Top performing high-risk ready-made portfolios

20 Jan, 2023

Mostly thanks to the poor performance of UK bonds, high-risk ready-made portfolios recorded slightly higher returns in Q4 2022 than the medium and low-risk options. Why? In general these high-risk portfolios hold the vast majority of our money in shares, not bonds. We’re talking between about 80% and 100% in shares.

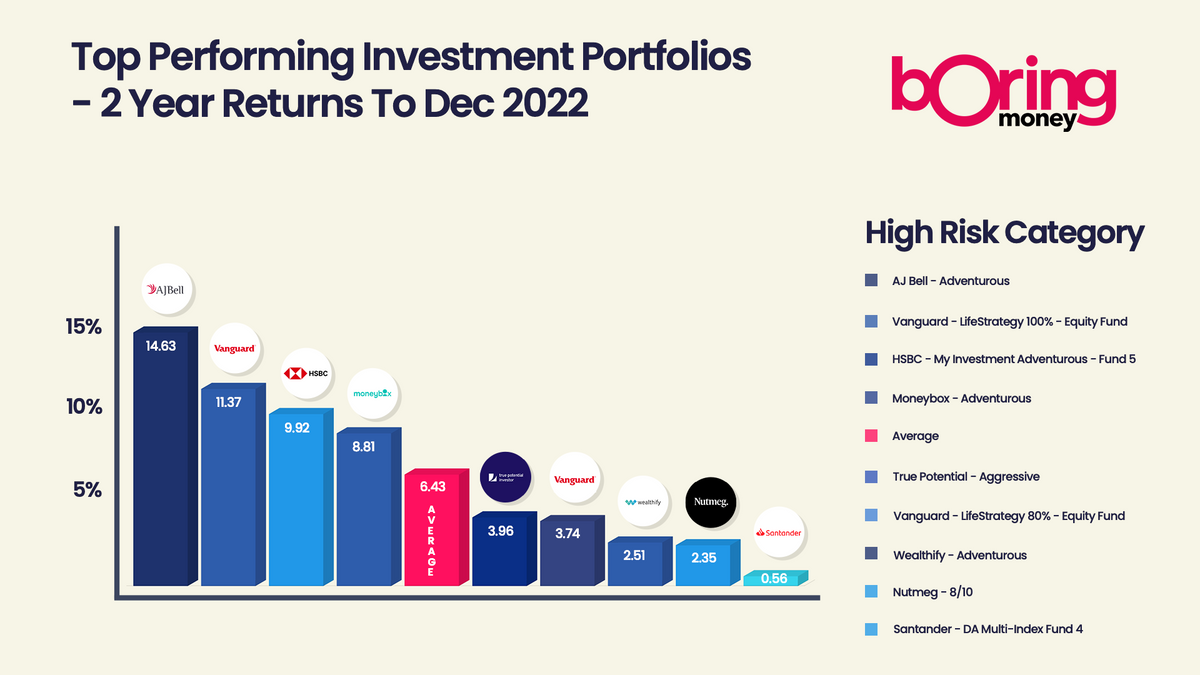

The average total return from a high-risk portfolio over a 2-year period, after all fees and charges, has been 6.43% - so £100 invested at the beginning of January 2021 would be worth £106.43 today, after all fees.

Scroll down for more information and the full table of performances!

Top performing ready-made portfolios

If we shorten the timeframe to just 2022, then we saw a huge range of returns from -0.35% to a painful -11.2%. No-one emerged without some pain, but there were some pretty chunky differences.

AJ Bell top the pack with average returns of 14.6% over the 2 years from the beginning of 2021 to the end of 2022. Why did they come out so well? According to an AJ Bell spokesperson “at the higher end of the risk spectrum it is exposure to the energy sector that has driven the outperformance”. So they went large on energy stocks, is another way of putting it! They say it was about clever selection.

Moneybox is a popular app, particularly with younger investors, and has posted decent returns on paper. Their mix of investments is the least complex of the lot – investors in the highest risk option will have £8 out of £10 in the Fidelity World Index Fund, which happened to have a relatively good run. Detractors will say they got lucky and have a very crude approach to building a portfolio. Fans may shrug and say “Who cares – they got me decent returns.” On paper, investing is as much about managing risk as it is generating returns, and this approach is certainly not the most sophisticated.

Wealthify, a popular ready-made portfolio with our readers, has had a less good 2 years, and took a more cautious approach. According to a spokesperson, “We have taken a cautious approach in 2022, which has seen overall greater allocation to bonds and, within our equity exposure, alternatives exposure. By alternatives we mean property and infrastructure… More generally, we have gradually taken risk off the table in 2022, and now stand at our minimum mandated allocation to equities (maximum to bonds). We have also aimed to reduce risk in other ways through hedging a majority of our US dollar equity exposure.”

Nutmeg is another ready-made portfolio which hedges most of its exposure to foreign currency. They say, “Our base long term allocation target is hedging a significant portion of our exposure to foreign currency. It is a decision that was taken early on at Nutmeg as we want to limit the risk to foreign currencies. Over the last two years, this has made a significant difference among the different portfolios particularly in relation to exposure to USD.”