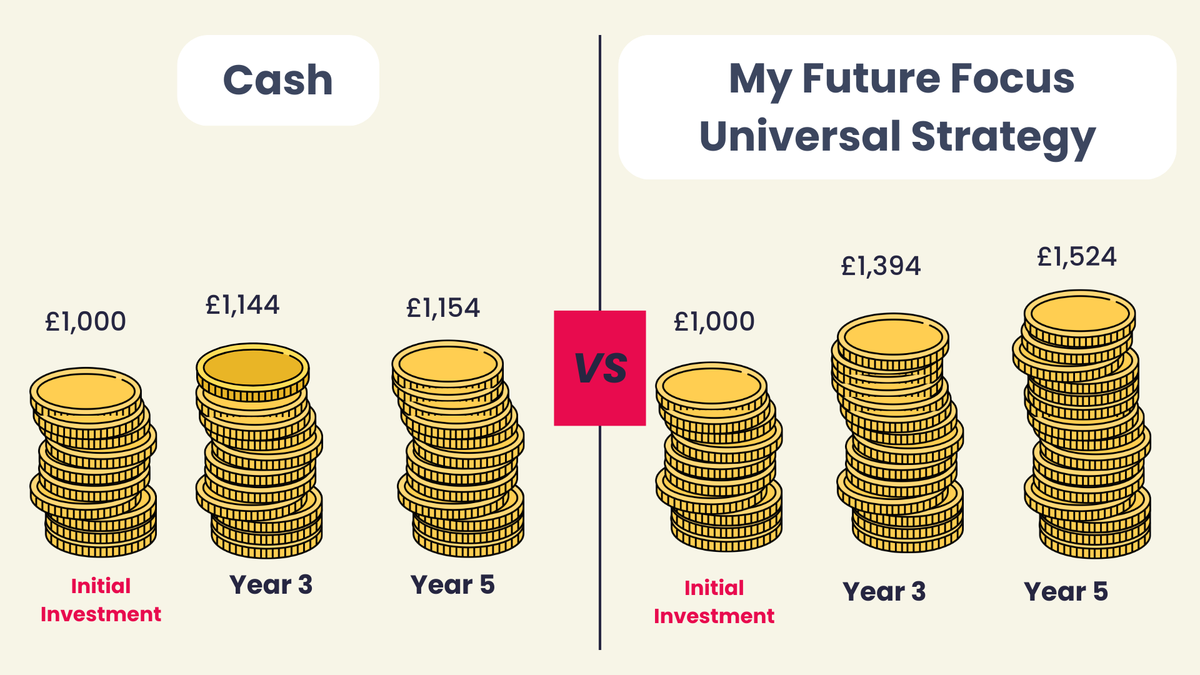

Below we show the performance of the default investment for Aviva customers. This is the My Future Focus Universal Strategy.

Recent performance:

In £ terms:

Source: For Cash Comparison: FE FundInfo, Bank of England Base Rate.

Performance* | 3-year performance | 5-year performance |

My Future Focus Universal Strategy. | 39.5% | 52.4% |

*This performance data shows returns for members 15+ years from retirement.

Past performance is not a guide to the future. Prices can fall as well as rise, meaning a member may not get back the full amount of capital originally invested.

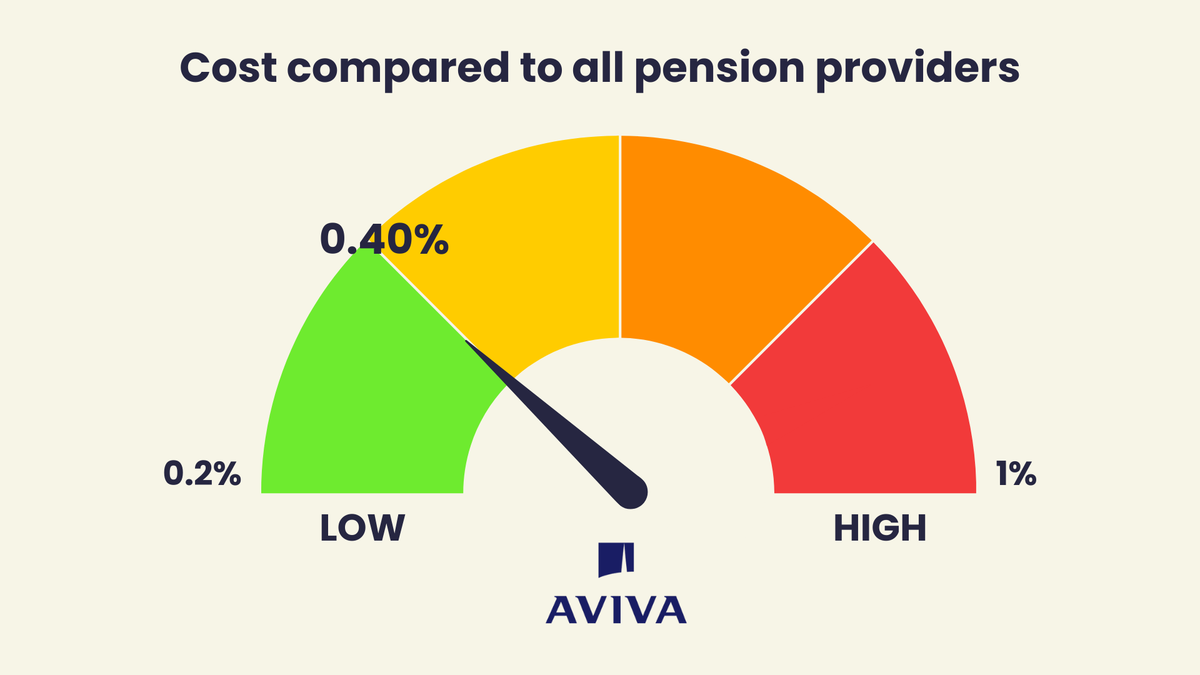

Fees and charges

Don't shoot the messenger, but pension charges can look complex. They are complex. The fees differ by employer, so it depends on who you work for. They're typically higher for small firms and lower for big companies with fat pension pots.

Aviva's average: 0.40% per year (all-in)

This includes everything - platform charges, investment costs, administration, the lot. No hidden extras.

But is 0.40% good?

The typical range for workplace pensions is 0.3% to 0.6%. So Aviva sits bang in the middle. It's cheaper than a personal pension you'd set up yourself (those usually start at 0.45% minimum), but it's not the cheapest workplace option. Given the service quality, digital tools, and investment management, this is fair value. As aforementioned, this will differ depending on the workplace scheme you are enrolled in may differ.

Customer service and support

Aviva has clearly made customer service and accessibility a priority. You can reach their customer service team via:

☎️ Customer service team

Who you're talking to on the phone: All Aviva staff. Not outsourced to a random call centre in... wherever. Around 240 full-time employees just for workplace pensions across 3 UK locations.

⭐ Customer satisfaction ratings

Trustpilot: 4.3 stars (from 53,878)

Google Play: 2.8 out of 5 (from 3,580)

App Store: 4.6 out of 5 (52,000+ ratings)

According to the regulator, there were 2.0 complaints for Aviva per 1,000 customers in the last reporting period. This is in the middle range of providers, so it looks reasonable to us.

Source: FCA, The data relates to the first half of 2025 (H1) and includes data from firms that report 500 or more complaints within this 6-month reporting period, or 1,000 or more for an annual reporting period.

Vulnerable Customers

This is a key area of focus for Aviva. They have over 100 Vulnerable Customer Champions scattered across the UK. These are specialists who deal with difficult situations and this goes beyond regulatory requirements. They champion a "tell us once" approach whereby the customer query and circumstances are recounted once and retained on record (should the customer agree to this) so they do not need to repeat themselves.

Boring Money customer reviews

Help others by sharing your feedback!

08 January 2026

I instructed Aviva to cash in my pension, filled in the appropriate forms and got confirmation in writing that payout should be within 15 business days of the 1st December, I booked a builder to do some work beginning the 6th January expecting the funds to be in my account by 22 Dec, nothing arrived! I called Aviva and was told there was a 5 day Delay due to the holiday period and staff sickness so I waited until 2nd Jan and called again only to be told there could be a further delay of 2 weeks??? at which point I had to cancel my building work. I lodged a complaint asking for a specific date when MY money would be available and received an email confirming my complaint with a case number and a contact phone number, however the phone number did not exist so I rang Aviva again asking for a payment date, after holding on the phone for what seemed like an eternity I was told that the payment team would contact me directly, as you probably guessed, nobody did so here I am posting this about a company I used to consider trustworthy. I am disgusted to think that Aviva are holding on to peoples own money just to earn a little more interest for themselves.

04 November 2025

Fees the absolute maximum they're allowed to charge and some restrictions on transfers. Insipid default fund. Decent app though

24 September 2025

Easy to use self-managed platform

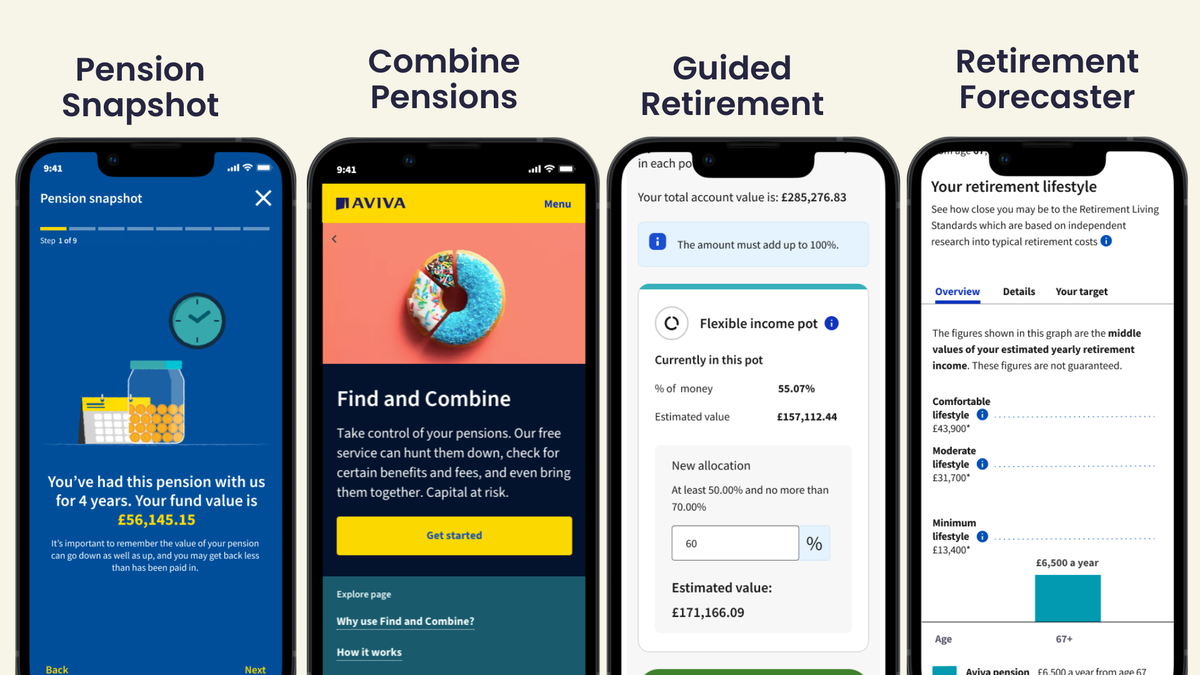

Digital tools and features

💻 Digital experience

Functionalities and features will vary depending on your employer.

There's a host of planning tools available on the Aviva app. The retirement forecaster helps you work out your monthly income at different pot sizes and includes a contribution modeller that shows what happens if you increase payments. It also features a career break modeller, so you can visualise how pausing contributions might affect your pension pot.

An AI-powered lost pension finder lets you track down and transfer in old pots—useful if you've accumulated pensions across multiple jobs.

The Guided Retirement feature is a guidance tool that helps people in retirement answer the question: "how should I divide this up?"

Depending on your employer, you might also get extras such as mortgage advice through Tembo, savings options, and employee perks.

The downside: while the content and tools are helpful—and in some cases necessary—the app can be difficult to navigate. Not everyone wants or needs this much; some people just want to see their balance and projected income. The app handles this well by not forcing engagement, but the complexity remains.

📬 Communications and Engagement

Aviva uses its insights to stay in touch at the right moments. You'll get welcome packs when you join, then communications tailored to your age—reminders about saving in your 20s-30s, retirement planning nudges in your 40s-50s, and decision support from 55 onwards.

There are free webinars (recorded if you miss them live) and a tiered support system: calculators and online tools if you want to do it yourself, a specialist phone team for retirement prep reviews, and signposting to financial advisers for anything complex.

Sustainability and ESG commitments

Here's where Aviva gets interesting. A lot of providers claim to care about ESG (Environmental, Social, Governance). Most are basically box-ticking. Aviva actually seems to mean it.

They describe it as "within the organisation's DNA rather than a flavour of the month”. That might sound like marketing waffle, but the evidence backs it up.

Aviva takes two main approaches to responsible investing.

Exclusions mean they won't invest in certain sectors or industries at all. Their list is straightforward: no tobacco, no controversial weapons, no thermal coal, no arctic drilling.

Active ownership means they buy shares in companies but use that ownership to push for change. In 2024, that meant 2,330 engagements with 1,325 companies (plus 59 governments), with 2,114 substantial interactions and 190 specific successful outcomes. They're not just passively holding investments—they're actively challenging companies to improve their practices.

How does Aviva implement this at fund level? Active funds consider ESG factors alongside financial metrics. Passive funds are optimised for higher ESG scores than standard indices, with a carbon intensity reduction pathway in place.