Why “Peak Fear” Is A Prime Opportunity For The Healthcare Sector

By Boring Money

18 Sep, 2025

This section is a paid promotion created in partnership with Polar Capital. The views and information presented reflect the sponsor’s messaging and may not represent the independent opinions of Boring Money. While we aim to ensure accuracy and relevance, this content should not be considered impartial advice.

Healthcare has historically occupied a rare sweet spot for investors - both a defensive haven during downturns and a hotbed of long-term innovation. Yet in 2024 and into 2025, sentiment cooled. Concerns about valuations, rising costs, and regulatory headwinds spooked markets, leaving many investors wondering whether the sector still has the evergreen appeal it’s famed for.

However, as the team at the Polar Capital Global Healthcare Trust argue, “peak fear” moments often create the very best entry points. Behind the headlines, the sector is quietly entering one of the most compelling investment phases in decades - driven by demographics, technology, and structural demand. For investors prepared to look past the noise, the story here is one of long-term growth, even if the journey proves a bit bumpy on the way.

1. Valuations: From hot to healthy

After years of outperformance, healthcare stocks entered 2024 at relatively stretched valuations. A cooling in sentiment - driven partly by concerns around US drug-pricing reforms and the volatility of biotech - has since pulled those multiples back.

MSCI World vs MSCI World Health Care, 2015-present

Source: FE FundInfo, August 2025.

Crucially though, this has not coincided with a collapse in fundamentals. Balance sheets remain strong, cash flows are healthy, and the pipeline of new drugs and treatments is still robust. That means investors now face a sector trading at more attractive levels than in years, with the same long-term growth drivers still intact.

History shows that healthcare drawdowns often precede strong recovery phases. During the 2015 biotech correction, valuations contracted sharply, but over the next five years, the Nasdaq Biotech Index rebounded by more than 60%. The set-up in 2025 looks strikingly familiar, say the fund managers at the Polar Capital Global Healthcare Trust.

“Valuations have now been pulled down to such an extent that the potential returns from here for healthcare stocks look extremely compelling,” says Gareth Powell, Head of Healthcare at Polar Capital. “As evidence of this, despite the concerns over US government policy, M&A activity is starting to pick up again.”

Indeed, Charles Stanley anticipates M&As to accelerate towards the end of 2025 “as large companies seek to replenish pipelines and diversify revenue streams”. It adds a “wave of strategic acquisitions” is likely.[1]

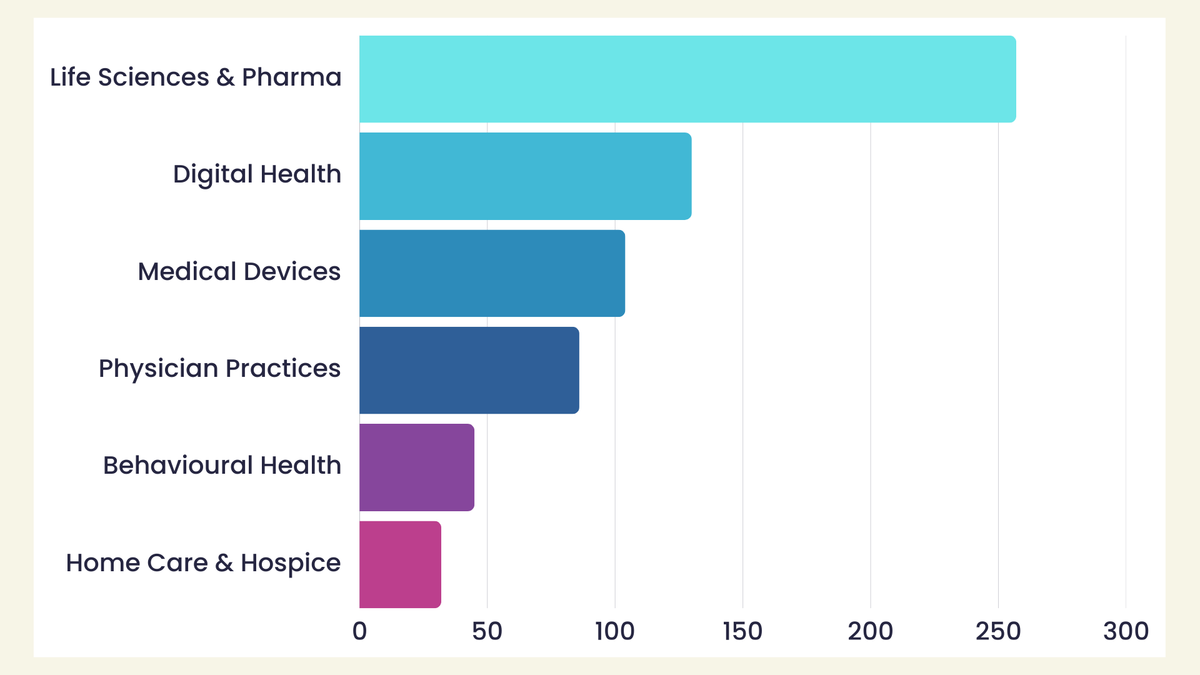

Healthcare M&A transaction volume by sector, H1 2025

Source: Modern Healthcare, August 2025.

2. Innovation: A wave still in motion

Healthcare innovation hasn’t slowed; it’s accelerated. Breakthroughs in gene editing, immuno-oncology, precision medicine, and AI-driven diagnostics are transforming how diseases are treated and prevented.

Clinical studies are exploring how newly developed drugs can help manage cardiovascular risk, kidney disease, and even Alzheimer’s, while weight-loss drugs continue to capture the interest of the industry and investors alike. The explosion of GLP-1 therapies from companies like Novo Nordisk and Eli Lilly, in particular, has reshaped the pharmaceutical landscape, creating a new multi-billion-dollar global market almost overnight.

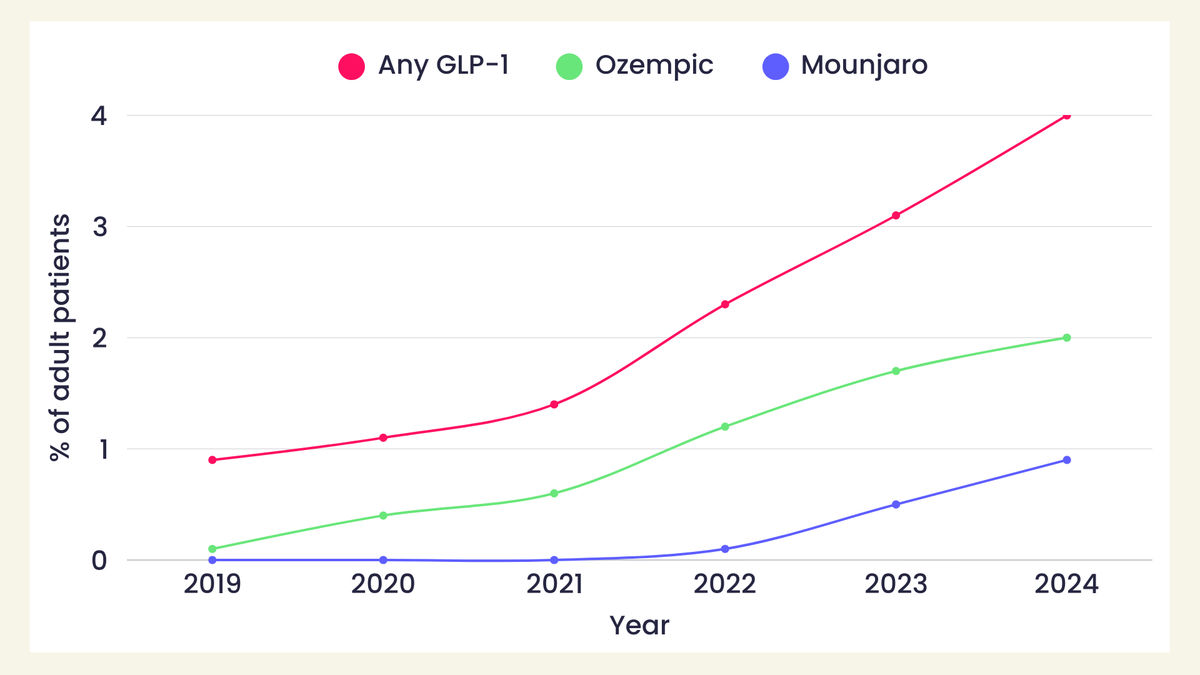

According to a FAIR Health study, prescriptions for GLP-1 drugs to treat obesity increased +587% from 2019 to 2024, while the number of adult patients prescribed a GLP-1 without a type 2 diabetes diagnosis soared almost +1,961% over the same period.[2]

GLP-1 use among adult patients, 2019-2024

Source: FAIR Health, May 2025.

Meanwhile, AI and big data are revolutionising drug discovery. Companies are cutting years off traditional R&D timelines by using machine learning to identify promising compounds faster. Diagnostics is another frontier; AI-powered imaging tools are enabling earlier detection of cancers and heart disease, vastly improving outcomes while reducing costs for healthcare systems.

A 2025 Deloitte report conceded that the healthcare sector – perhaps more than any other - is ripe for digital innovation:

“Accelerated digital transformation was cited as the issue most likely to impact global health systems in 2025. That’s not surprising given that health care is years behind many other industries, such as retail and finance, in adopting digital technologies. Many health systems still rely on fax machines, manual processes, and outdated workflows, making them prime candidates for digital transformation.”[3]

For investors, this pipeline of breakthroughs creates a rich hunting ground in the near-to-medium term. While not every biotech firm will succeed, the structural trend towards smarter, faster, more targeted healthcare is undeniable, and analysts are widely in agreement that the sector as a whole will benefit from the digital revolution.

3. Demographics: Ageing populations drive demand

Perhaps the most reliable driver of healthcare is also the simplest: demographics. Populations in developed markets are ageing rapidly. In the US, one in five people will be over 65 by 2030. Europe faces a similar trajectory. Ageing populations naturally mean higher demand for treatments, diagnostics, hospital services, and long-term care.

- “Healthcare is at a critical juncture. Global medical costs are projected to increase by double digits for the third consecutive year, with estimates suggesting an average rise of 10.4% worldwide.” World Economic Forum, January 2025

But it’s not just about age. Chronic conditions - diabetes, cardiovascular disease, and cancer - are on the rise globally. According to the World Health Organization, non-communicable diseases (NCDs) already account for 74% of global deaths, a figure that will continue to climb.[4] That represents an unavoidable and growing demand for pharmaceutical, biotech, and medical device solutions.

“The rising tide of healthcare needs due to an aging population is multifaceted, encompassing increased service utilization, higher prevalence of chronic diseases, escalated healthcare spending, and complex medication management. This scenario places unprecedented demands on the healthcare system, calling for innovative approaches in care delivery, financial planning, and resource allocation.”[5]

Unlike more cyclical industries, this isn’t demand that disappears in a downturn. It’s structural, predictable, and expanding year after year.

4. Emerging markets: The next growth engine

In developed markets, healthcare already accounts for a large share of GDP. In emerging markets, the story is just beginning. As middle classes expand in countries like India, Brazil, and across Southeast Asia, demand for private healthcare, insurance, and modern treatments is surging.

China is a case in point. Its healthcare market has grown more than fivefold in the past 15 years, and despite recent geopolitical frictions, the long-term direction is clear: rising incomes translate directly into rising healthcare spend.

“China, Japan, and the rest of Asia Pacific is a really important part of the global healthcare system,” explains Helen Chen, Global Healthcare Sector Co-Head, Asia-Pacific at L.E.K. Consulting. “If you think about it, nearly half of the world's population is in the region. So if you're in healthcare and if you're not in Asia Pacific, then you're really not a global healthcare company.”[6]

What’s more, digital health platforms are leapfrogging traditional infrastructure, making modern healthcare accessible to millions of new patients. For companies positioned in these regions - whether in pharmaceuticals, diagnostics, or medical devices - the growth runway is enormous.

“With the proportion of over 65s in emerging markets growing – they are forecast to increase by more than 2.5 per cent a year, more than double the rate that will be experienced in the developed world – these governments realise that the youth factor will fade.

“As a result, several governments, Indonesia for example, have responded by rolling out schemes for healthcare insurance to look after the health of their growing and aging populations. With more funds from governments, and increasingly wealthy consumers, being directed towards better healthcare, all the signs point to an attractive opportunity in the space.”[7]

5. Defensive qualities in a volatile world

For all the excitement around innovation, healthcare’s defensive qualities remain its bedrock. Unlike tech or consumer sectors, healthcare demand doesn’t typically fall when recessions hit. People still need treatment, prescriptions, and hospital care regardless of interest rates or inflation.

This makes healthcare one of the few sectors that is positioned to provide both long-term growth and protection. When broader markets wobble, healthcare often plays the role of the stabiliser in portfolios. That combination is particularly attractive in today’s turbulent macro environment, where geopolitics, tariffs, and rate speculation continue to fuel uncertainty.

“In our view, healthcare is a “defensive growth” sector, characterized by its defensive and growth nature,” explains Ben Bei, Product Strategist at BlackRock. “It is defensive thanks to its low correlation with global macro conditions. Compared to other sectors, demand for healthcare is resilient and less impacted by economic swings. Historically, the sector has been the strongest performer in late cycle and recessionary periods, suggesting this may be an area investors should look into amid uncertainty over the broader macroeconomic outlook.”[8]

This sentiment is shared by the team at Polar Capital, who emphasise that – despite the recent underperformance - “the demand for products and services is not dissipating and the sector continues to innovate and find solutions for complex medical problems. [...] We firmly believe that high-quality, rigorous science will prevail in the long run; we just have to be patient and battle through the volatility.”

Active management: Why stock-picking matters more than ever

One of the most striking points Polar Capital makes in a recent sector outlook is that stock dispersion in healthcare is unusually high. In other words, the gap between winners and losers is wide.

That’s perhaps hardly surprising – for instance, drug development is inherently binary. A positive clinical trial result can send a stock soaring, while failure can wipe out billions in market cap overnight. As such, healthcare is a sector where selective stock-picking really matters.

For investors, that suggests passive exposure may miss the nuance. Fund managers with deep sector expertise can be better placed to separate tomorrow’s winners from the dead ends.

“For the investor looking for defensive qualities in a sector with attractive structural tailwinds, it’s important to tread carefully. Not all healthcare companies offer the traits you might be looking for,” cautions interactive investor’s Ben Hobson.[9]

“An active management approach with a keen understanding of the risks and opportunities in the space will still be crucial going forward,” Stephanie Aliaga, Global Market Strategist at J.P.Morgan Asset Management, reiterates. “The opportunity set is vast, and within-sector performance can vary significantly. As such, security selection will be critical.”[10]

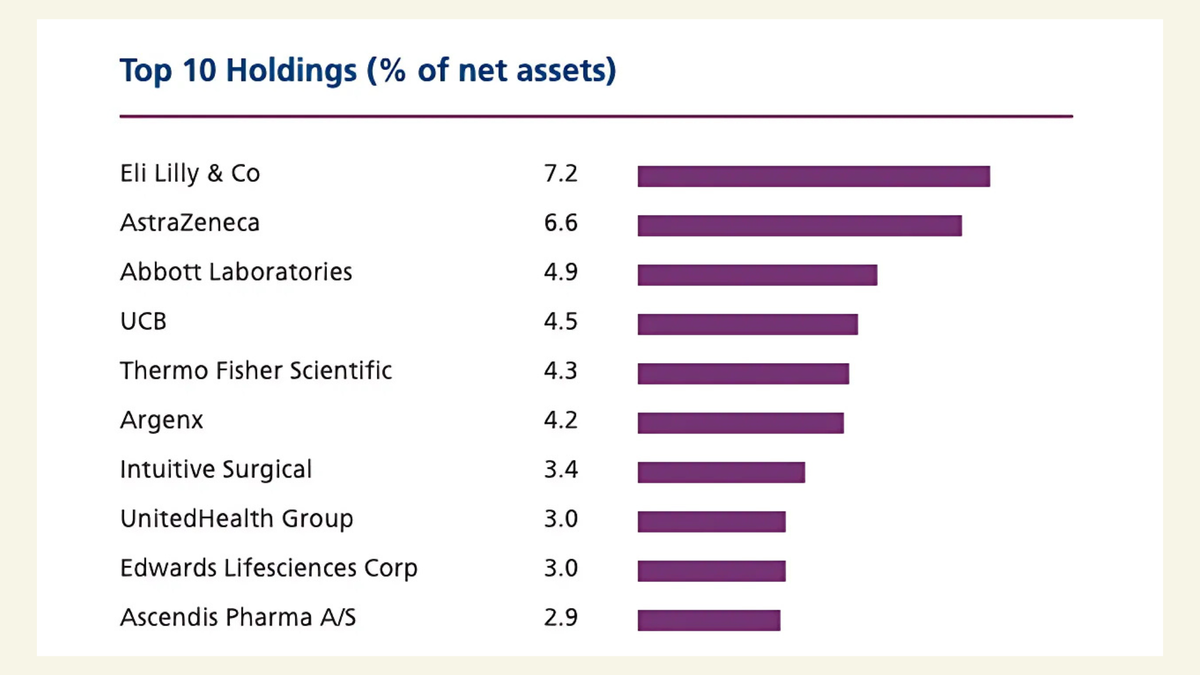

Polar Capital Global Healthcare Trust, portfolio breakdown

Source: Polar Capital, as at August 2025.

Outlook: Healthcare as a prime opportunity

So where does this leave investors? In short: healthcare possesses a compelling long-term investment profile. Valuations are attractive, innovation is accelerating, structural demand from demographics is undeniable, emerging markets offer fresh growth potential, and core defensive characteristics remain intact.

- “Now is an interesting time for contrarians to be looking at the healthcare sector in a positive light.” James Douglas, Fund Manager, PCGHT

Yes, policy risks and political noise will continue to generate volatility. But for investors with a long-term horizon, that volatility looks more like opportunity than threat.

“We think healthcare is bruised but not broken. The sector may be heavily out of favour but, for the most part, fundamentals are intact and we need to navigate through a few near-term transient headwinds.”

“This current period of volatility allows us to take advantage of investment opportunities that offer long-term growth. We see plenty of really exciting medium and long-term investment opportunities and remain optimistic for our investors and our outlook.”

---

[1] Charles Stanley, June 2025

[4] World Health Organisation, September 2025

[5] National Library of Medicine, April 2024

[6] L.E.K. Consulting, June 2024

[8] BlackRock, accessed September 2025