Another yo-yo week

By Holly Mackay, Founder & CEO

25 April, 2025

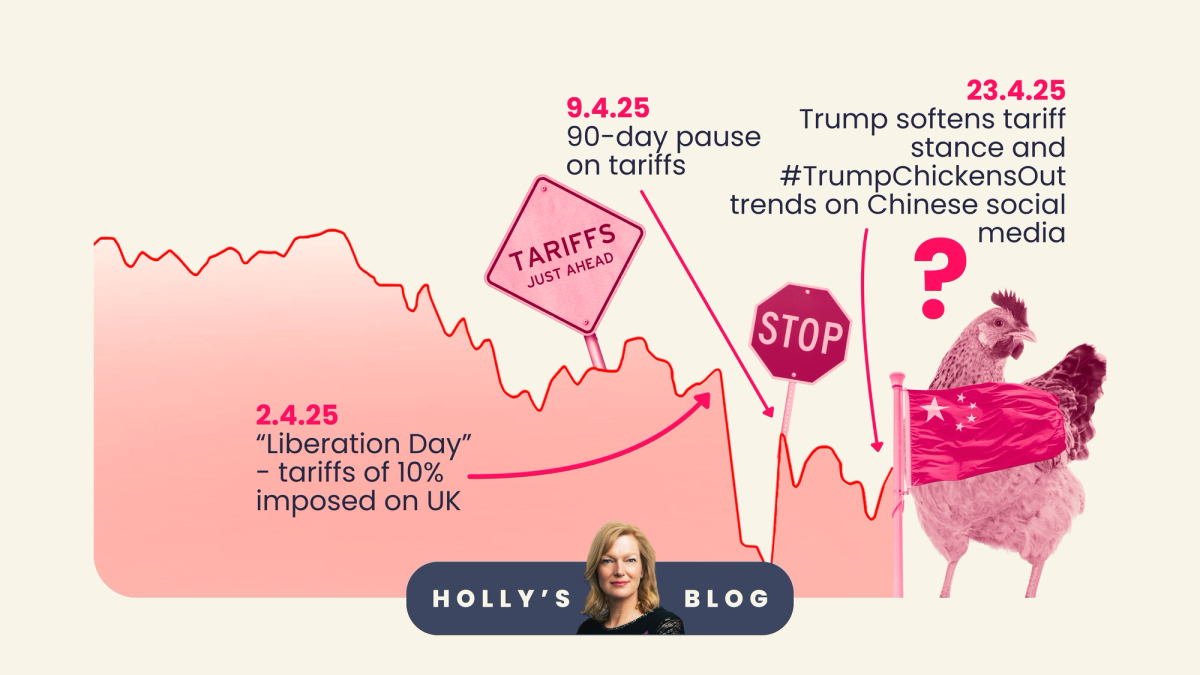

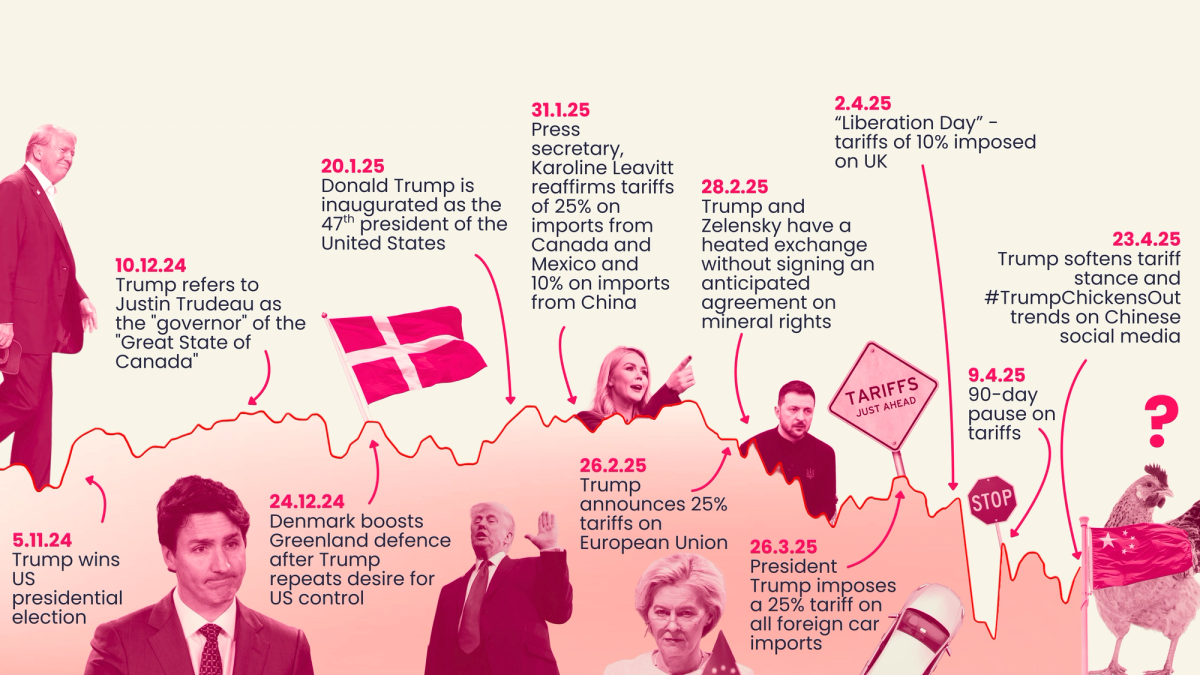

Another yo-yo week on markets as the big global financial game of Blind Man’s Buff continues. Does Trump mean it? Will China fight back? Is Xi Jinping perhaps ‘a very nice man’ and could China be ‘beautiful’ again?

We’ve all felt some respite as markets relaxed a little bit on more positive news. On Wednesday, it was reported that the hashtag “Trump chickened out” was trending on social media platform Weibo, with more than 150 million views. Oh dear. Donald won’t like that. That’s a very nasty platform.

We’ve traced here the impact that Trump has had on markets since winning the election in November and you can just see the nervousness and uncertainty shining through. The graph line actually looks like my heart rate as I log onto my investment app these days.

It’s not just tariffs. Is Jerome Powell, Chair of the Federal Reserve and man in charge of US interest rates, indeed a ‘major loser’ or just someone battling sticky inflation in the way in which central bankers do?

And there are company-specific issues too. Elon Musk, fresh from a F-bomb shouting match with Treasury Secretary Scott Bessent (oh, how I would have loved to see that), has promised investors he will get back to his desk at Tesla, as the financial results of the last three months showed the cost of politics and tariffs. Revenues fell by 9% - and revenue from cars fell by 20%. Costs were slightly up and profit shrank. The operating margin (basically the profit before interest and taxes) - which used to tickle 20% has now fallen to 2%.

The markets want Musk’s focus back on cars and the share price responded well to his commitment and various meetings held over the week. Tesla shares were down about 30% since the start of the year, but jumped by 12% on Monday.

Tesla used to be a key holding of Scottish Mortgage Investment Trust, an investment I know many of our readers hold. Things looked better at the Trust this week after a rocky three months, and interestingly they also announced a small investment in challenger bank Revolut, as the bank reported a $1.4 billion profit last year. Revolut was founded in 2015, has over 50 million customers around the globe, and is currently unlisted although there are rumours of a potential stock market listing, maybe as soon as 2026.

Accessing these unlisted companies is a key draw of some Investment Trusts which have the flex to buy these privately-owned companies. Scottish Mortgage can hold up to 30% in unlisted companies and privately-owned SpaceX is the top holding here, making up 7.8% of the portfolio. This Musk baby has held up better than Tesla – according to SMT “given its main customers are government and large telecoms and there is no proper rival to its Starlink satellites, SpaceX is arguably less susceptible to brand pressure than Tesla". In other words, Governments are less snitty about the moral compass of who’s at the helm, than eco-friendly Chino-wearing Democrats in California who have ditched the Tesla.

If you’re interested in slightly less spicy stuff, you may like to listen to the portfolio manager of the JPMorgan Global Growth and Investment Trust (this week’s blog sponsor) in an update video. These guys provide income and also try to pick tomorrow’s winners, and have been in the best-selling Investment Trusts on platforms for ages now. Or, if you’re a more nervous newcomer, put off by the yo-yos, I’ve pulled together a new piece looking at where you can start investing from just one tiny pound.

Moving forward, I don’t see things getting calmer in the short-term. Will Trump de-escalate the trade war? Will the weaker US dollar (no longer such a safe haven investment) see some money moved out of this currency and back into share markets? And a biggie – what will the earnings season look like? Apple announces results next week, as do Meta and Nvidia. Google should jump today, posting great results last night and unveiling a new quantum chip which has enthused investors.

Finally, will the US slip into recession? Despite a very mweh GDP, the jobs market is nonetheless resilient which gives some hope that this might just be a flat time rather than a full-on slump.

Gold feels like the most stable choice for many right now and will also benefit from the loss of confidence in the US dollar (and maybe the tense relationship between Trump and bond markets?) as a safe haven place to park money. Of course, all those shiny gold bars will still be here after all the puffy blustery hot air blokes in this blog have puffed themselves off the face of the planet. Or off to Mars?

Have a great weekend everyone,

Holly

Post a comment:

This is an open discussion and does not represent the views of Boring Money. We want our communities to be welcoming and helpful. Spam, personal attacks and offensive language will not be tolerated. Posts may be deleted and repeat offenders blocked at our discretion.