Holly's Blog: Fund managers stop investment in Russia

4 Mar, 2022

Against a menacing global backdrop, markets this week had been relatively and almost strangely benign... but are falling today, partly in response to the fire at the Ukrainian nuclear plant.

FTSE tumbles…

As I write this on Friday morning, the FTSE 100 has fallen by about 3%. But there is so much volatility it’s impossible to write a blog which acts as a reliable weekly summary - things are moving so quickly. Last night when I thought what I might write about, the story was one of markets seeming almost complacently stable. Hhhm. Not by the time I sat at my desk this morning.

The FTSE100 is a family of very different children. Shell is the largest part of this index now (representing about £7 for every £100 invested in the FTSE100) and is up 18% over 3 months. BP is a chunky part and is up 7% over 3 months. Banks are also a big part of it – HSBC – and this is up 15% over 3 months. (“Goody goody, higher inflation = higher interest rates = more money for us” is the general gist of banks and inflation). That said, it’s a sea of red today with almost everything down between 2% and 4%. The travel sector is particularly hard hit with British Airways owner IAG and Rolls Royce taking a pounding.

As commodities rise yet further…

The only global constant seems to be the upwards trudge of commodity prices. It’s not just oil. The cost of wheat has shot up, with contracts traded in Chicago up by 40% in 7 days. (You think the cost of living is high today….) Closer to home, gold miner Fresnillo is a rare show of green on the FTSE 100, along with defence budget beneficiary BAE Systems. There you have a snapshot of the world – commodities, gold, US dollars and weapons are where money is seeking refuge.

Investing in Russian markets

We reported last week that one of the most traded investment trusts on interactive investor was the JP Morgan Russian Securities fund. The trust has fallen by a whopping 73% over the course of a week.

It’s their Annual General Meeting today at 2.30pm, followed by a Question and Answer session where shareholders attending in person can ask questions. Individual shareholders have always been unpredictable voices at these AGMs and they of course ask their questions with no fear of politics or ‘the done thing’, before claiming their free sandwiches and biscuits.

There will be a recording available afterwards. I will be very genuinely interested to hear the managers’ outlook, JP Morgan’s broader position and the individual answers to any questions.

More generally, asset managers are starting to respond to the crisis. We’ve spent a few years listening to asset managers set out their stalls for being the shiny champions of all things environmental, social and governance. What we are seeing in Ukraine right now tramples on all 3 of these, and we don’t need any complicated data sets to tell us this.

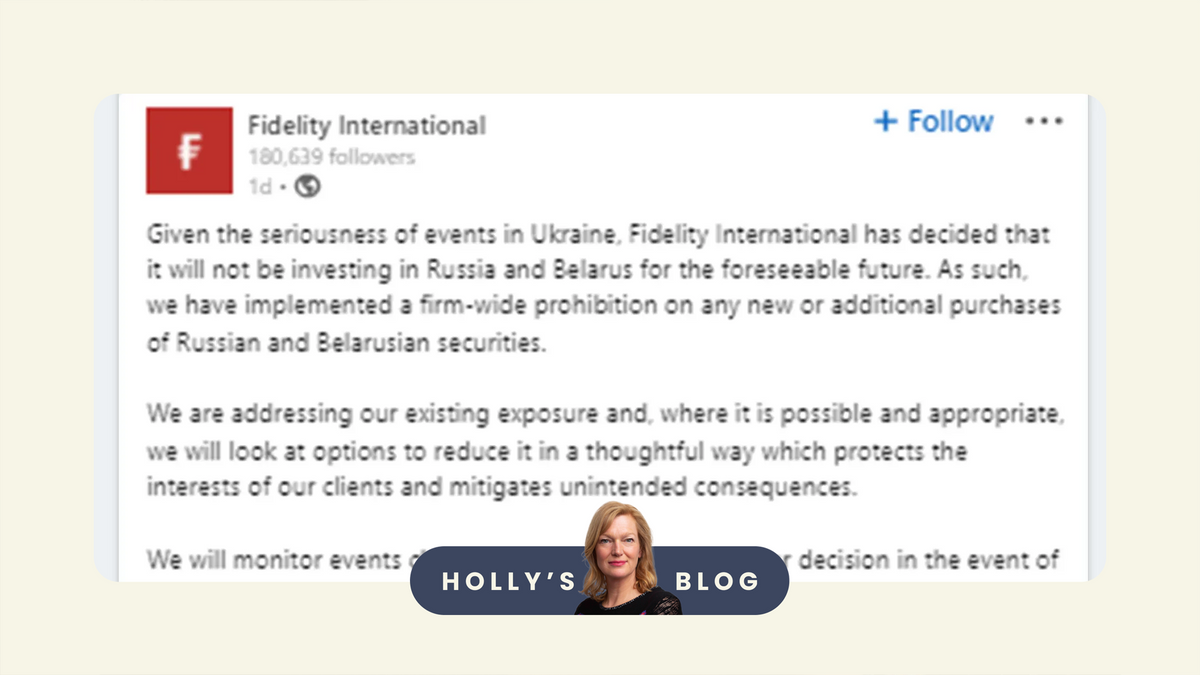

In a LinkedIn post yesterday, Fidelity announced that it had implemented a firm-wide prohibition on any new or additional purchases of Russian shares. Abrdn and Schroders have taken similar positions.

Also yesterday, BlackRock, the world’s largest asset manager, reported that it had "suspended the purchase of all Russian securities in [its] active and index funds." Index providers FTSE Russell and MSCI already announced on Wednesday that they were removing Russian equities from all their indexes. This is arguably the more important announcement as – by definition – all index managers just buy what’s in the index. So if the indices change, then so the holdings of very single ‘passive’ manager in the world also change.

As for existing holdings, with Russian markets suspended since Monday and the London Stock Exchange halting trading on 27 companies with strong ties to the country, asset managers have no choice but to hang onto their existing holdings until markets stabilise.

The end of the tax year, tick tock

Despite the hiatus in markets, I’ve not changed my view that using our ISA and pension allowances, and investing as much as we can, as often as we can, remains the long-term sensible thing to do. With just one month left to go this tax year, now is the time to consider new accounts, topping up accounts or moving any money outside of the tax-quarantined ISAs and pensions into them. Next week we’ll bring you an end of the tax year countdown special, with a particular consideration of how to move at times of such volatility, and in the interim you can see who we rate in our Best Buy tables here.

Over and out

Like many, I feel quite helpless as I watch the news. It’s a stark reminder that when you’re a kid, you just relax because the grown-ups are in charge. And then the older you get, the more you realise that the grown-ups don’t know what to do either. One small thing I can do is to make a donation of £1,000 on behalf of the Boring Money team to the Disasters Emergency Committee – the UK Government will match donations from the public pound of pound up to £20 million.

Have a good weekend everyone and thanks for reading.

Holly