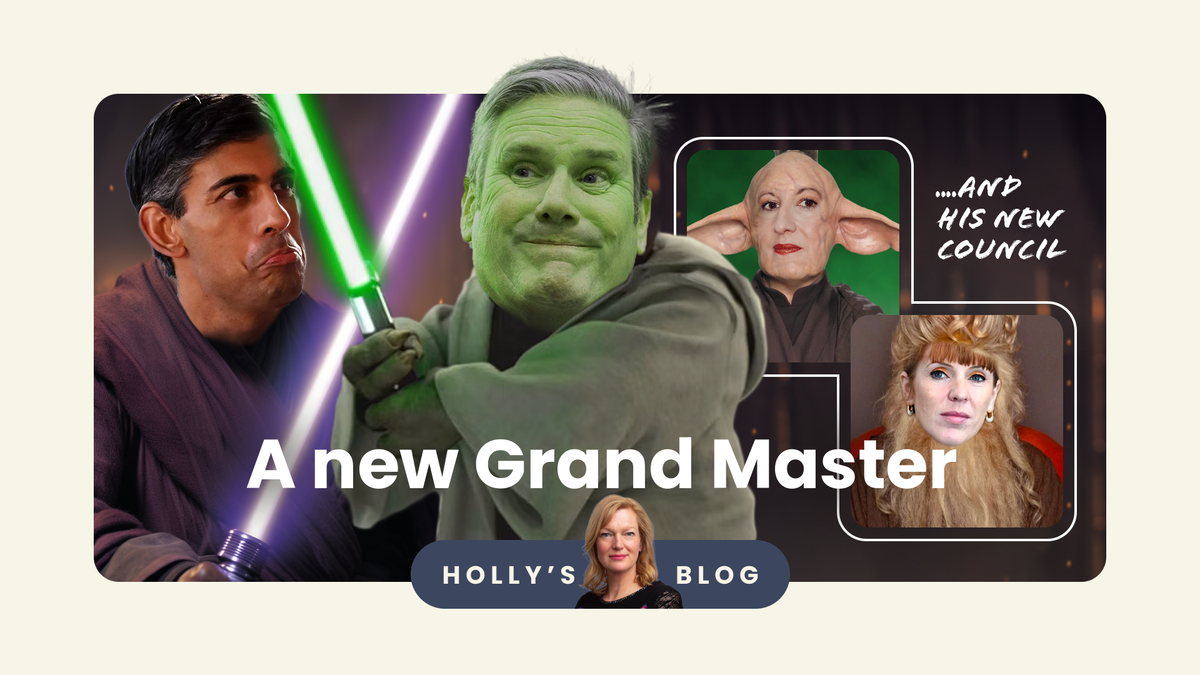

A new Grand Master and his new Council

By Holly Mackay, Founder & CEO

5 July, 2024

Triumph for Labour and a pasting for the Conservatives. Yes, we have a new Grand Master and (probably) our first female Chancellor of the Exchequer, so congrats to Rachel Reeves.

I got to bed at 2am. Not because I was glued to the BBC and Jeremy Vine’s strangely irritating 3-D hexagons on a map which made me feel sea-sick, but because I was driving my teenager home from a party about 50 miles away. My teen observed that he and Keir Starmer both had the best night of their lives last night which made me laugh, but let’s leave that there.

Whatever our political leaning, one thing I think we all hope for is a time of some stability. The last 4 years have been characterised by an inability to plan. Whether you’re a CEO, a Mum, a small business owner, a teacher or even simply someone trying to book a holiday, plan your pension or run a family budget. This stability should be good for the UK markets in relative terms, particularly as France descends into turmoil, the far-right cast a shadow over Europe and the potential return of the Orange Man-Baby in the US threatens unfunded tax cuts, turmoil and trade wars.

As I write, the financial markets seem almost immune to the election and the pound is pretty stable, the bond markets are calm and the FTSE 100 seems to have been watching Netflix instead, opening largely unchanged. More important to markets are interest rates and we hope for our first cuts in August or September.

On the currency point, I had a call from a financial journalist this morning, asking about people’s holiday money. Rather than try to game exchange rates, the best thing we can do is avoid hefty charges through ‘lastminutism’. If you like folding cash, use a bureau which will deliver pleasingly crisp notes to your home in advance – Sainsbury's Bank and Tesco Bank are typically decent. Or get a debit card with no ATM withdrawal fees and fee-free spending – Chase and First Direct are good options.

Back to the election and over the coming months, Labour’s plans move from manifesto to policy. It’s been pledged that income tax, VAT and national insurance will have no change, and I suspect the main impact for our personal finances will likely be capital gains tax, inheritance tax and pensions.

The landed gentry will be rushing their kedgeree this morning, selling surplus game lodges in a CGT-fuelled panic, private schools will be continuing work to assess how much of the impending VAT increase can be absorbed by them, financial advisers will be fielding questions on pension contributions and oil and gas producers will be grumbling about more impending windfall tax.

The reality is we’re unlikely to see much financial change until the Autumn Budget and these reforms will start to filter through next April. In terms of second-guessing changes to pension rules, they still remain free from capital gains tax and the fact is they're a brilliant tax shelter, so I would hold your nerve and wait for the facts. If you have spare cash to contribute, of course the rules are that most of us can put in up to a whopping £60,000 a year, so there may be some logic to contributing what you can this tax year before anything changes. Do consider financial advice on this if you’re unsure, as this is one area where mistakes can be expensive. Many advisers will give one-off advice around pension planning for a fixed fee, so don’t be afraid to see what help is available.

And there we have it. A very touching speech, I thought, from Rishi Sunak on his way out, and well-earned jubilation from Keir Starmer on his way in. Once the party has subsided, the hard work quickly begins as the hangover of a cash-strapped public purse sets in. Victory, you say? Begun the Clone War has.

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login