Holly's Blog: Teeth in an economic can of Coke

17 Sep, 2021

Calling all hipsters. Control your excitement. This week is Pension Awareness Week.

So here are 5 pension nuggets from me:

Too few people are aware of the perks of pensions – basic rate taxpayers get a free 20p for every 80p they deposit in a pension. Higher rate taxpayers get to claim back another 20p when they file their tax return. This is mega! Where else can you get £1 for 60p! Without risking imprisonment? Hargreaves Lansdown has a useful tax relief calculator which tells you how much you would get in your pension account for every £1 you paid in. Go on! Have a peek.

Do you know where all your pensions are? There are 1.6 million unclaimed pensions worth about £20bn in the UK. If you have lost track of yours, then try this Government Pension Tracer tool.

It’s easy to get a forecast of your State Pension – how much will you get as the foundation for your retirement income?

For those over 50, there’s a free impartial service from the Government where you can talk through your pension questions with a real human being! They can’t give you personalised financial advice but they can certainly tell you what’s what and make some suggestions – I think it’s a worthwhile call for anyone with questions.

Finally if you have a number of pensions scattered around, consolidating them into one pot can make a lot of sense. (I’m not talking final salary schemes here which should be treated with kid gloves and caution). But for younger folk with pensions they have paid into at work or privately – could you shove them all into one place? It’s actually very easy to open a pension online now, and you can get your new provider to do all of the legwork for you. Check out our Best Buy tables for options.

If you are interested, we have 100s of pension questions which have been answered by financial advisers on our site – check out our question directory and filter by pensions to see what everyone else is asking. Alternatively, if you have a pensions question – ask away in the 'financial advice' dropdown and one of the advisers on our site will answer it for you!

Phew. Enough pension excitement already

In other news – and actually a reminder of why investing is so important for everyone - inflation hit new recent highs of 3.2% in August. This is why a latte now costs £3. Petrol is 135p a litre. And the weekly shop is edging up.

My friends we are under siege. We are like a poor old tooth dropped in an economic can of Coke. And investments and pensions are our (gum) shield.

Interest rates are basically zilch. Inflation is biting. Tax increases are happening. More than ever we have to think of smart alternatives to cash for our long-term savings. And with the freebie top-ups - pensions are as sexy as they come! (As long as you can afford to set that money aside until you’re 55+.)

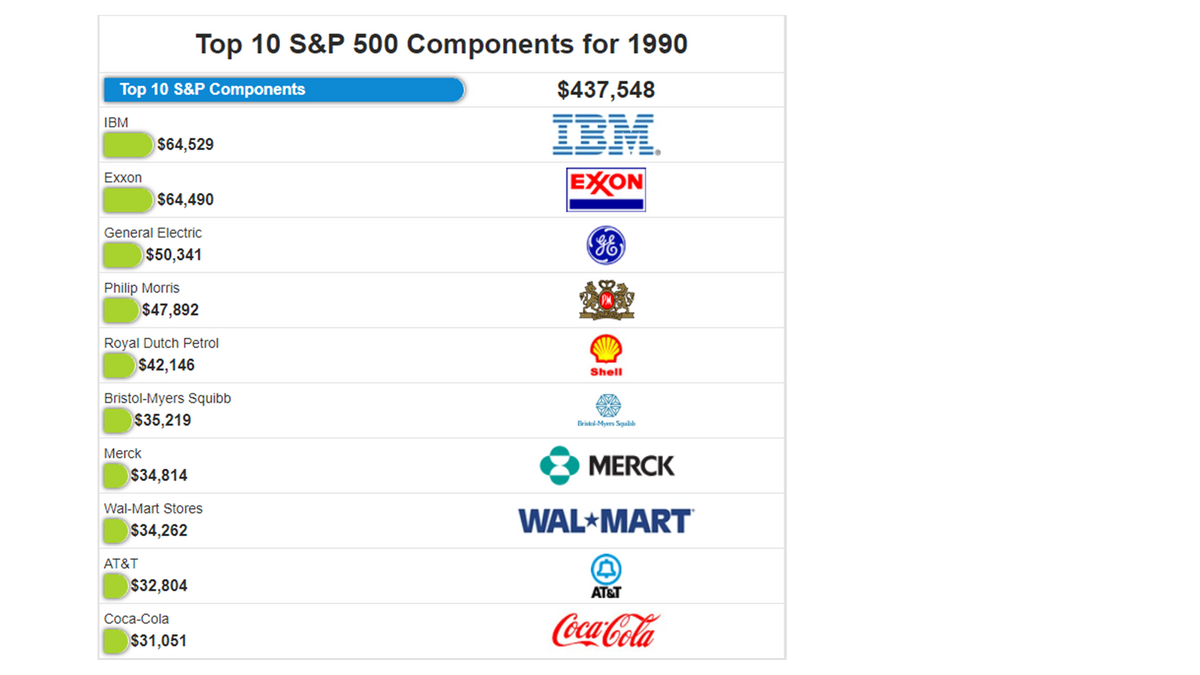

As we consider long-term savings AND digest our rapidly changing world, I think it’s interesting to consider the broader shifts and trends around us as we try to make some sensible choices. Obviously change is the only constant. Since launch in 1984, only 28 names in the FTSE100 have remained the same.

Check out the S&P 500 from 1990 in the picture below – fags, oil, IBM, Coke and Walmart

Next Tuesday at 6pm you can join myself on a webinar with Scottish Mortgage’s Catharine Flood and chartered financial planner Dennis Hall to talk about investment opportunities and long-term planning. I’ll be asking Catharine about valuations, long-term trends and specific stocks such as Tesla, Illumina and Moderna. And Dennis will share what his clients are asking him – and how he thinks about diversification and risk. Sign up here to join live or watch on catch-up.

Thanks everyone – have a cracking weekend!

Sponsored Message

Consolidate existing pension pots into one, easy to manage plan.

Planning for the retirement of your dreams can be difficult enough without having to deal with multiple pension pots built up with different providers throughout your working life. To make things easier we've designed a hassle-free, low cost service to help you bring your pensions together under our award winning Self-Invested Personal Pension (SIPP) product - we call it One Plan.

Capital at Risk.