Proof points: 3 ways to make sure a sustainable fund does what it says on the tin

1 Nov, 2022

When it comes to sustainable funds, there’s an awful lot of technical jargon flying around that can make it tricky to work out what you’re actually investing in.

Whether it’s ‘ESG’ (environmental social and governance), ‘SRI’ (socially responsible investing) or ‘impact investing’ (focusing on a smaller pool of firms which can evidence creating direct change), so-called “greenwashing” - whereby an investment is falsely or misleadingly advertised as more sustainable than it really is – can be a major concern. In fact, our research this year shows that a quarter (29%) of investors thinking about investing sustainably are worried about greenwashing.

So what proof should you be looking for when picking a sustainable fund to make sure the money manager in question is doing a) a good job and b) what you expect?

We’ve picked out three things to think about – and check – to make sure you get what you’re expecting.

1. Is it all about what is NOT included?

What is most important to you when it comes to investing sustainably? Is it the exclusion of nasties? Are you looking for something more thematic and specific, such as clean energy? Or do you want to put your money behind products that are just generally better?

If it’s the former and the exclusion of common ‘nasties’ - such as tobacco, gambling or fossil fuels - then you're looking for what the industry often calls an ‘ethical’ fund. These are usually quite easy to identify because most funds will tell you what they exclude if you do some digging. It’s unusual for funds labelled as ‘ethical’ to hold these so-called sin stocks, but don’t just rely on the name. The top 10 holdings will also give you a quick feel for what the fund is invested in.

One best-selling fund which excludes sin stocks is the ‘iShares MSCI USA SRI ETF’, which actively cuts out companies involved in ‘nasties’ such as nuclear weapons, tobacco, firearms, alcohol, gambling, and adult entertainment, whilst offering a low-cost one-stop shop to investing in the US stock market. You can read more about the fund’s objective and see its top 10 holdings here.

Other examples are the Liontrust Sustainable Future Managed Growth fund - excludes all nasties and also has a Silver rating from independent research firm Morningstar - as does the Schroders ISF Global Sustainable Growth fund, also with a Silver rating. Research firms like Morningstar can be a godsend if you need a reliable third-party to do the detective work for you.

You can usually find more information about a fund on the fund manager’s website, or if you’re not sure where to look, just pop the fund name into a search engine and you’ll often find the full disclosure near the top of the results. Sometimes, the individual fund factsheets are not as clear as they should be, in which case digging around for the company’s annual sustainability report or similar might give you the answers you need.

2. “It’s not easy being green”

If you have a specific thing that you want to invest in, then you’ve got to make sure you’re picking the right metric to assess it by.

For example, if you want to invest specifically in clean energy, you might want to look at the % of green revenues in the fund. This measures how much of the money which companies in the fund make comes from “green” activities, which are essentially things that benefit the environment - such as the use of wind power. So if you want to invest primarily in clean energy here and now, then looking for green revenues of 70% or higher is not a bad rule of thumb.

Other investors take a different approach and are happy to back companies which may be involved in fossil fuels today, but are spending big on transition and future change. In which case, a fund holding firms with great sustainability plans for the future may be OK for you. But it will not have a good % of green revenues today.

Another carbon-centred proof point is known as WACI, rhyming with "wacky" as in "backy". This is the acronym for ‘Weighted Average Carbon Intensity’, which measures a fund’s exposure to carbon-intensive companies by revenue, expressed in tonnes of CO2 emitted per $1M revenue. Or in other words, how much carbon is produced by the activity of the companies you invest in per $1 million of their sales?

The higher this number, the more damage the company is doing to the environment. It's not a perfect metric by any means. Note that it’s pegged against sales to enable comparison – obviously, you’d expect a car manufacturer to produce more carbon than a lollipop manufacturer, per item made. It's an interesting start but it’s far from perfect.

For example, if super pricey Mulberry handbags were compared to Top Shop handbags, it could make Top Shop look bad because they can churn out 10,000 handbags and bring in $1m of revenue, compared to Mulberry, who would only have to make 1,000 bags to bring in that same revenue. You’d expect the firm making 10,000 bags to belch out more carbon – so Mulberry could look great by comparison not because they’re a green angel, but because they’re really expensive (this is just a random example by the way – no reflection on either brand).

Despite these flaws, it’s a useful general measure and a helpful number if you’re looking for a benchmark to ascertain a fund’s sustainability credentials.

To help you get a sense of what is ‘average’ – the FTSE UK average was 136.26 as at July 2021, according to FTSE Russell's 'Sustainability in the UK' report. Less than this is better.

3. Check the fund against the UN’s Sustainable Development Goals

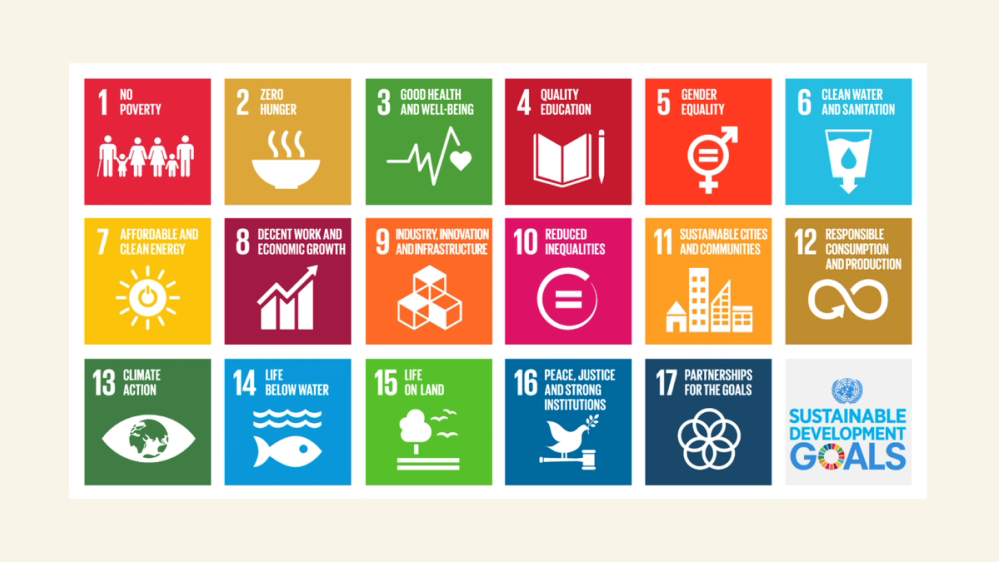

A final helpful guide, the United Nations has a series of 17 Sustainable Development Goals (SDGs) which are often treated as consistent ways to articulate the sustainable intentions of a product or investment. Here they all are:

Some funds automatically report against the SDGs, so you can see which of these goals the fund’s revenues are aligned to without having to do too much digging. Liontrust has some of the best reporting in the industry, and their annual sustainability report will show the % of its sustainable funds which align to SDGs.

If we take SDG 7 (affordable and clean energy), for example, then Morningstar report that Invesco Solar Energy ETF is 84% aligned to this SDG. L&G Clean Energy ETF is 70% aligned and Schroder Global Energy Transition Fund is 51% aligned.

If Clean Water and Sanitation (SGD 6) is more your concern, then iShares Global Water is 79% aligned and the Pictet Water Fund is 58% aligned.

Finally, looking at SDG 10 – Reduced Inequalities – then Robeco Sustainable Asian Stars, Jupiter Global Emerging Markets Focus and BNY Mellon Sustainable Global Emerging Markets funds have revenues which are between 4% and 5% aligned, leading the pack according to Morningstar.

You can usually find information about a fund’s alignment (or lack thereof) to the SDGs in the fund’s investment objective, and it can be a helpful way to map your goals and values to how your money is being put to work.

What other metrics can you use to assess a fund’s sustainability credentials?

Other proof points exist that you can use to measure a fund’s sustainable credentials, such as the % of women on the board or whether the fund manager is a signatory to the UN’s Principles for Responsible Investing (PRI). But remember that if you’re looking for a good place to start, have a nosey at the top 10 holdings to give you a good flavour of what’s in the fund and what your money will be doing. You can find this list on any fund’s factsheet which is on your investment platform, or on the asset manager’s website.

Phew!

As you can see, the more you dig, the more complicated this gets – and it does so quickly. If it all starts to fry your brain, pick a theme that resonates with your values, such as clean energy, gender equality, or workplace diversity. The UN’s SDGs are a great place to start.

Then, for a bit more guidance ,either seek advice from a professional adviser, go to a ready-made robo adviser for a pre-assembled portfolio, or check out a fund platform with good research who will do all the heavy lifting for you.

A final (boring) note

The more specific you get about any one theme, by definition, the less diversified you get. Some of these funds mentioned here will be volatile and so make sure you don’t just leap into backing themes which resonate, without reading about the volatility and risk. And don’t put 100% of your money into them.

Most retail investors should have a very boring solid base of well-diversified mainstream things. If this is you, then look at the sustainable or ESG variants of large global indices like the S&P 500, or a sustainable multi-asset fund. And maybe consider a few of these funds or ETFs as ‘satellite’ or smaller holdings, rather than the ‘core’ of your investments.