What can equity investors learn from the world cup?

24 Aug, 2023

The World Cup – the lessons for growth investors

Sponsored by Martin Currie Global Portfolio Trust

Imagine you were the manager of a World Cup football team and you were allowed to select any player from any country - filling every position with the very best in the world. You would be freed from the limitations of having to pick weaker players to fill positions purely on the grounds of their nationality.

A global investment portfolio offers a similar opportunity. The investment manager has the freedom to select from the world's best companies and combine them into a diversified, well-balanced portfolio.

Many UK investors heavily favour their own home market, however, and this bias can have some unintended consequences. Find out how global portfolios can potentially help to reduce some of the hidden risks - and how access to the world’s best companies may be able to help you achieve your investment goals.

Home bias – an own goal?

It has never been easier for you to access the global stock markets, especially following the rise of online fund supermarkets and investment platforms in recent years.

Despite the myriad of options, many investors still prefer to stick within the borders of their home market. And a domestic bias is perfectly understandable - the familiarity we have with home-grown firms could be one reason - but this constrained approach can significantly increase the levels of risk and could be very costly over the long term.

A rudimentary analysis shows that if you had invested the current ISA allowance of £20,000 in Global equites ten years ago (represented by the MSCI All Country World Index) your investment would have grown to over £64,800. However, an investment in UK equities would have returned around £36,600 – over £28,000 less; a significant difference. Please remember, past performance is not a guide to future returns and the returns could be very different in the future.

Concentration risk – too many players in one position?

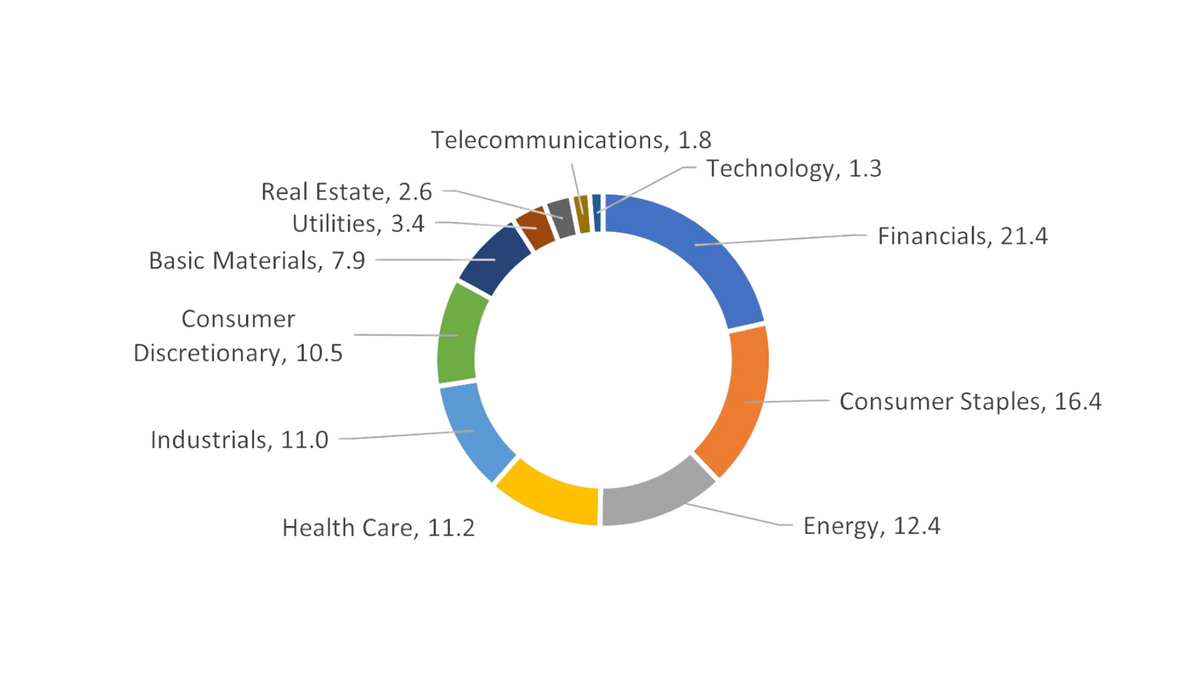

Today, the world's leading companies are based all around the globe. It’s less likely than ever that the best stocks are all going to be in one country. Look at the UK as an example. The three largest sectors account for more than half of the entire market. So, if you were invested in an UK index fund, you would have a significant overweight to Oil & Gas, miners and banks.

Source: Bloomberg< FTSE All-Share as at 31 October 2022

Such an over-dependence on a few companies can increase risk – especially when they are in the Energy sector which can be volatile and is facing calls for windfall taxes on profits. In fact, our team does not currently invest in oil & gas or banks because our fundamental analysis suggests they offer low growth prospects over the long-term, and we prefer other sectors, like technology-based companies, semiconductors and healthcare.

And it’s notable that only 1.3% of the market is related to Technology. Think of the new giants of the technology sector and some of the biggest growth stories in recent times: Apple (US), Google (US), Tencent (China), Samsung (Korea) and Alibaba (China) to name just a few. The unfortunate reality is that not a single one of them is a UK company so UK only-investors would not be able to benefit from the growth the sector has offered.

Political risk – avoiding the injury prone

Every country in the world has an element of political uncertainty or unpredictability but a large overweight to one single country can risk substantial losses if a political event triggers a downturn.

You don’t have to look far for examples. In the UK, recent political surprises and events like Brexit, or Liz Truss’s short-lived economic policies, have greatly impacted the wider economy and led to emergency action from the Bank of England. Russian equities have been written off entirely in many cases.

Although there are no guarantees, a global portfolio, if managed wisely, can avoid some of these potential pitfalls. It can shift allocations away from companies that are facing specific adversities in countries or regions, in favour of those facing more advantageous backdrops.

Any manager running a single country portfolio, however, is continually limited to one country and its constraints, a risk that could be easily mitigated by widening the investment horizon.

As a global portfolio offers the widest remit, it has the potential to blend the best companies in emerging markets with those in developed markets – the best of both.

The opposition

Investing outside your domestic market does introduce some currency risk. But it’s hard to avoid currency exposure entirely because even a domestic investor’s portfolio is likely to include some global companies which have earnings from abroad.

Similarly, some global portfolios may include stocks in emerging markets which can be perceived as risker than their developed market counterparts. However, many emerging market countries have greatly improved their economic management and accounting standards over recent years and offer some great growth opportunities.

The International Monetary Fund (IMF) estimates that 65% of economic growth will be generated in emerging market economies* - home to some of the world’s most innovative and exciting corporations that are harnessing technology.

Whether it is in e-commerce, semiconductors, fintech, big data, artificial intelligence (AI) or gaming, some emerging market-based companies have become leaders in global innovation.

As a global portfolio offers the widest remit, it has the potential to blend the best companies in emerging markets with those in developed markets – the best of both.

How to invest with Martin Currie

It’s easy to invest in a way that suits you. A range of online platforms and fund supermarkets allow you to trade online, manage your portfolio and buy UK listed shares.

* These sites do not give you advice, they simply allow you to trade. Many of these sites also offer ‘wrapper’ products like ISAs and pension plans.

The first pick? Global as a core holding

Many investors use global portfolios as a core holding or a ‘one stop shop’ around which they top-up exposure to other regions or countries with additional investments. The benefit of a global portfolio is that the manager typically balances elements across sectors, regions and exposures, based on their professional analysis, research and experience. This can be hard to replicate by an individual.

The ‘All-Star’ solution?

So, what can equity investors learn from the World Cup?

On the pitch during the World Cup, players can outperform and underperform, just as companies can. But as investors chart out their route to the ‘right result’, allowing their team to start with the best possible lineup is essential. No single country has all the best players and a wider selection could help you build a better team.

This is the opportunity open to the manager of a global portfolio who is free to pick from the world’s best companies, irrespective of nationality. This means they could handpick the equivalent of an All-Star team of superstars like Ronaldo, Messi, Kane – from Portugal, Argentina and England.

In fact, you could have a whole team of the world's best to help you achieve your goals.

Further reading

What are the risks?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments.

Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.

References to particular industries, sectors or companies are for general information and are not necessarily indicative of a fund’s holding at any one time.

For illustrative/discussion purposes only. It is not a recommendation to purchase, sell or hold any particular security. It is neither indicative of any portfolio holdings at any one time nor reflective of current or future portfolio holdings. Past performance is not necessarily indicative nor a guarantee of future performance.