Best performers and market wobbles

By Holly Mackay, Founder & CEO

19 April, 2024

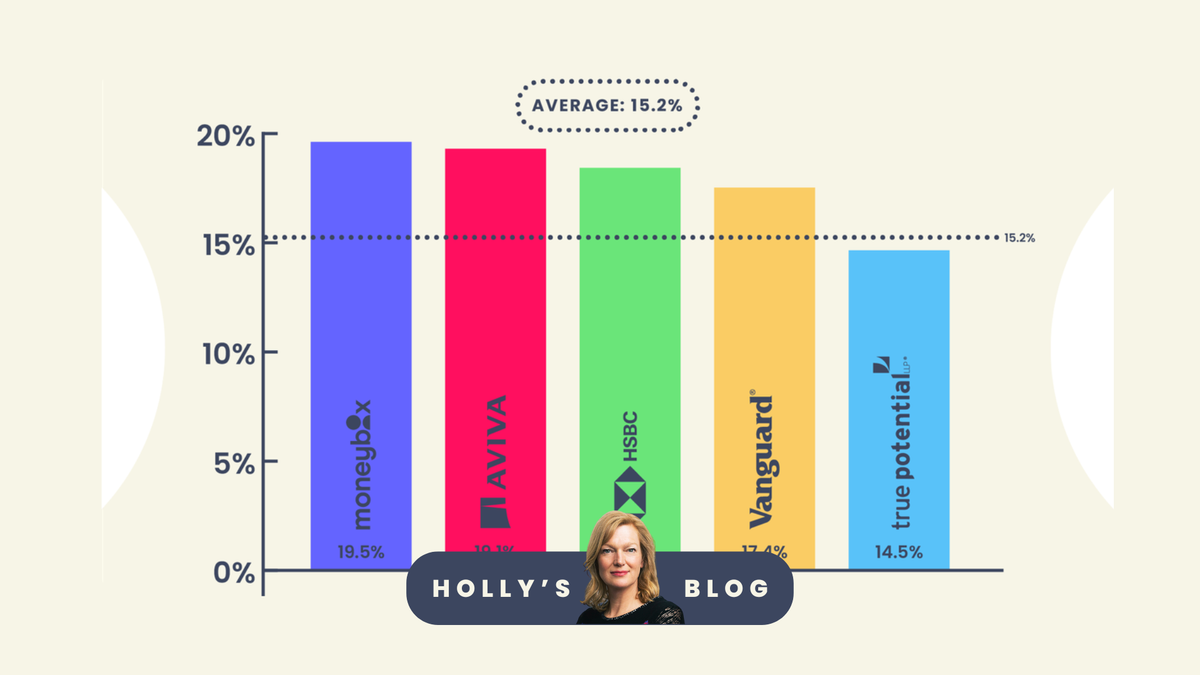

This week we published performance data for the first three months of the year for ready-made investment collections, or ‘robo advisers’. You can see and compare all providers here.

In a nutshell, Q1 was a bodice-ripping start to 2024, and every portfolio was up. High risk options in particular had an excellent start to the year, with performance ranging between 4.6% and 8.5%. Low risk options ranged between 0% and 2.6%, with medium risk options ending up between 2.3% and 5.8%.

It’s important to remember that risk in this context is not the same as being a Tory MP at Jeremy Corbyn’s birthday party – it simply describes how big a slice of your investments is in volatile shares, rather than more predictable cash-like stuff. The longer your timeframes, the more sensible it is to have ‘high risk’ investments which should do a lot better over a 5-year+ period.

If we look back at performance, we can see that Aviva and Vanguard have done well in the higher-risk category, not just in the most recent months, but also over a longer two-year period. Ideally you want to look at the longer timeframes to evidence skill, not just luck, and we share this longer-term performance across all risk profiles here. To be honest, the proverbial monkey aiming at a dartboard could have made money this quarter, because most things have gone up!

A key question unsettling investors this week is the aggression between Israel and Iran. Markets across the world have opened lower today as concerns about a war in the Middle East accelerate. European markets were all lower – the FTSE 100 is nearly 1% lower, as is the Dax in Germany and the Cac40 in France. (Dax ‘n’ Cac sound like a Chas ‘n’ Dave tribute band. Younger readers – have a look at Chas ‘n’ Dave on YouTube – may I suggest ‘Rabbit’ as their most astonishing oeuvre?)

Asian markets were also down overnight – Japan’s Nikkei had its worst showing in nearly three years and Hong Kong was down about 1%.

Meanwhile gold and oil are doing well. This always happens when people get rattled about war. Gold, nearly at all-time highs (which will please my Dad!), is always seen as a safe asset which people can hold, put under the bed and keep safe as the world goes nuts around them. And of course the threat to oil supply creates fear of scarcity, which makes it more expensive to get your hands on. Brent crude oil – the international benchmark – was up over 4% to around $90 a barrel after explosions were reported earlier.

Assuming ongoing tension, and also anticipating rumbling concerns about US interest rates potentially not falling at all this year as inflation there remains super sticky, the first 6 months of 2024 may look like me on a big night out. I’m sparkly and raging ahead for the first half. And tripping over the pavements and falling asleep in the second half?!

Have a lovely weekend everyone. I moved house on Tuesday (just up the coast from Southampton) and have unpacked enough boxes to be able to walk into most rooms! I’ve also felt the rage with Sky. Whoever came up with the tagline ‘Believe In Better’ was surely having a laugh... grumble grumble.

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login