How to invest in China - without investing in China?

6 June, 2023

Sponsored by Martin Currie Global Portfolio Trust

China offers investors an exciting opportunity. It is a huge market and it has many supportive long-term trends underpinning its future growth potential, including rising wealth and infrastructure development.

How to gain exposure?

However, investing in China can be perplexing for many investors. Direct investment is far from easy, fraught with risks and may require professional know-how beyond most individuals. So how do you plug-in to that growth potential?

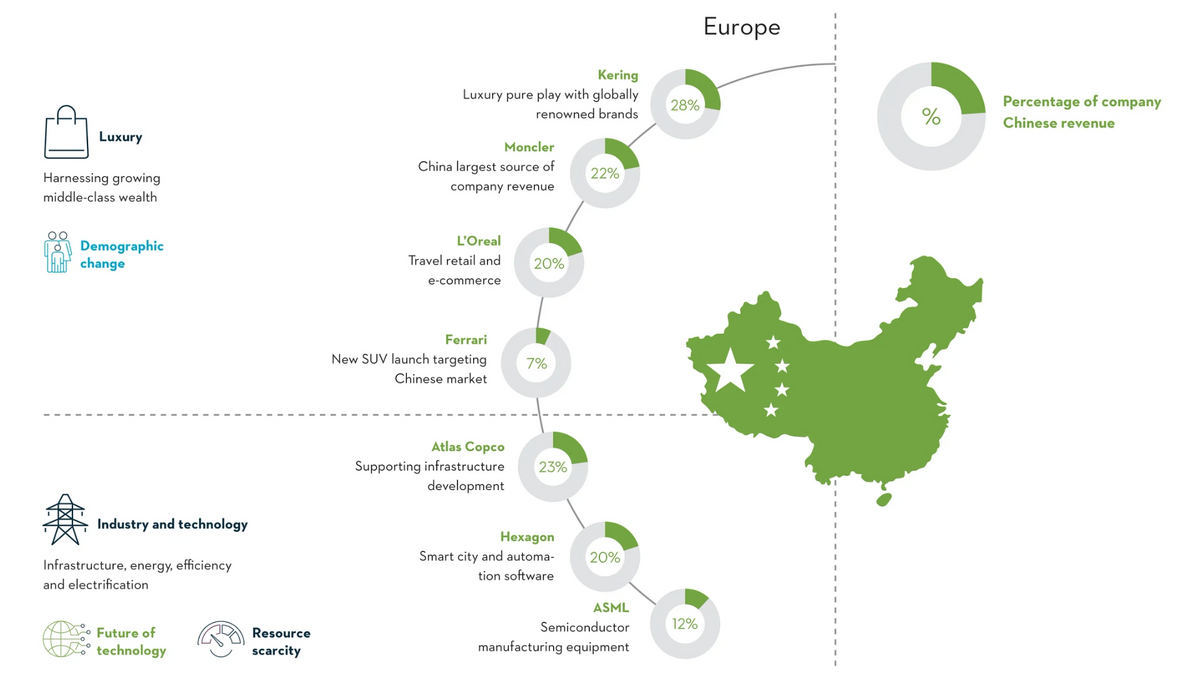

At Martin Currie Global Portfolio Trust, we invest in Chinese companies directly, but we also take an international approach, gaining exposure indirectly through companies that are listed outside China.

European companies meeting the demand for luxury

Some of our luxury related holdings generate meaningful revenues from China, which saw consumer spending revenue reach US$53 billion at the end of 2022 and is predicted to rise by 25% to U$66 billion by 2027. [1]

These include Moncler the Italian luxury jacket maker. Not only does China represent the largest source of revenue for the company, but a major growth opportunity with a network of 40 stores and plans to open more.

L’Oreal, the global beauty brand, is harnessing China’s growing travel retail market. The company has a strong presence in China’s Haitang Bay, the world largest Duty-Free shopping complex, and will be expanding into the new Haikou International Duty-Free City (opened in October 2022), set to be twice the size of Haitang.

Sportscar maker Ferrari is also eyeing the Chinese market. The new Purosangue, the company’s first SUV, is in part targeted at this market, where high net worth individuals prefer to be driven.

Exposure to China through European companies: harnessing revenue opportunities

The electric transition and smart cities

Infrastructure development, including electrification and the growth of ‘smart cities’ [2], are also presenting opportunities for specialist industrial technology and software companies.

It is estimated that China will need to spend c. US$13.7 trillion [3] by 2060 to achieve carbon neutrality, with US$2 trillion needing to be spent by 2030 alone across electricity generation and transport infrastructure. This has a high demand for semiconductors, and the Netherland’s ASML is a major exporter of semiconductor manufacturing equipment to the Chinese market.

While this carries some geopolitical risk from export restrictions, the semiconductors used in electric transportation and green energy are the less advanced ones and are currently at less risk of trade restrictions. With increasing urbanization, China is seeking to develop its smart city capabilities, with the industry reaching 19 trillion yuan in size by 2021 [4].

We have exposure to this through Swedish industrial technology firm Hexagon, the company’s smart city software has notably been deployed in Shanghai.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the securities discussed here were, or will prove to be, profitable.

Further reading

Important legal information

This information is issued and approved by Franklin Templeton Investment Management Limited (FTIML). It does not constitute investment advice.

The information provided should not be considered a recommendation to purchase or sell any particular security. It should not be assumed that any of the security transactions discussed here were or will prove to be profitable. These opinions are not intended to be a forecast of future events, research, a guarantee of future results or investment advice.

Past performance is not a guide to future returns. The return may increase or decrease as a result of fluctuations in the markets, in currency and/or in the portfolio.

Market and currency movements may cause the capital value of shares, and the income from them, to fall as well as rise and you may get back less than you invested.

The analysis of Environmental, Social and Governance (ESG) factors form an important part of the investment process and helps inform investment decisions. The strategy does not necessarily target particular sustainability outcomes.

The opinions contained in this document are those of the named manager(s). They may not necessarily represent the views of other Martin Currie managers, strategies or funds.

Shares in investment trusts are traded on a stock market and the share price will fluctuate in accordance with supply and demand and may not reflect the value of underlying net asset value of the shares. The majority of charges will be deducted from the capital of the company. This will constrain capital growth of the company in order to maintain the income streams.