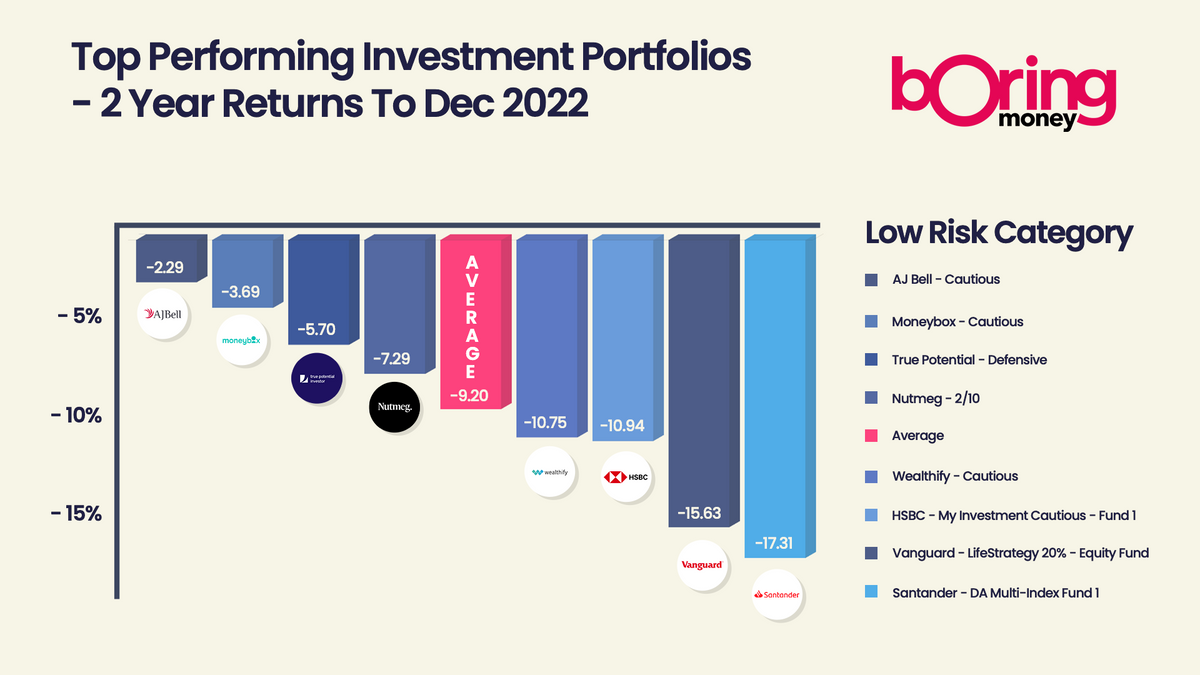

Top performing low-risk ready-made portfolios

20 Jan, 2023

These ready-made portfolios were the greatest victim of the tumbling bond prices we saw towards the end of September in 2022, which hammered returns. Things then bounced back in the last three months of the year as a semblance of calm returned.

Santander's 'Multi-Index Fund 1’ had amazing returns of 4.3% in the last quarter but any YAY should be tempered by the eye-watering total -17.41% losses over the course of the last year. With 75% plus in bonds, this really was a horror show for customers. And they weren’t alone. There was a similar pattern for other low-risk portfolios, such as Nutmeg's '2/10', which recorded gains of nearly 3% in Q4 against a backdrop of -8.8% over 2022 as a whole (it has an almost 60% weighting to bonds).

Scroll down for more information and the full table of performances!

Top performing ready-made portfolios

Here's what AJ Bell had to say about their relatively strong showing with their 'Cautious' fund. Read it – and then we’ll translate!

“The reason for the short duration bias in the portfolios was a determination by the team that there was an asymmetry within fixed income markets, where yields had been driven to very low levels during the era of quantitative easing. In other words, any potential return benefit that was available from being exposed to the wider market levels of fixed income duration was insufficient to account for the risk in the event of higher rates. So, when interest rates did rise, the lower risk targeted portfolios continued to behave as they are supposed to do.”

Huh? Bonds are like IOUs investors make to the government, which have a pay back date. Maturity. If this is in a year, this is a short duration. Duration just measures how much the price will change if interest rates move. Short duration stuff is normally less risky. If you expect rates to go up, you would usually buy shorter duration stuff, but it’s a trade-off because longer duration things would usually have the chance of higher returns.

AJ Bell didn’t think the potentially juicier returns from longer term duration thingammybobs were worth the risk. So they stuck with more boring short duration bonds, which got hammered less when Kwasi went Krazy. Ooof!

Moneybox has also done relatively well. But their portfolio has a very large chunk of cash in – in the form of a Legal and General fund – so it’s a very blunt instrument which will hold its own when things are grim. And not do anything when things go well. It’s not particularly diversified but you can also say that it has approximated doing what it says on the tin, where other more ‘clever’ options have crashed and burned.

So much of the disparities in performance in these low-risk portfolios comes down to how the group’s managed their bonds – which are usually calm, but not in 2022! A spokesperson for Nutmeg said, "We have a structural UK bias in fixed income and gilt exposure, which had a pretty negative impact during the Liz Truss period. It helped on reversal during the 4th quarter... Movements in the gilt market were very unusual in the period September to November 2022. Overall in 2022, we were underweight Fixed Income compared to our long term target. That helped to generate, to our measurement, outperformance among the lower risk portfolios (less so in the higher risk ones)”.