Home • Articles • 2024 in review: Magnificent Seven, global elections, interest rates, and market trends

2024 in review: Magnificent Seven, global elections, interest rates, and market trends

By Boring Money

21 Oct, 2024

There has been a lot to digest in 2024, from mounting global tensions to the potential impact of AI to a slew of election results. Markets have, for the most part, sailed through, and investors will almost certainly be pleased with their progress over the year. But what have been the hottest news stories in an action-packed year?

The Magnificent Seven

The dominant market story has been the trajectory of the Magnificent Seven. These US technology behemoths – Meta (that's Facebook), Alphabet (and that's Google), Tesla, Amazon, Microsoft, Nvidia and Apple - started the year riding high having delivered an astonishing performance in 2023. However, there were early signs of weakness as first Tesla faded, then Apple, then Microsoft. By October, only Nvidia and Meta had been truly magnificent and even there, cracks were starting to appear.[1]

The problem lies with not one single business, as they have all continued to go from strength to strength. Nvidia, for example, reported a 122% in rise in revenues for the second quarter.[2] The problem is that they have become a huge part of most global indices - making up nearly 36% of the benchmark S&P 500 index (an index that tracks the performance of the 500 largest publicly traded companies in the United States) and nearly 23% of the MSCI World index (a global index that represents large and mid-cap equity performance across 23 developed markets countries), according to BNP Paribas.[3]

They are also extremely expensive: Nvidia trades on 63x its current earnings at the time of writing.[4] For context, TSMC - the company which makes all of Nvidia’s chips - trades on half that.[5]

History suggests that investors will grow tired of the trend, though predicting the end of a buoyant phase for an individual sector is tough. Nevertheless, 2024 may go down in history as the point at which the Magnificent Seven became a little more ordinary.

Election fever

2024 was a year of elections. More than 50 countries, home to more than half of the world’s population, went to the polls this year.[6] It started in Taiwan in January, with pro and anti-China parties going head to head. Indonesia and Pakistan followed in February. India began its elections in April, while June saw Mexico elect a new President. The UK unexpectedly went to the polls in July but was upstaged by a snap parliamentary election in France, in response to President Macron’s losses in the European elections.

There were a few surprises. In India, Prime Minister Modi unexpectedly lost his parliamentary majority.[7] In France, a three-way split in the parliament presented a significant governing challenge for Macron. However, for the most part, the elections passed without significant incidents, which was a particular relief in vulnerable areas such as Taiwan.

The most significant – and potentially volatile – contest remains undecided. The US election has loomed over much of 2024. The polls remain tightly drawn between Donald Trump and Kamala Harris, and the result is likely to come down to a few swing states. The result is a global issue, with Trump threatening onerous tariffs and a withdrawal from foreign entanglements. It is set against the ticking time bomb of the US debt, which is now $35.7 trillion and rising.[8]

Interest rates

After a period when central banks across the world had raised rates very rapidly and very steeply, by the start of 2024, there were signs that inflation was easing and further rises were unlikely. However, it took time for central banks to be reassured that inflationary pressures were truly under control. In particular, service sector inflation proved a tough nut to crack.

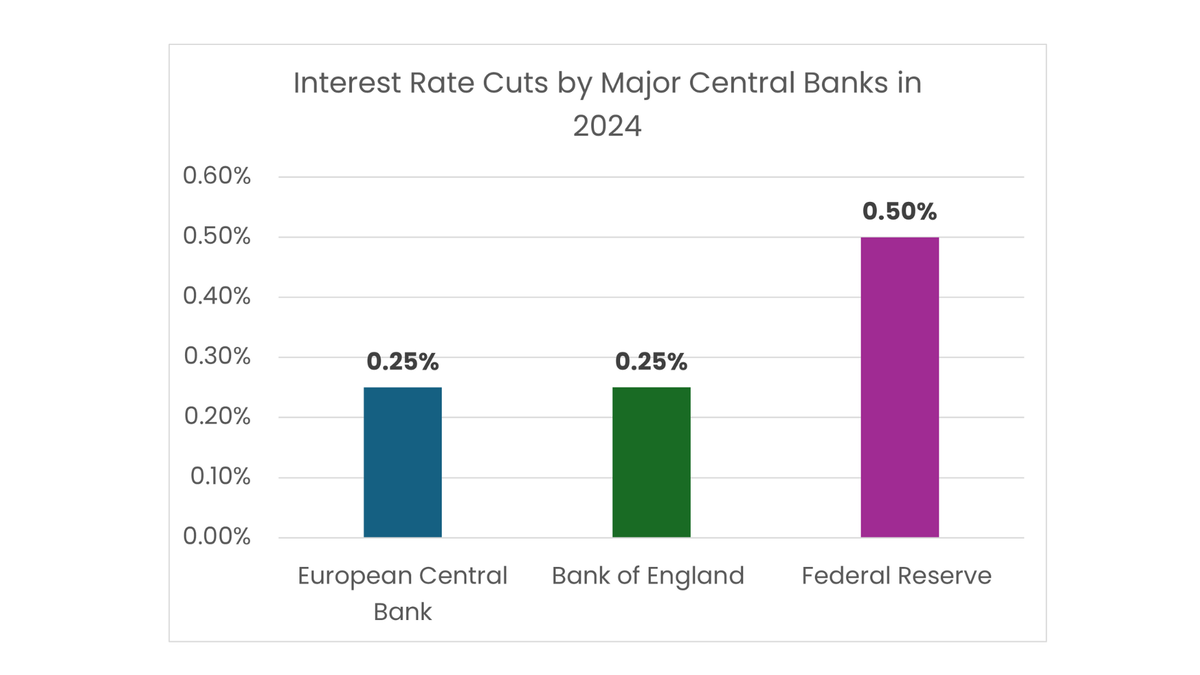

The European Central Bank was the first major bank to cut, reducing interest rates by 0.25% in June.[9] At that point, inflation had been comfortably under 3% since October 2023.[10] The Bank of England took longer, finally cutting rates from 5.25% to 5% in August.[11] The Federal Reserve waited until September, but cut rates by 0.5%, more than markets were expecting.[12]

This change in direction from central banks has proved important for market confidence. Almost all stock markets across the world have made progress in 2024, with the MSCI World Index up over 19% since the start of the year.[13] Investors have also had the courage to diversify away from the safety of the Magnificent Seven. Smaller companies have done better, as well as previously unloved areas such as property and infrastructure.

More rate cuts are expected before the end of the year and into 2025, though how many remains a source of contention among economists. Equally, there are fears that geopolitical tensions could revive inflation as instability in the Middle East returns. For the time being, central banks are in an uneasy holding pattern.

A UK revival?

The UK stock market has been in the doldrums for almost a decade. It has seen persistent outflows and weak returns, with investors not liking the sector mix, the UK domestic economy, or the political situation. There were signs of this changing in 2024.

The new government may have made an uncomfortable start, but it brought some political stability after a long period of volatility. The hope is that the UK will now have a sufficiently stable business environment for international businesses to reinvest. At the same time, the economic outlook has improved.

This has been helpful for the stock market. Outflows have continued from UK domestic investors, but there are signs of selling pressure easing. Share prices have been buoyed by international investors snapping up domestic companies at a rate of almost one a week.[14] Companies buying back their own shares have also been supportive.

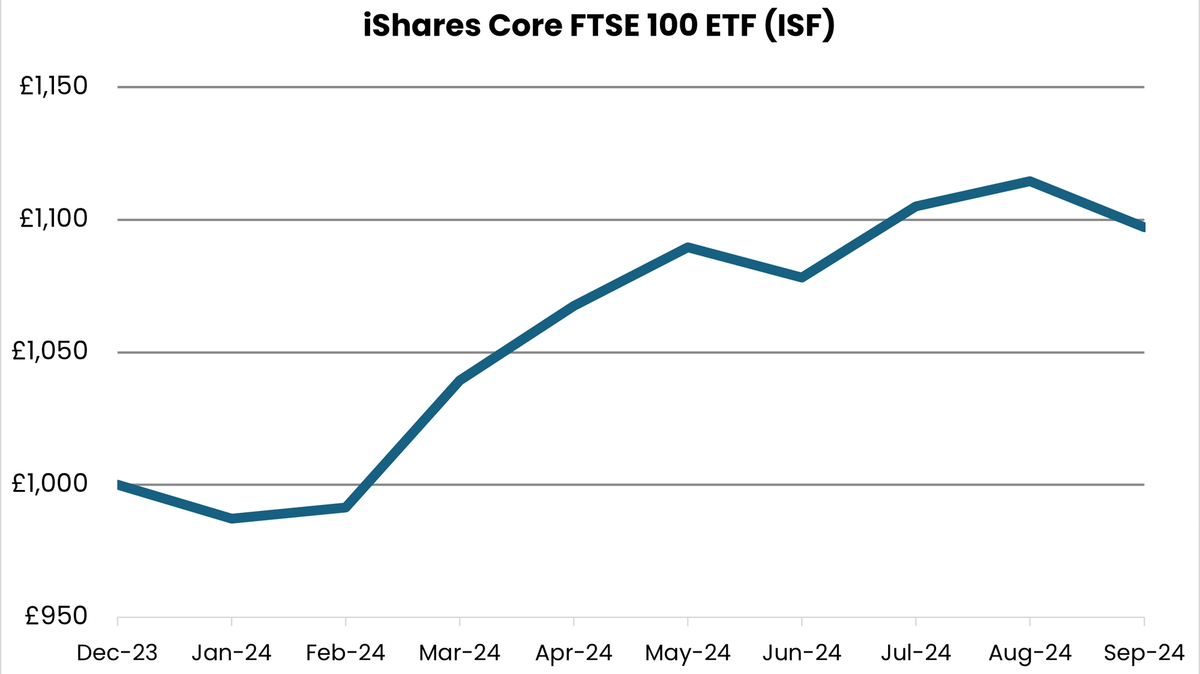

Below you can see the performance of iShares Core FTSE 100 as an example of performance for the UK FTSE 100 index.

Data provided by FE fundinfo, correct as at 30th September 2024

While true momentum remains absent, there are tentative signs of a revival for the UK market. The country has put some of its recent troubles behind it, and may compare favourably to some of its closest peers.

Geopolitics

For the most part, and in spite of their human and social toll, geopolitics do not weigh heavily on financial markets. The crisis in the Middle East has yet to create any significant spike in oil prices, for example.[15] There has been some disruption to trade in the Red Sea, which briefly threatened to raise inflation, but this proved short-lived.[16]

There are ongoing concerns, however. Tensions between China and the US remain elevated, and this has weighed on the Chinese economy. Threats of tariffs of up to 60% on Chinese goods under a Trump presidency could cause further damage, and may also contribute to higher inflation in the US. The US deficit is partially funded by Chinese purchases of US government debt, so there are also vulnerabilities there as well.

That said, while 2024 has been a year characterised by growing global tensions, it has also had its share of good news stories: there has been progress on renewable energy, technology innovation continues at pace, companies are, for the most part, in good health. Stock markets have made good returns, and there are reasons for investors to be cheerful.

---

[1] Investors Business Daily, March 2024

[2] Nvidia, August 2024

[3] BNP Paribas, July 2024

[4] YCHarts, October 2024

[5] YCharts, October 2024

[6] King's College London, October 2024

[7] The Guardian, June 2024

[8] Peter G. Peterson Foundation, October 2024

[9] Euronews, September 2024

[10] Trading Economics, October 2024

[11] BBC, October 2024

[12] CNBC, September 2024

[13] MSCI World Index (USD), October 2024

[14] Trustnet, October 2024

[15] Trading Economics, October 2024

[16] IMF Blog, March 2024