Healthcare: A new bull market?

5 Jan, 2023

Sponsored by Polar Capital Global Healthcare Trust

Written by Gareth Powell, Head of Healthcare, Polar Capital

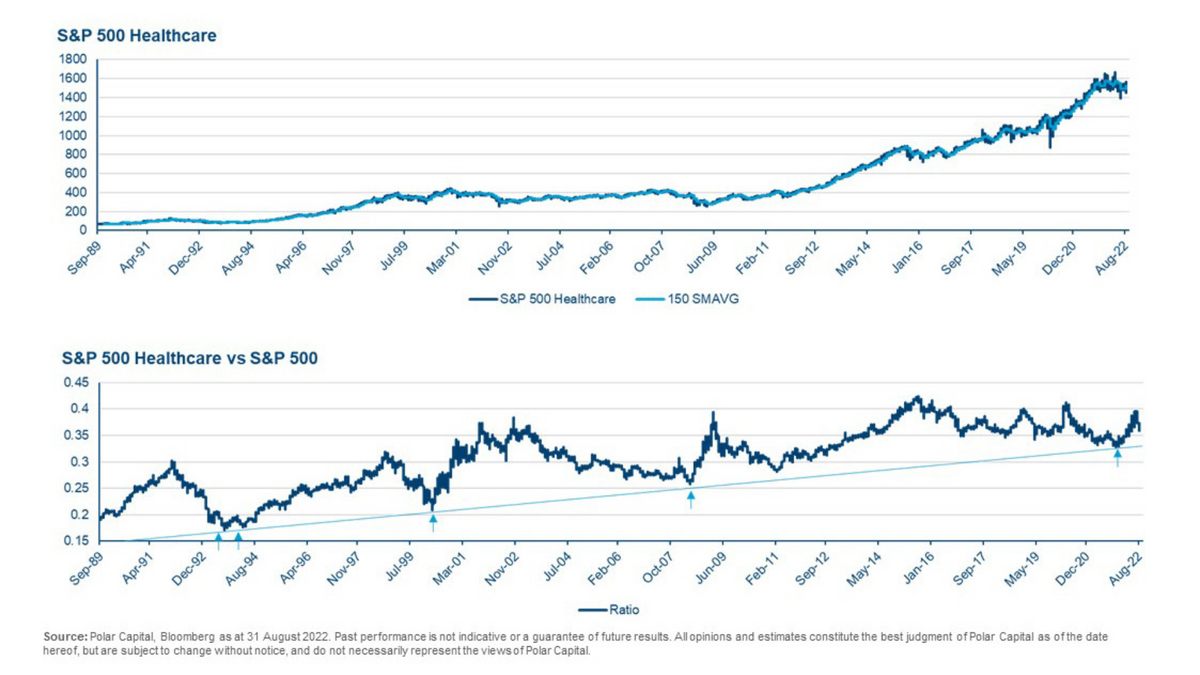

Going back over the past 30 years, healthcare, while outperforming significantly over the long term, seems to go through periods of positive performance, typically for 7-8 years, followed by periods of underperformance, again, typically, for 7-8 years. Looking back seven years to Q3 2015, healthcare has since underperformed the market at the broader index level, so we are hopeful things will turn and we will see an extended period of outperformance.

What seems to be critical in driving these 7-8-year periods is policy risk in the US, the largest healthcare market, particularly drug pricing policy. The sector is very much out of favour when policy risk is high and a significant overhang lifts when that policy risk is cleared. One example is the fear over changes in healthcare under the Clinton administration in the 1990s that ultimately did not happen and we saw a bull market in the sector over the following few years. Another is the spike in outperformance in 2008, with mega-cap healthcare showing its defensive attributes, followed by Obamacare which derated the sector until late 2010, then another bull market as we moved past those policy concerns.

Over the past 7-8 years, healthcare has underperformed the broader market though, more recently, we are seeing signs of change. In the US, the Inflation Reduction Act has just been signed by President Biden, passed by the Democrats without Republican support using a process called ‘reconciliation’ so they were able to achieve the healthcare policy they wanted. We see this as major clearing event and think this could be a peak in healthcare policy risk, justifying our view of a period of outperformance for a number of years.

A multi-cap opportunity

Looking up and down the market cap scale, the decade-long outperformance for small and mid-cap stocks peaked in a bubble for the most speculative stocks in 1Q21. Since then, the scale of the move downwards makes small and mid-cap stocks that were not in the bubble areas, in our view, much more interesting from a risk/reward perspective.

We still like large and mega-cap healthcare, particularly given their defensive attributes in today’s stagflationary environment. The larger companies have top-line strength and, critically, margins that give them the ability to offset inflationary pressures and still deliver on earnings growth, valuable for investors in this kind of environment.

The S&P 500 Healthcare (large cap) Index has pulled back a little recently, though is still at a 10-15% discount to the broader market. Mega-cap healthcare has outperformed by even more due to the stagflationary environment, thus we feel these types of company are likely to outperform.

If you go back to the 1970s when we had stagflation, large-cap healthcare outperformed significantly, both in the US and Europe. Looking at the other end of the spectrum, again if you go back to the 1970s, after the first peak in inflation there was a period of significant outperformance by small-caps over the following decade.

Long-term themes

While demographics are a major positive driver of growth, the cost of healthcare is huge and, particularly in developed markets, the delivery of healthcare is incredibly inefficient. We need innovation to make healthcare much more cost effective and the way we think about investing is in products and services that keep patients out of hospital as this is the most expensive setting for delivery care. For those who do go into hospital, we look at products and services that help them avoid open surgery through minimally invasive approaches that enable patients to leave much more quickly than has been possible historically. We have exposure to them all, to differing degrees, across the range of healthcare products we run at Polar Capital.

Healthcare delivery disruption: shifting where healthcare is delivered, to the home or surgery centres, with the aid of technologies such as telehealth and robotics.

Innovation: you would expect exposure to innovation through investing in healthcare, particularly in biotechnology and medical devices. In five years’ time, we hope to be talking about potential cures for major diseases through the use of novel therapies such as cell therapy and gene editing.

Consolidation: this is a major theme for healthcare, the most fragmented industry there is. We expect to see M&A continue as the industry tries to become more efficient, particularly with small and mid-cap stocks looking so attractive now, alongside pharma companies looking to improve their revenue growth for the 2025-30 period.

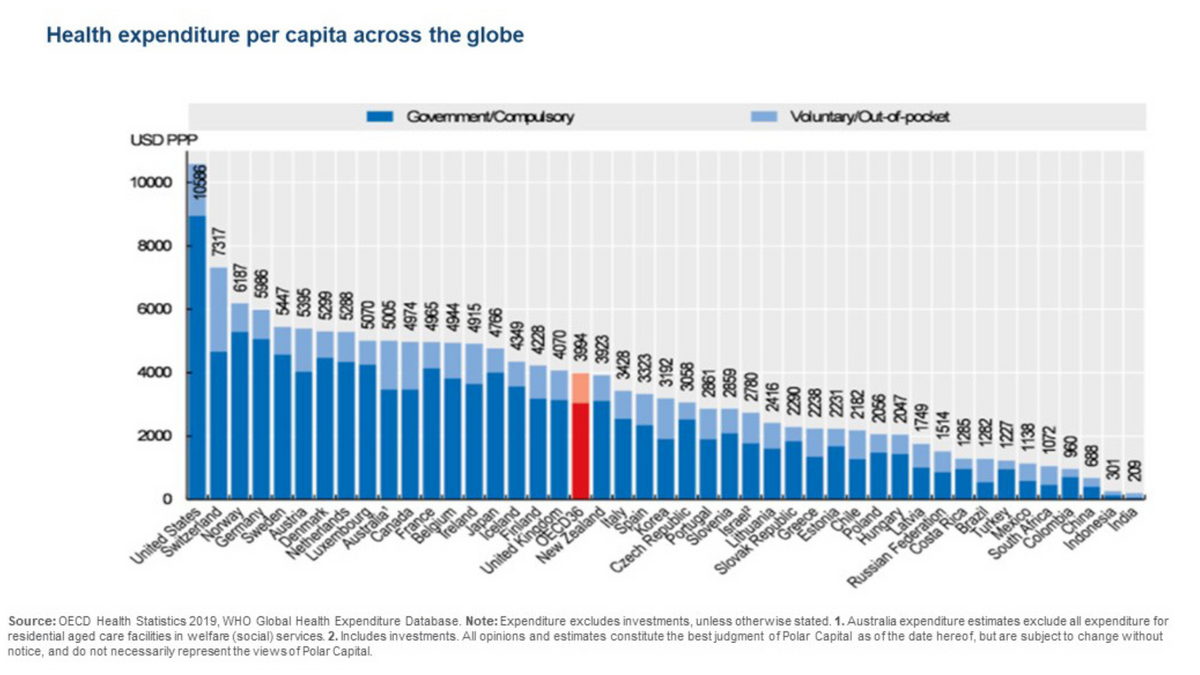

Emerging markets: the graph below shows healthcare expenditure per capita across different countries. On the left are the US and Switzerland which spend the most but need to become much more efficient and productive; on the right are emerging markets where healthcare expenditure is especially low. One of the big surprises is India, where we have some direct healthcare exposure. The US, for example, spends 50x more than India on a comparative basis, an extreme difference that we expect to narrow over time.

Outsourcing: outsourcing was absolutely critical in the development of the Covid vaccines and is a key way for the industry to become more efficient.

Prevention: again, the pandemic highlighted the value of diagnostics and vaccines and how powerful they are in preventing negative healthcare outcomes.

The key focus point for us is that we are able to find opportunities across the market cap scale and across the healthcare subsectors. The fundamentals for large/mega-cap healthcare are extremely attractive and the stagflationary environment is where these types of company really shine. At the other end of the spectrum, small and mid-cap stocks – which have been hit hard and is where stock-picking is crucial – look attractive on a number of metrics.

We are optimistic about healthcare and there is the potential for the sector to do very well over the coming several years. Driven by what is happening in the US, we are hopeful that we will now see a number of years where policy is not a major headwind that could lead to an expansion in valuation for the healthcare sector and potentially be a new bull market.

Discover more about the Polar Capital Global Healthcare Trust

Important Information

This is a marketing communication. Please refer to the Polar Capital Global Healthcare Trust plc offer document and to the KID before making any final investment decisions. This document is provided for the sole use of the intended recipient It shall not and does not constitute an offer or solicitation of an offer to make an investment into any Fund or Company managed by Polar Capital. It may not be reproduced in any form without the express permission of Polar Capital. The law restricts distribution of this document in certain jurisdictions; therefore, it is the responsibility of the reader to inform themselves about and observe any such restrictions. It is the responsibility of any person/s in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. Polar Capital Global Healthcare Trust plc and its subsidiary, PCGH ZDP plc are investment companies with investment trust status and as such their shares are excluded from the FCA’s (Financial Conduct Authority’s) restrictions which apply to non-mainstream investment products. The Companies conduct their affairs and intend to continue to do so for the foreseeable future so that the exclusion continues to apply. It is not designed to contain information material to an investor’s decision to invest in Polar Capital Global Healthcare Trust plc or PCGH ZDP plc, Alternative Investment Funds under the Alternative Investment Fund Managers Directive 2011/61/EU (“AIFMD”) managed by Polar Capital LLP the appointed Alternative Investment Manager. Excluding the UK, in relation to each member state of the EEA (each a “Member State”) which has implemented the AIFMD, this document may only be distributed and shares may only be offered or placed in a Member State to the extent that (1) the Fund is permitted to be marketed to retail and professional investors in the relevant Member State in accordance with AIFMD; or (2) this document may otherwise be lawfully distributed and the shares may otherwise be lawfully offered or placed in that Member State (including at the initiative of the investor). As at the date of this document, the Company has not been approved, notified or registered in accordance with the AIFMD for marketing to investors in any member state of the EEA. However, additional such approval may be sought or additional such notification or registration may be made in the future. Therefore this document is only transmitted to an investor in an EEA Member State at such investor’s own initiative. SUCH INFORMATION, INCLUDING RELEVANT RISK FACTORS, IS CONTAINED IN THE COMPANIES OFFERING DOCUMENTS WHICH MUST BE READ BY ANY PROSPECTIVE INVESTOR. A copy of the Offer document and Key Information Document (KID) relating to the Company may be obtained online from [https://www.polarcapitalglobalhealthcaretrust.co.uk/Corporate-Information/Document-Library/] or alternatively received via email upon request by contacting Investor-Relations@polarcapitalfunds.com.

Investor Rights: A summary of investor rights associated with an investment in the Company can be requested via email by contacting Investor-Relations@polarcapitalfunds.com.

Statements/Opinions/Views: All opinions and estimates constitute the best judgment of Polar Capital as of the date hereof, but are subject to change without notice, and do not necessarily represent the views of Polar Capital. This material does not constitute legal or accounting advice; readers should contact their legal and accounting professionals for such information. All sources are Polar Capital unless otherwise stated.

Third-party Data: Some information contained herein has been obtained from third party sources and has not been independently verified by Polar Capital. Neither Polar Capital nor any other party involved in or related to compiling, computing or creating the data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any data contained herein.

Holdings: Portfolio data is “as at” the date indicated and should not be relied upon as a complete or current listing of the holdings (or top holdings) of the Companies. The holdings may represent only a small percentage of the aggregate portfolio holdings, are subject to change without notice, and may not represent current or future portfolio composition. Information on particular holdings may be withheld if it is in the Companies’ best interest to do so. It should not be assumed that recommendations made in future will be profitable or will equal performance of the securities in this document. A list of all recommendations made within the immediately preceding 12 months is available upon request. This document is not a recommendation to purchase or sell any particular security. It is designed to provide updated information to professional investors to enable them to monitor the Companies.

Benchmarks: The following benchmark index is used: MSCI All Country World Index/Healthcare. This benchmark is generally considered to be representative of the Healthcare Equity universe. This benchmark is a broad-based index which is used for comparative/illustrative purposes only and has been selected as it is well known and is easily recognizable by investors. Please refer to www.mscibarra. com for further information on this index. Comparisons to benchmarks have limitations as benchmarks volatility and other material characteristics that may differ from the Companies. Security holdings, industry weightings and asset allocation made for the Companies may differ significantly from the benchmark. Accordingly, investment results and volatility of the Companies may differ from those of the benchmark. The indices noted in this document are unmanaged, unavailable for direct investment, and are not subject to management fees, transaction costs or other types of expenses that the Companies may incur. The performance of the indices reflects reinvestment of dividends and, where applicable, capital gain distributions. Therefore, investors should carefully consider these limitations and differences when evaluating the comparative benchmark data performance. Information regarding indices is included merely to show general trends in the periods indicated and is not intended to imply that the Companies was similar to the indices in composition or risk. The benchmark used to calculate the performance fee is provided by an administrator on the ESMA register of benchmarks which includes details of all authorised, registered, recognised and endorsed EU and third country benchmark administrators together with their national competent authorities.

Regulatory Status: Polar Capital LLP is a limited liability partnership number OC314700. It is authorised and regulated by the UK Financial Conduct Authority (“FCA”) and is registered as an investment adviser with the US Securities & Exchange Commission (“SEC”). A list of members is open to inspection at the registered office, 16 Palace Street, London, SW1E 5JD. FCA authorised and regulated managers are expected to write to investors in funds they manage with details of any side letters they have entered into. The FCA considers a side letter to be an arrangement known to the Investment Manager which can reasonably be expected to provide one investor with more materially favourable rights, than those afforded to other investors. These rights may, for example, include enhanced redemption rights, capacity commitments or the provision of portfolio transparency information which are not generally available. The Companies and the Investment Manager are not aware of, or party to, any such arrangement whereby an investor has any preferential redemption rights. However, in exceptional circumstances, such as where an investor seeds a new fund or expresses a wish to invest in the Companies over time, certain investors have been or may be provided with portfolio transparency information and/or capacity commitments which are not generally available. Investors who have any questions concerning side letters or related arrangements should contact the Polar Capital Desk at the Registrar, Equiniti on 0800 876 6889. The Companies are prepared to instruct the custodian of the Companies, upon request, to make available to investors portfolio custody position balance reports monthly in arrears.

Information Subject to Change: The information contained herein is subject to change, without notice, at the discretion of Polar Capital and Polar Capital does not undertake to revise or update this information in any way.

Forecasts: References to future returns are not promises or estimates of actual returns Polar Capital may achieve. Forecasts contained herein are for illustrative purposes only and does not constitute advice or a recommendation. Forecasts are based upon subjective estimates and assumptions about circumstances and events that have not and may not take place.

Performance/Investment Process/Risk: Performance is shown net of fees and expenses and includes the reinvestment of dividends and capital gain distributions. Factors affecting the Companies’ performance may include changes in market conditions (including currency risk) and interest rates and in response to other economic, political, or financial developments. The Companies’ investment policy allows for it to enter into derivatives contracts. Leverage may be generated through the use of such financial instruments and investors must be aware that the use of derivatives may expose the Companies to greater risks, including, but not limited to, unanticipated market developments and risks of illiquidity, and is not suitable for all investors. Those in possession of this document must read the Companies Investment Policy and Annual Report for further information on the use of derivatives. Past performance is not a guide to or indicative of future results. Future returns are not guaranteed and a loss of principal may occur. Investments are not insured by the FDIC (or any other state or federal agency), or guaranteed by any bank, and may lose value. No investment process or strategy is free of risk and there is no guarantee that the investment process or strategy described herein will be profitable.

Allocations: The strategy allocation percentages set forth in this document are estimates and actual percentages may vary from time-to-time. The types of investments presented herein will not always have the same comparable risks and returns. Please see the private placement memorandum or prospectus for a description of the investment allocations as well as the risks associated therewith. Please note that the Companies may elect to invest assets in different investment sectors from those depicted herein, which may entail additional and/or different risks. Performance of the Companies is dependent on the Investment Manager’s ability to identify and access appropriate investments, and balance assets to maximize return to the Companies while minimizing its risk. The actual investments in the Companies may or may not be the same or in the same proportion as those shown herein.

Country Specific Disclaimers: The Companies have not been and will not be registered under the U.S. Investment Company Act of 1940, as amended (the “Investment Company Act”) and the holders of its shares will not be entitled to the benefits of the Investment Company Act. In addition, the offer and sale of the Securities have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”). No Securities may be offered or sold or otherwise transacted within the United States or to, or for the account or benefit of U.S. Persons (as defined in Regulation S of the Securities Act). In connection with the transaction referred to in this document the shares of the Companies will be offered and sold only outside the United States to, and for the account or benefit of non U.S. Persons in “offshore- transactions” within the meaning of, and in reliance on the exemption from registration provided by Regulation S under the Securities Act. No money, securities or other consideration is being solicited and, if sent in response to the information contained herein, will not be accepted. Any failure to comply with the above restrictions may constitute a violation of such securities laws.