Gold and Silver Outlooks to Q2 2022

23 Aug, 2021

By Nitesh Shah, Director, Research at WisdomTree

Gold is a unique asset class, offering a defensive and inflationary hedge at the same time. Closely correlated silver shares many of gold’s attributes. There are many factors that affect the price of these precious metals. At WisdomTree we developed a model framework using historic price behaviour of the two metals to develop gold and silver forecasts for the year ahead.

At WisdomTree, our goal has been to develop a robust, impartial model to forecast the behaviour of precious metals such as gold and silver.

We recognise that many factors affect the price of gold, so we have modelled the precious metal in a multivariate fashion. We have been able to build a basic model with four key explanatory variables – inflation (positive correlation), investor sentiment (positive correlation), US Dollar (negative correlation) and nominal yields (negative correlation) - and our gold price forecasts can be positive, negative, or neutral, depending on the direction of these underlying variables.

Ultimately, understanding gold’s historic behaviour allows us to make gold price forecasts, as long as we have a view on the explanatory variables.

Silver’s price performance is 80% correlated with gold. In our modelling framework, gold price is therefore the main driver of the silver price. However, there are other additional variables acting as important drivers of the silver price.

Gold: Needs to catch up with inflation reality

After staging a recovery for most of Q2 2021, a mid-June 2021 wobble in gold prices has been hard to overcome. Based on our modelling framework, gold looks severely under-priced. Red-hot inflation - currently above 5% [1] - should point to a gold price above US$2000/oz, yet we are currently languishing around the $1785/oz handle. Our model indicates that in July 2021, gold prices should have risen close to 12% year-on-year, when in reality it fell 8% year-on-year.

Even though gold could face headwinds from rising Treasury yields and cooling inflation, gold still needs to catch up with the high level of inflation that we see today.

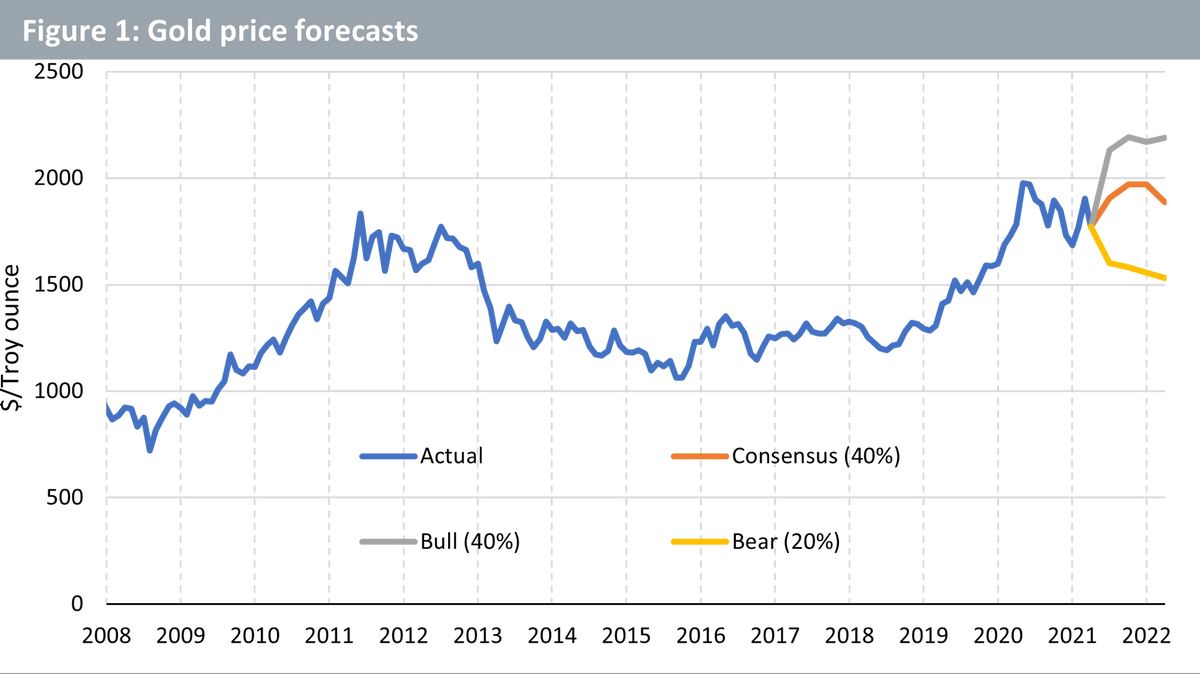

In figure 1, we show 3 distinct forecasts:

Consensus - based on consensus forecasts for all the macroeconomic inputs and an assumption that investor sentiment towards gold drops further.

Bull case – inflation remains higher defying the “inflation is transitory” mantra central banks are trying to convince the market of. Treasury yields don’t pick up as fast as in consensus scenario as the Federal Reserve takes a more dovish stance. US Dollar resumes a depreciating trend that started in 2020.

Bear case – If the Federal Reserve raises rates, inflation could be battened down, Treasury yields would rise faster and the US dollar would appreciate.

We place roughly a 40% probability on the consensus case, a 40% probability on the bull case and 20% probability on the bear case.

Source: WisdomTree Model Forecasts, Bloomberg Historical Data, data available as of close 31 July 2021. Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

In our consensus gold scenario, even though inflation cools from 5.4% on June 21 to 2.6% in Q2 2022, it is still relatively elevated compared to the historical average, which should be positive for gold prices. A relatively stable US dollar is unlikely to drive gold prices in either direction. However, in economic recovery with moderating inflation, we think that investor sentiment towards gold could trim. In the consensus scenario, gold prices could rise to US$1890/oz by Q2 2022, which is 6.5% above Q2 2021.

Please visit WisdomTree’s Gold page for more details about the outlook and gold investing: wisdomtree.eu/gold.

Silver: Surfing on an industrial rebound

With a strong correlation to gold, silver prices should gain as gold stages an upside correction. Moreover, a continued economic recovery should bode well for the metal given its high industrial usage.

In our modelling framework, gold price is the main driver of the silver price. However, we also find the following variables relevant:

Growth in manufacturing activity – more than 50% of silver’s use is in industrial applications [2] (in contrast to gold where less than 10% comes from that sector [3]). We use the global manufacturing Purchasing Managers Index (PMI) as a proxy for industrial demand.

Growth in silver inventory – rising inventories signal greater availability of the metal and hence is price negative. We use the futures market exchange inventory as a proxy.

Growth in mining capital investment (CAPEX) – the more mines invest, the more potential supply we will see in the future. Thus, we take an 18-month lag on this variable.

We believe that silver will outpace gold, to gain 37.5% over the coming year [4] versus 6.5% for gold. By Q2 2022, we expect silver prices to trade at around US$35.81/oz. A rebound in industrial activity will bode well for the demand for the metal. Meanwhile, a contraction in mining capital expenditure and a reduction in silver inventory on exchange, point to tightening supply.

Energy transition and electrification to boost silver demand

One of the major themes that we at WisdomTree have been highlighting for 2021 and beyond is that the energy transition is intensifying. We are moving away from the use of hydrocarbons towards more renewable sources of energy, and we are rotating towards electric vehicles, away from internal combustion engine vehicles.

Focusing on renewable sources of energy, silver is a key component of photovoltaics (solar panels). Around 10% (105 million ounces) of all silver uses are expected to be in photovoltaics in 2021 and its use in this category has doubled since 2014 [5]. Given the commitments to net zero emissions by 2050 from European Union, United States, Japan, South Korea, and similar commitments by China by 2060, we expect the use of photovoltaics to expand.

Silver’s use in renewable power generation doesn’t stop at photovoltaics. Silver-bearing sensors are used in turbines, grid management systems, and smart switches. Silver oxide batteries can also be used for energy storage systems.

Silver’s use in vehicles has been expanding in general with greater use of electric components such as semiconductors, sensors, harnesses, controls, fuses, switches and displays. That is being accelerated by electric vehicles. Electric vehicles have a greater need for sensors to monitor battery usage and the functioning of other electrical components. Additionally, there is a role for silver in the charging infrastructure. As vehicles become more autonomous, the electrification and demand for silver in cars is likely to continue to grow.

Please visit WisdomTree’s Metals page for more details about Silver and the outlook: wisdomtree.eu/metals

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

[1] US CPI inflation was 5.4% in June 2021

[2] World Silver Survey 2021, Silver Institute and Metals Focus, July 2021

[3] Gold Focus 2021, Metals Focus

[4] Q2 2021 to Q2 2022

[5] World Silver Survey 2021, Silver Institute, Metals Focus