Rebalancing your investment portfolio: A key strategy for long-term success

By Boring Money

3 Oct, 2024

The goal of any investment is to buy when that investment is low, and sell it when it has risen. That seems intuitively easy, but is surprisingly difficult to do in practice. Rebalancing your investments is an important tool in ensuring your portfolio doesn’t give you any nasty surprises.

Behavioural economics tells us that humans aren’t wired to invest successfully. We like to run with the pack, which was useful on the plains of the Serengeti when we were fleeing wildebeest but is not so useful in financial markets!

It tends to mean that we invest when something is popular, when the economy is going well, and when lots of other people are doing the same. We also tend to sell when everything is looking gloomy. This is a fast way to lose money.

The most famous study on this is the Dalbar study. Each year, the study shows that investors tend to receive worse investment performance than the index. The study has been running since 1994 and the pattern is consistent.[1]

In 2023, the average equity fund investor underperformed the market again, earning 5.5% less than the S&P 500 index. This was the 3rd largest gap in the last 10 years. Why? Because investors get spooked when markets drop, and sell, and buy at the top when everything is going swimmingly.

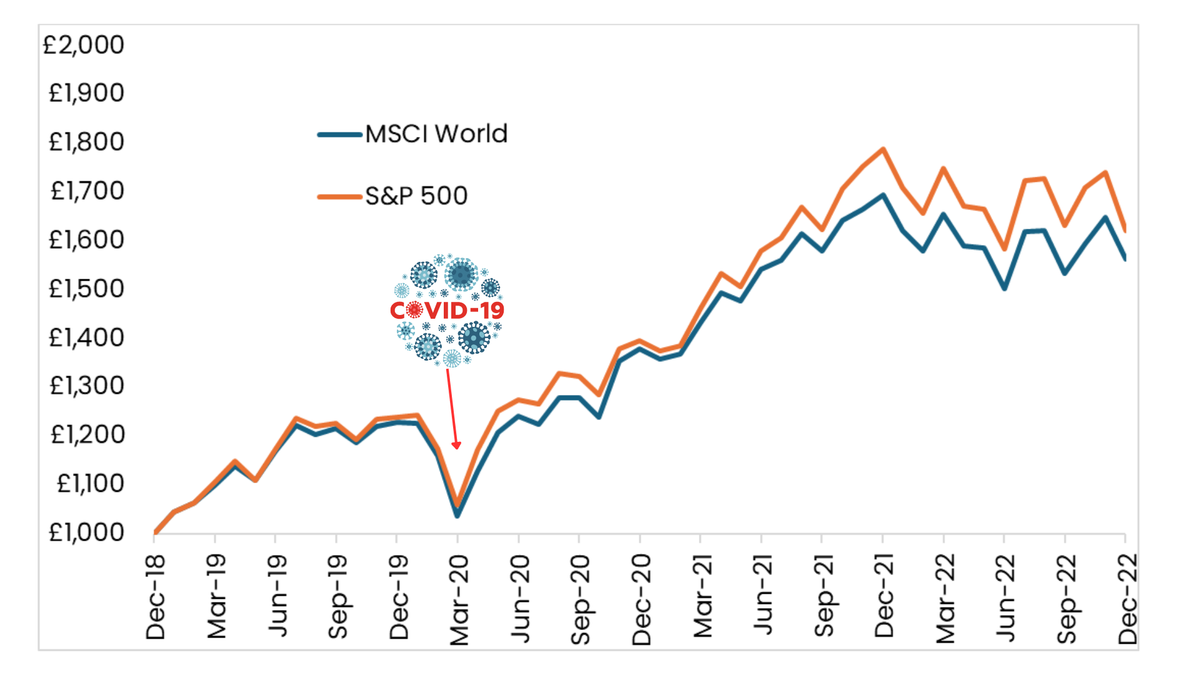

Source: FE FundInfo

Investors need to recognise these traits in themselves and put plans in place to deal with them. That means when markets have a wobble, you need to fight the instinct to liquidate everything and stick it in a bank account! Not only will you probably be doing this at the wrong time, but you’ll almost certainly miss the bounce when it comes.

Consider the sell-off in markets during the pandemic. The market turned in March 2020.[2] This was long before a vaccine emerged, or there was any other clear pathway out of repeated lockdowns. Would an investor have felt confident enough to call the bottom of the market and reinvest? Probably not.

Even worse, it is often after these sell-offs that markets bounce hardest. Missing a number of key days is crucial. US financial adviser Hartford says:

Avoiding the market’s downs may mean missing out on the ups as well. 78% of the stock market’s best days occur during a bear market or during the first two months of a bull market. If you missed the market’s 10 best days over the past 30 years, your returns would have been cut in half. And missing the best 30 days would have reduced your returns by an astonishing 83%[3].

This is where rebalancing comes in.

What is portfolio rebalancing?

Unlock this article to continue reading

Unlock this article to continue reading

Already have an account? Login