Does going green always mean lower returns?

1 Nov, 2022

Back in the 1980s, when oil and cigarette firms were the big money-making machines, investing ‘ethically’ used to mean that you’d expect to make a bit less money. However, the world has changed a great deal in the 40 or so years since then (!!!) and matching your money to your values no longer means having to accept lower returns.

While short-term macroeconomic events - such as Russia’s invasion of Ukraine - can cause prices to fluctuate, if we look longer-term, there has been a tsunami of policy-fuelled money backing climate transition in recent years. And as more and more countries hurtle towards their own net zero targets, we’re likely to see inflows increase even further.

As well as environmental concerns, many large companies have made pledges to improve their treatment of their workforces – like fast fashion giant Boohoo - and weak corporate governance has already brought down some major players, such as the former heavyweight construction firm Carillion.

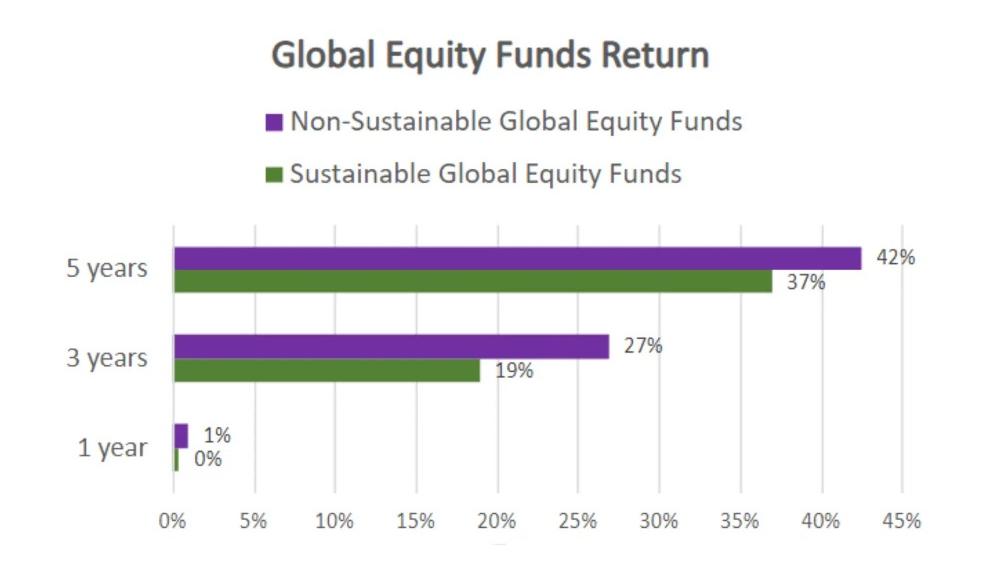

So we can see that the implementation of ESG (environmental, social and governance) factors can be a powerful financial driver, but does this equate to lower profits for the end investor? Let’s look at returns over the last few years and how these have stacked up against more ‘traditional’ funds.

Why are sustainable funds down in 2022?

While there is undeniably a lot of money flowing into sustainable funds – in fact, research from Morningstar revealed that overall inflows into sustainable funds grew by 9% in the first three months of 2022 alone – it was not consistent growth across the board. So-called ‘light green’1 funds (as classified by Article 8 in the Sustainable Finance Disclosure Regulation [SFDR]) actually shed money.

So what’s making investors shy away from sustainable funds? The answer lies mostly in one word: Putin. With oil and gas supplies being manipulated to slap the West on the wrist for its involvement in the war, the cost of energy has shot up – aswe’ve all seen clearly in our domestic energy bills.

And while many other global stocks suffered in the face of consumer pessimism, rampaging inflation and general gloom, BP and Shell made roughly £30bn in profit in the first six months of 2022 alone.

But what does that mean for sustainable funds? Well, BP and Shell make up a significant proportion of the FTSE100. In fact, if you imagine the FTSE100 as a pie chart, BP and Shell alone make up a slice representing about 12% of the total. So, for every £100 we invested in a FTSE100 fund, £12 is allocated to BP and Shell.

If you invest in a sustainable fund which has opted to NOT own any BP or Shell, then that £12 will be invested elsewhere, most likely in things which haven’t done so well in 2022. Meaning your overall profit is probably less than if you owned funds which held shares in big energy companies.

So we can point to Russia as a key culprit behind the relative and shorter-term underperformance of sustainable funds.

Sustainable fund returns over the last 5 years

That being said, it’s worth bearing in mind that, as is the case with many investing strategies, there are good years and bad years. 2020 was a good year for sustainable funds, and it still paid for investors to lean towards sustainable in 2021, even as energy companies were among the stock market’s best performers.

Indeed, companies that scored the strongest on environmental, social, and governance metrics saw some of the highest returns in 2021, with help from stocks such as Nvidia (a big American software firm), Microsoft and Tesla. But with the advent of war in Europe and burgeoning economic crises in many countries, 2022 has been a tougher environment, meaning that the 5-year performance of sustainable funds has emerged lower than traditional peers (as shown in the chart below).

Source: Morningstar. Data correct as at July 2022.

Let’s look at some examples:

Leading passive funds provider BlackRock offers an ETF which invests in American shares with socially responsible filters, going by the super catchy name of ‘iShares MSCI USA SRI ETF’.

This is an example of a low-cost passive fund, rated highly by independent analysts, with a decent sustainability rating and very good 5-year performance. It returned 30% in 2021 and 26% in 2020. By the end of September 2022, it had gone down by 24% YTD. However, for investors looking to weed out any ‘nasties’ from their portfolio, it remains a popular and comprehensive option, screening out exposure to companies involved in industries such as nuclear weapons, tobacco, civilian firearms, alcohol, gambling, adult entertainment and genetically modified organisms (GMO).

Now let’s look at an actively-managed fund instead. ‘Liontrust Sustainable Future Managed’ is highly rated and also boasts a very strong 5-year performance, as does ‘Janus Henderson Global Sustainable Equity’. The latter, spread more globally and not just in the US, returned 25% in both 2021 and 2020, but was down 13% as at end of September 2022.

Nevertheless, it’s managed to avoid the same extent of losses as seen by the iShares ETF as its holdings are specially selected to deliver growth, with assets spread across global equities, bonds and cash too. Proof that there are sustainable funds out there that can temper market shocks to some extent by being well-diversified, if you’re looking to go green without sacrificing returns.

Will sustainable fund returns get better?

If we make any investment decisions to leave some things out, by definition, we’ll do worse if these things do well. And looking ahead to 2023, it’s hard to believe that the war in Ukraine will suddenly stop and that Putin will quickly remember how much he likes sharing oil with his global friends. So there may well be continued slower performance from funds which exclude it.

But there are also billions of dollars being committed globally towards a transition away from a fossil fuel-first economy, and appetite for sustainable business models is growing for multiple reasons. In many parts of the world, government policy now dictates that we must incorporate sustainable investments into our economic plans for the future. So the consensus opinion is that there is no reason to believe that sustainable funds should underperform over the longer-term.

Whether you opt for a fund that actively excludes the big energy firms, or you’d rather keep them in for now and consider changing tack in the future once the numbers start to look more favourable, one thing is clear: sustainable is here to stay. And as is the universal pattern of investing, the longer you’re in the race, the more time you’ll have for interest to accumulate. So getting your foot in the sustainable door sooner rather than later may be a smart move.