The Stagnant Pond and Powerful Downward Forces

10 Feb, 2023

A brief moment of solidarity with any parents of teens in the throes of Revision Wars. In the last few weeks, I have been forced to reconfront Relative Atomic Mass, ohms and the interior angles of a polybloodygon. Thank the Lord for YouTube. And could ChatGPT just hurry up and get a bit better, please? If it could learn to drive and pour me a drink too, that would be marvellous.

In other news, huge excitement in Economistville as the data shows that we are not technically in a recession. So we are in a stagnant slimy green pond, not a sink hole. This is 2023’s version of good news. The formal definition of a recession is one where gross domestic product (GDP) falls by two quarters in a row – and we narrowly avoided this.

People bandy around the term GDP, but don’t often explain it. There are three ways we can work this out. Perhaps the easiest is to add up everything that everyone has spent. What we spend in the shops; what businesses invest; what the government spends; and everything we sell to other countries less what we spend on stuff from abroad.

Meet Inflation The Orc

I participate in the Bank of England’s Decision Maker Panel – the Bank send out a monthly survey to people who run businesses and are adapting to the economic environment all the time. The questions they ask are very telling as to what is worrying them.

Last month they were interested in growth and anticipated growth – the rough gist was “How awful was Q3 for you?”. This month it is all about wage inflation – anticipated changes to salaries and staff numbers. Balancing tougher trading environments and potential layoffs with the need to acknowledge the impact of inflation on your staff and increase wages.

This is a very finely tuned balancing act and will be the story of the UK economy this year IMHO. The Guv’nor of the Bank of England has come over all Gandalf, and predicts that ‘powerful downward forces’ will rein in the nasty orc that is inflation. This means that he basically thinks we’ll have less money, spend less, takings will fall at the till, layoffs will have to happen and wages won’t be able to go up in line with inflation because companies will go into survival mode... so his sense is inflation will shoot back down to under 5%.

If he sees the above scenario start to happen naturally, we’ll say bye-bye to the relentless increase in interest rates. As the slower economy provides the chill pill that we used higher interest rates to start administering.

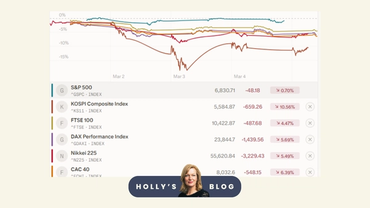

But the FTSE is a skipping hobbit

Beyond the economic environment of Mordor, the stock market seems to have its ear plugs in. “La-La-La,” sang the FTSE 100 last week, as it hit an all-time high in Middle Earth.

This index was created in 1984, when Footloose and Ghostbusters were in the charts. And happiness was a new ra-ra skirt with three tiers. I digress... The FTSE has been unloved in recent years and appears to be staging a comeback. Just a little contrary note of caution – the pound is down against the dollar by more than 10% over the last year. All those Big British Beasts, which earn lots of profit in dollars, will look more jolly than they really are when the pound is weak.

So the question is – are they doing well because of what they do? Or because of currency conversion?

I think you can loosely say that HAPPY FTSE 100 = HIGH ENERGY PRICES + HAPPY SHELL AND BP; HIGH INTEREST RATES = HAPPY BANKS + WEAK POUND.

Three dates for your diary

Coming up at Boring Money, we have 2 events to highlight. First, a free webinar with Polar Capital’s Ben Rogoff on Tuesday 21st February to talk all things tech. Ben’s been investing in tech for donkey’s years and we had a fantastic chat about AI and ChatGPT the other day – so do join us for some insights on the future of this sector.

And second, as part of our Visible! series for women, you can book your spot at a small online workshop hosted by adviser Dasa Medvecka on February 17th (next Wednesday) to talk about tax hacks with ISAs and pensions, and pose your questions.

Lastly, make a mental note about next week’s blog – as we announce our . After months of research and over 6,000 customer reviews to support our views, we’ll share what we think are the best ISAs and pensions out there. Get your dicky bows, taffeta frocks and boxing gloves ready for the financial Oscars!

Over and out for this week. Think of me as we head into a weekend of erosion, the passé composé and parallel circuits. 🤢

Holly