What to expect from stock markets in 2022

30 Dec, 2021

What to expect from stock markets in 2022?

As 2021 draws to a close, we spoke to some investing experts to get their predictions for the year ahead. What can investors expect? Do they need to be concerned about rising inflation and the latest Covid variant? And will tech stocks continue to deliver or is it a bubble set to burst?

In Summary: 2022 is not a year to try and be an investment hero. Diversify. Stick with large known options. Think global.

In detail: Most reckon the era of ‘easy money’ money is over and although they expect to see some gains in the coming year, a market correction is a possibility - unsurprisingly, much hinges on the trajectory of the pandemic. The general view is cautiously optimistic although they do not expect a repeat blockbuster year of many strong sectors and regions.

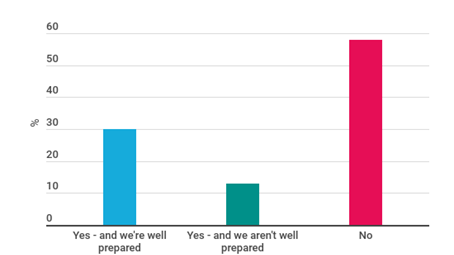

When we asked financial services industry professionals at an event we held in mid December, the majority felt optimistic about 2022, although over 40% said they expected to see a correction in share prices next year.

Do you anticipate a market correction in 2022?

Produced 08/12/21 in a live webinar

A critical factor is how Central Banks respond to competing pressures of rising inflation (to which the normal response would be raising interest rates) and supporting a global economy still troubled by Covid concerns.

‘The challenge is rising inflation pressures in the first half of the year, although these should be easing by year-end,’ says Gerard Lyons, chief economic strategist at Netwealth. He points out that it is ‘often challenging for markets’ when Central Banks impose tighter monetary conditions (meaning they raise rates and it becomes harder to borrow) but thinks that ‘markets should be able to cope’ as long as the move is gradual.

AJ Bell, head of investment analysis, Laith Khalaf is also generally upbeat. Although he says ‘a strong year and a correction are both plausible outcomes’, he believes that the former is more probable if there isn’t a major ‘pandemic setback’.

Emma Wall at Hargreaves Lansdown agrees that on balance investors can be moderately optimistic about the prospects for a globally diversified portfolio, but warns ‘investors should expect significant volatility and certain regions will post losses.’

Jason Hollands, Managing Director, Corporate Affairs, Tilney Smith & Williamson, also says things are on a knife-edge, but reckons that a lack of viable alternatives will continue to support stock markets: ‘inflation looks set to remain at relatively high levels for several months yet and with very low interest rates on cash and dismal yields on bonds, real returns (after inflation is factored in) are going to remain deeply negative on the supposedly “safe” stuff. That will continue to support the case for investing in the stock market’.

The team at Interactive Investor recommended looking at a ‘globally diversified investment trust or fund’ rather than trying to pick out the sectors and regions most likely to flourish. In such an unpredictable environment this is a ‘road to disappointment’ they say. Instead they suggest globally diversified Trusts like the F&C Investment Trust and Scottish Mortgage which have ‘weathered Spanish Flu, The Great Depression, world wars, economic crisis after economic crisis, the internet boom and bust, the financial crisis’ should come through today’s uncertain times in decent health.

US vs UK?

In Summary: On balance the US is slightly more favoured by commentators although experts note the main UK index looks cheap, just don’t expect any rocket-like action. Slow and steady.

In detail: Whatever your investment approach and portfolio choices, it is almost unavoidable that the performance of US stocks will be a big determiner of overall performance.

American companies make up a massive share of aggregate global stock market capitalisation (the sum total of all the company shares in circulation). Vanguard’s Lifestrategy 100% Equity fund (a mixed global bag of investments) is nearly 50% invested in the US, for example.

So what about the US stock market? Is the S&P 500 still a good bet, or should investors look closer to home?

‘A recent new all-time high for the broad US index against a high for the FTSE-100 back in 2018 suggests momentum remains Stateside’ says Keith Bowman, Investment Analyst at interactive investor.

His team point out that Scottish Mortgage and F&C Investment Trust (two of the most popular Trusts in ii’s ‘Super 60’ rated list), seem to be taking a very clear view on the UK vs. US: F&C IT has 53% share of its portfolio in the US and just 12% in the UK, while Scottish Mortgage has 56% in US assets and just 2% allocated to the UK.

Jason Hollands, Managing Director, Corporate Affairs, at Tilney Smith & Williamson, agrees the US is the ‘standout market globally for nurturing great companies from small beginning through to the mega-league’. Nonetheless, he thinks the UK looks relatively cheap and shouldn’t be ignored: ‘UK equities are a bit of a bargain at the moment, something not lost on US private equity firms who have been engaged in a frenzy of bids this year.’

Those thoughts are echoed by Gerard Lyons, chief economic strategist at Netwealth, who says ‘U.K. assets are currently undervalued and should benefit from an improved post pandemic economic outlook.’

Emma Wall of Hargreaves Lansdown says there’s value to be found in ‘unloved’ UK stocks too, Although she believes it ‘should be considered a multi-year play – not all the recovery will come in 2022’.

‘I’d probably take the FTSE 100 as it looks undervalued compared to the S&P 500,’ adds Laith Khalaf from AJ Bell.

We’ll call it a draw in the UK vs. US prediction stock market predictions stakes. The UK may be cheap, but that’s partly a reflection of greater optimism the future of US companies, leading to higher valuations (i.e investors are willing to pay a premium in anticipation of future profit growth)

“Happily investors don’t have to choose and should allocate money across markets so all their eggs aren’t in just one basket, or indeed, basket case,” says Khalaf.

Can Big Tech stocks continue to deliver?

How about Big Tech? At the time of writing, Alphabet (parent company to Google) shares are up almost 70% year to date in US Dollar terms.

It’s a similar story at Apple and Microsoft, up by more than 35% and 50% respectively.

Can they continue to deliver for investors? Or is the bubble about to burst?

In Summary: Look beyond the dominant big 5 names in US tech and keep investing in technology via broader sectors and firms which stand to benefit from digitisation.

In detail: The experts think some tech firms could suffer in 2022. ‘I’d expect gravity to catch up with some of the frothier areas of the market,’ says Laith Khalaf of AJ Bell.

Jason Hollands of Tilney Smith & Williamson agrees that ‘the environment we are moving into won’t be as favourable for tech as it has been for many years’ and thinks ‘we could see a bursting of bloated valuations.’

He offers a technical evaluation, explaining that higher inflation and interest rates could dampen tech stocks because they have been ‘huge beneficiaries’ of low interest rates that have helped them borrow money to buyback their own stock and boost share prices in the process.

Higher inflation and borrowing costs make for a less flattering environment for growth firms, he adds, which means that safe and steady bets solid divided-payers could become more attractive.

Emma Wall from Hargreaves Lansdown says that investors should look for stocks and sectors where there are opportunities for tech to change existing industries, rather than focussing on the biggest tech stocks alone. ‘Most firms are embracing digitalisation now, accelerated by the pandemic, for the benefit of customers and the planet’ she says. Instead of focussing on the boom in Big Tech stocks alone, she argues it is possible to think instead of retail, financial services, entertainment, and telecoms companies as an alternative, especially where they’re making use of new opportunities to market, sell and distribute products and services digitally.

Relying solely on the FAANGS (now the MANGAs thanks to Facebook’s name change to Meta) could be a risky bet. Global financial conditions may not be as favourable for them, and although the dominant position of huge names like Amazon make them strong businesses, the case for continued growth may not be quite as robust as it has been. So, as ever, diversifying is likely to be a sensible move, rather than betting everything on Big Tech. Perhaps look for funds and companies taking advantage of opportunities to exploit new opportunities in existing industries.

Should investors look at Sustainable Funds?

One of the big themes of the last 2-3 years in the investing world has been the emergence of Sustainable funds, designed for investors that want a return at the same time as doing some good for the planet.

But there is some scepticism concerning the possibility of greenwashing. This is something we know a lot of investors are worried about. Almost 70% of fund investors we surveyed this year were suspicious about some of the claims being made for Environmental, Social and Governance (ESG) focussed funds.

In Summary: The transition to low carbon economies is still underway and presents huge opportunities. Look behind the marketing fluff and crowd pleasing names and participate in this structural shift.

In detail: ‘I expect more money going into this area which should help to sustain share prices,’ says Laith Khalaf of AJ Bell, although he does warn that ‘valuations are looking a bit toppy, and a backlash against greenwashing could make growth less plentiful.’

Despite greenwashing worries, sustainable funds have been popular - data from Interactive Investor shows that the Baillie Gifford Positive Change fund is the most-bought by its customers in 2021.

The experts think these funds are here to stay, and could be well-placed to benefit from long-term, structural shifts toward decarbonising the global economy. ‘The rise of responsible investing is not a trend, it’s a structural shift,’ says Wall.

Netwealth’s Lyons agrees, pointing out that the ‘shift to green’ is still in its infancy and that there is room for ‘a greater pool of investable assets’ to emerge.

‘The drive to transition to a low carbon global economy is going be key megatrend for the next couple of decades,’ agrees Jason Hollands from Tilney Smith & Williamson. ‘That is going create plenty of opportunities for sustainable funds.’

If you’re interested in researching Sustainable, check out our fund filter here. You can search for Sustainable funds, which might help you find a fund that matches your own values and ethics.

Funds & Sectors to look out for in 2022

As long as they stick to these basic guidelines, some more-experienced investors will choose to increase their investments a little in one area and dial back in another to take advantage of trends and opportunities.

In Summary: China; sustainable funds; UK shares (with a small cap focus) and emerging markets.

In detail: We asked the experts for some funds and sectors they think are worth looking at if you’re adding to your investment portfolio. But remember, nobody has a crystal ball, so treat this as food for thought, not a cast-iron guarantee of outperformance.

Jason Hollands, Managing Director, Corporate Affairs, Tilney Smith & Williamson

Sectors: UK equities; “Value” funds; Emerging Market equities

Funds/ETFs/Trusts: Artemis UK Select; Fidelity Special Situations; Aubrey Global Emerging Market Opportunities

Emma Wall, Head of Investment Analysis & Research at Hargreaves Lansdown

Sectors: Given how bad returns have been this year, the contrarian in me thinks China looks like a good buying opportunity.

Funds/ETFs/Trusts: Broad-based tracker funds, with an ESG tilt, such as the Future World series from L&G.

Laith Khalaf, Financial Analyst at AJ Bell

Sectors: The UK equity market still looks unloved and cheap by comparison with other regions; Smaller companies have shown their ability to deliver outstanding returns, albeit with more ups and downs; Thirdly it’s a good idea to hedge your bets - a global fund gives you a spread of investments.

Funds/ETFs/Trusts: The cheap and cheerful iShares UK Equity Index which just tracks the UK stock market; For a global investment I’d suggest Monks investment trust; and for smaller companies exposure there’s the ASI Global Smaller Companies fund.

Iain Barnes, Head of Portfolio Management, Netwealth

Sectors: The US; UK small and mid caps; emerging markets

Funds/ETFs/Trusts: Vanguard S&P 500 UCITS ETF; Amundi Prime UK Mid and Small Cap ETF which strips out the investment trusts which clutter the FTSE 250 Index to give cleaner exposure to the UK market. And the iShares Core EM IMI ETF, but when we see emerging currencies performance improve, will take the attractive yields on offer from the PIMCO Emerging Markets Advantage Local Bond Index UCITS ETF.

Jemma Jackson, Head of PR at Interactive Investor

Funds/ETFs/Trusts: F&C Investment Trust and Scottish Mortgage which have ‘weathered Spanish Flu, The Great Depression, world wars, economic crisis after economic crisis, the internet boom and bust, the financial crisis’