...and when they were bad, they were horrid...

21 Oct, 2022

Once upon a time all the Tory MP children knew that only one child could win the coveted Prime Minister prize. Everyone else consoled themselves with seconds of jelly or a quick bottom grope in the corridors of Whitehall.

Today, however, all the children want a prize. And that tiresome Boris is queuing up for seconds before poor Penny’s even had a turn. Would somebody please send him to bed (alone) with no supper?

Let’s play Find The Forty Billion!

Behind all the almost unbelievable and frankly embarrassing hoo-ha, the Chancellor still needs to find about £40 billion of savings, to regain our lost credibility with those unforgiving global markets.

Nothing is off the table. From news of a potential windfall tax on banks – which hit their share prices this week – as well as the oil companies back in the spotlight. If we’re going for a windfall tax on unpopular sectors, could I suggest we add a windfall tax to Tory MPs?

Pensioners have a temporary reprieve as Truss is ‘completely committed’ to the triple lock (where pensions go up by the largest of the cost of living, the average wage increase or 2.5%). The increase will be pegged to September inflation figures, which were 10.1%. Sounds like a relief for pensioners, but before we all get too carried away… I am also completely committed to drinking less than 14 units of wine a week. Just not this weekend. 😀 How committed is committed??

Mortgage costs have gone up again this week and a 2-year fix is now around 6.65%. Add this to increasing fuel bills, and the removal of the energy price guarantee come April for better-off households, and it’s clear that we’re all in for an extremely tough 2023.

What about my investments and pensions?

Investment markets are offering no short-term silver lining. UK Government bonds tumbled in September and early October. And in turn, challenged the basics of how we are all taught to think about risk.

The general thinking is that bonds behave a bit like cash and bounce around less than shares. Shares can make more, but also lose more and be volatile. So we diversify – or have a blend. And the closer we get to taking our money out of investments or pensions, the more we reduce risk and bumpiness and the more we dial up our allocation to bonds.

So very loosely, we might say that a 30-year-old should have their pension savings in 100% shares, a 50+ year-old might go to 80% shares and 20% bonds, and a 65-year-old might be 20% in shares and 80% in bonds. Safe-r. Allegedly. (Don’t shout at me actuaries. It’s what normal people call ‘a rough example’ 🤓).

This all worked much better 50 years ago when people politely died much earlier than they do today. If you’re going to live to your late 90s, getting out of shares too early will see your money run out of steam. So it all kinda depends on how long until you need your dosh. The longer your timeframes, the more you should have in shares.

However. This year everything has gone nuts at this most curious of birthday parties. 🎉

Who has gone up …and by how much?

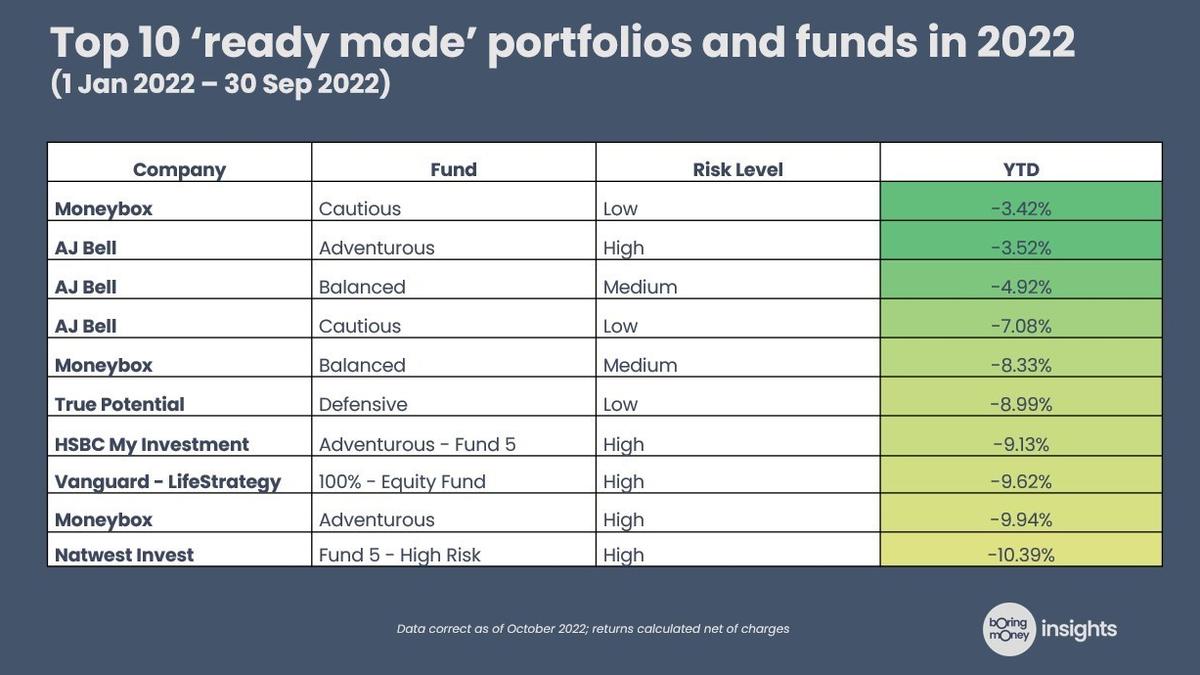

We have funded test accounts with 10 providers, covering 33 different ‘ready-made’ portfolios or funds for DIY investors. And we track performance every three months, after charges.

We have looked at the returns from January this year to September. The average ‘low risk’ portfolio is down by 13% in 2022, and the average ‘high risk’ portfolio is down by 12%. Ouch. And for those of you with advisers, it’s a similar story too. The ‘low risk’ stuff has done worse as bonds have had a shocker.

Here are the top 10 performers in a year when everything has gone South. In normal times, we’d expect the Low Risk guys to fall less than the High Risk guys. But not this year when many of the low risk options have fared worse.

Those interested can see all 33 portfolios and more detailed analysis here.

Several new investors in the poorly performing ‘low risk’ options have written to me, felling let-down and bruised. Should they sell now? If your timeframes are long, then selling now doesn’t make any sense – you are just turning a paper loss into a real loss.

But do have a think about your risk profile and why you picked it. Too many of us still approach picking a ‘risk profile’ like we do picking a kettle at John Lewis. I don’t need the fancy one. The cheapest will probably break. So I’ll plump for the middle one.

This is fine for a kettle. But picking Risk Option 3 out of 5 choices for your future wealth – just because it’s in the middle – is not a great plan.

Those with shorter timeframes – maybe 4 or 5 years – should typically go for lower risk. And those with 10 years+ should really go high risk. But as we’ve seen this year, we have to prepare ourselves to tough out any falls in any portfolio, and not give in to those inner voices telling you to bail.

Final food for thought

Here’s a little glimmer of hope at the end of this dismal party. The main US collection of shares, the S&P 500, is down about 25% from its 52-week high point. Do I think it’s hit the bottom? Probably not. But at some point do I think it will go higher? Undoubtedly. I just don’t know when.

I probably get asked more questions about “when is a good time to buy?” than anything else. In the absence of a crystal ball, drip-feeding in on a monthly basis always feels sensible to me. And global stock markets are on sale.

Have a good weekend everyone. If Boris does indeed try to stage a comeback, in this latest game of Pin The Tail On The Self-Entitled Donkey, I’m booking a one-way ticket to the Moon. I suspect the aliens have very orderly bond markets up there.

PS Amongst all this turmoil, if you’d like an update on global markets, a discussion on pockets of opportunity and a deeper dive into clean energy as an investment theme, join me on Tuesday 8th November at 6pm for a webinar with guests including Invesco’s Dr Christopher Mellor, a sort of investment sommelier who looks after ETFs (exchange traded funds).

Holly