Top performing investment collections

By Holly Mackay, Founder & CEO

25 July, 2025

I’m just back from a glorious week in Corfu, enjoying swimming in the Med instead of the Solent in January. It was all super relaxing apart from the occasional Where Are My Teens game around the resort at 1am! Grrrrr...

With the Greek vibe still lingering, I have a few things on the Boring Money mezze board for you. First up, some dips.

One reader has asked us about the best and most tax-efficient way to gift money to children. This is super topical right now, given the growing tax take and the upcoming Budget this Autumn. We asked financial planner Matthew Spence for his views and share them here. And we share some tips for beginner investors - one grandma asked about the best way to get her grandson into investing.

Moving to this week’s main course, and I have a Greek ready-meal to propose. (Do they even exist? Charlios Bighamos?). Every 3 months, we track the performance of collections of investments managed for you by investment experts, a superb choice for those who can’t be bothered or feel stuck. We separate these collections into 3 groups – ‘high risk’, ‘medium risk’ and ‘low risk’.

How much have they made?

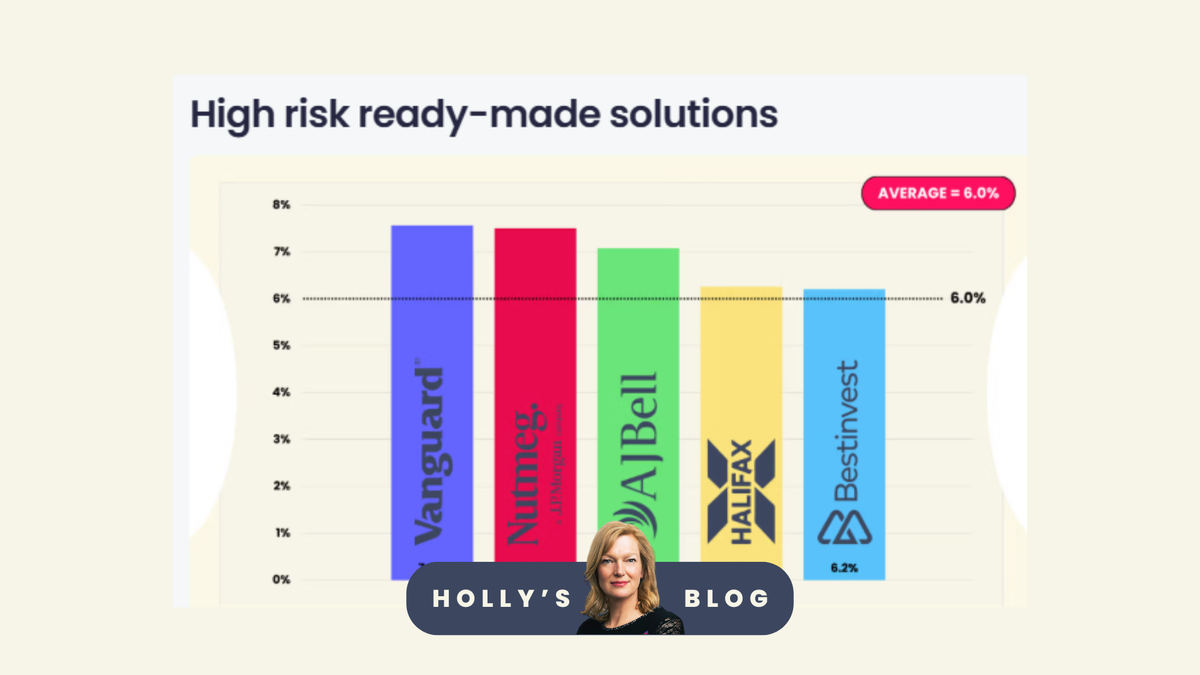

On average, the higher-risk portfolios returned 6% over the last year – that’s after all fees and charges. If we look at the 3 months of Q2 (ie April – June) the average returns were 4.6% in just 3 months. Not to be sneezed at, although it was a bumpy old ride with Trump volatility tanking things before a blistering surge in June.

Here is one fact I’d like to add to the menu. Over the last 5 years, total returns in these high risk collections have ranged from 37% to 69%. The average return has been 55%. It's against this backdrop that the Government is gearing up to try to get more Brits into investing with their long-term savings. Compare those returns to even the top-paying cash accounts and you see the point.

This also presents a real challenge to those who ‘play it safe’ and automatically pick the medium risk option. This can be the investment equivalent of picking the third cheapest bottle of ouzo on the wine list or the mid-priced toaster at John Lewis. We like being in the middle of the pack, but this can hurt us if our timeframes are longer than 5 years. That said, for those with shorter timeframes and those who can’t stomach too much volatility, they can be a good choice. The average 5 year returns here have been 29%.

Who did the best?

You can see the full details here and also check out our independent reviews of each provider in our comparison tables.

Why do similarly labelled dishes behave differently?

It’s all about the ingredients. These mixed collections involve choices from the managers. Those with a higher % allocated to the US have typically performed better over the last 5 years, but over the short-term it’s also been an advantage to have a higher weighting to the UK, as the FTSE has had a moment in the sun.

Conversely, those supposedly lower-risk collections, which have a lot in UK Government bonds, are still showing the scars of Liz Truss’ mini-Budget in their 5 year numbers. For example, Vanguard’s low risk option (20% Equity) was hammered by this and the 5 year numbers tell the painful story, despite better times over the last 3 years.

A little metaxa to wash it down

More confident readers will want to make their own choices, so I propose you a little something to end our meal. This week’s featured content from Invesco makes the case for high-yield bonds, an interesting consideration for those who need an income from their investments. And the Chair of Aberdeen Equity Income Trust highlights the yield of 6.5% for this ‘dividend hero’ and argues that current turbulence makes this a stock-picker’s market.

Over and out for this week, my friends. I’m not regulated to give advice, but I will leave you with one tip. If you also have nocturnal teens, I highly recommend getting a Snapchat account. Not only can you amuse yourself by turning your face into a piece of toast/dragon/nun, but the geolocator is probably superior to anything the British Army has. Cunning...

Holly

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.