Investment Focus: Precious Metals

Why the high returns sector is staging a comeback in 2025

By Boring Money

24 Oct, 2025

It has been a purple patch for precious metals. Gold tipped over $4,000 per ounce in early October[1], while silver and platinum have seen even stronger gains since the start of the year. After a slow start, this is being reflected in the prices of mining companies, which have risen rapidly over the past few months. What have investors found so appealing?

In each case, the reasons for the strong gains are slightly different. For gold, the primary driver has been its role as a ‘safe haven’ at a time when other defensive assets have started to wobble. It is a beneficiary of a weaker Dollar and of concerns around US debt levels. Geopolitical tensions have also helped inflate the price.

This has helped it defy normal trading patterns for gold. Gold does not usually perform well when real interest rates

are high (i.e. interest rates adjusted for inflation). It has no yield, so there is an opportunity cost to holding gold if investors can receive a high real return on cash. Real interest rates are currently higher than they have been for much of the past 20 years, but other factors are proving more important for gold in the current environment.For other precious metals, there are other considerations beyond their role as a store of value. Both silver and platinum have industrial uses that can drive demand and push prices higher.

In 2024, industrial use accounted for approximately 58% of silver demand, with rising consumption in photovoltaics, electrification, wind turbines, high-end electronics, electric vehicles, and chips for artificial intelligence (AI). This structural growth in industrial applications distinguishes silver from purely monetary metals, potentially contributing to a more resilient demand base.

It is a similar picture for platinum, which has uses in electronics, in the automotive industry for catalytic converters, and in dentistry equipment, alongside jewellery. Palladium has many similar applications. It is also used in catalytic converters and for medical equipment. Palladium can help speed up chemical reactions, which gives it widespread use in the pharmaceutical industry.

A lack of supply has also been an important factor in the strength of commodity

prices over the past 12 months. In previous cycles, commodity producers have leaned into high demand and invested in greater production. This hasn’t happened this time round. Kung at DWS says of the silver market:The real shift lies in how scarcity is reshaping the market…The silver market is in its fifth consecutive year of deficit, with 2025 projected to see a shortfall of around 118 million ounces. Mine output remains constrained, as most silver is produced as a byproduct of other metals, limiting supply elasticity. Recycling has risen by 24%, but this is insufficient to close the gap.

Other precious metals markets have similar supply gaps. The global platinum market, for example, is in its third consecutive year of deficit. Estimates point to a shortfall of approximately 850,000 ounces in 2025. This has helped contribute to the strength of these metals.

What Drives Precious Metal Prices: 5 Key Factors

In the longer-term, there are a number of factors that tend to drive precious metal performance. These will also be more or less important for individual precious metals and will also vary in importance over time.

💱Concern over fiat currencies

This has been the most important factor in the recent performance of precious metals. Markets are subject to a ‘debasement trade’, whereby vast government borrowing – and the lack of inclination from governments to address it – has destabilised currencies.

This is most evident for the Dollar. The US government debt now sits at $38 trillion[2], and attempts to reduce it have been piecemeal and ineffective. Government interference with the independence of the Federal Reserve has also been unsettling and has dented the position of the Dollar and US treasuries as a ‘safe haven’. Gold has been a beneficiary, alongside other precious metals.

🔋Limited supply

Precious metals are scarce and it takes time to bring on new supply. Prices often need to remain high for long periods of time to incentivise mining companies to invest in new production. Mining sites are often located in remote areas with difficult terrain, and in politically complex countries – Russia and Zimbabwe hold two of the world’s largest platinum reserves, for example[3]. This can make logistics such as transportation, finding skilled labour and extraction extremely difficult. When supply is low, it should push prices higher.

%When real interest rates are low

This has not been an important factor in the recent performance of precious metals, but is normally an influence on pricing. The opportunity cost for holding gold and other precious metals rises as real interest rates increase because they do not pay an income. Historically, gold and precious metals prices have therefore had a relationship with global interest rates and inflation.

🗺️When geopolitical tension is high

When there is a lot of global conflict, it increases demand for safe haven assets such as gold and precious metals. More recently, this has been given an additional boost by central bank buying from countries such as China, Kazakhstan and Turkey[4]. This appears to have been part of a concerted effort by certain nations to reduce their holdings of US treasuries and the Dollar in the face of US hostility or outright sanctions.

🏭Industrial uses

Precious metals have certain properties that put them in high demand for industrial uses. For example, palladium has a high melting point and is resistant to corrosion. It is also a good conductor of electricity and can absorb hydrogen effectively. Silver’s conductivity and reflectivity make it the ideal component for solar panels. When there is rising industrial demand in these areas, prices for precious metals are also likely to rise.

📈Recent performance and outlook

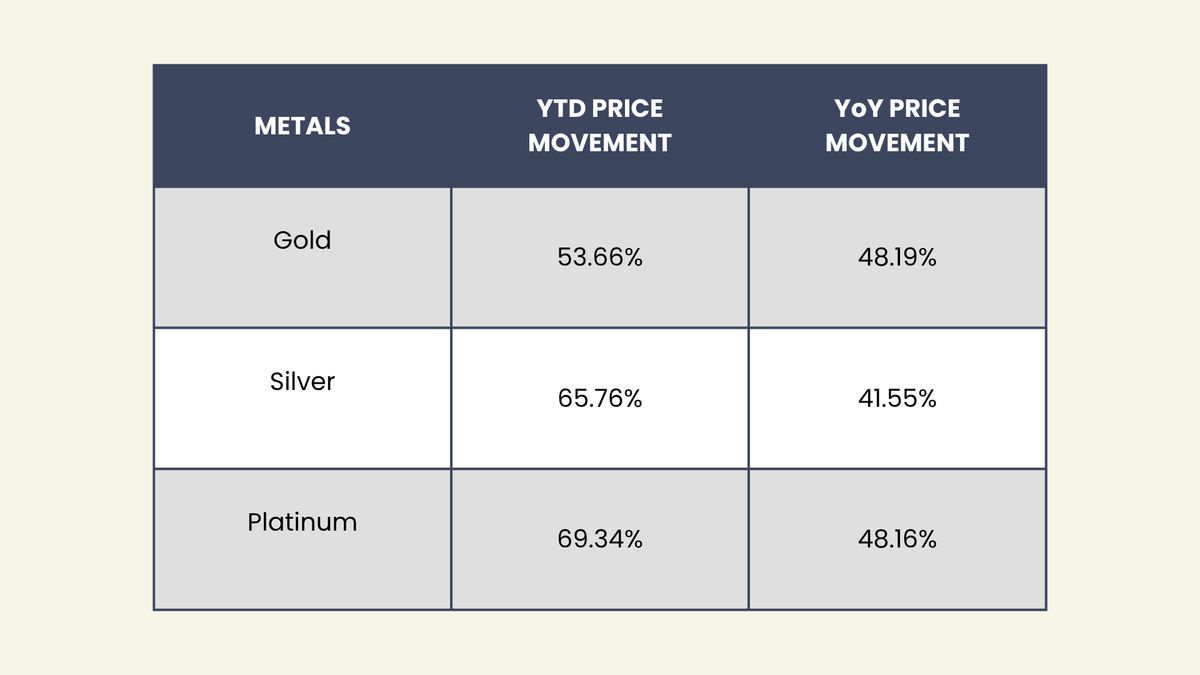

Precious metals prices have seen a significant bounce this year. Gold is up 57%, silver is up 67%, while platinum is up 69%[5].

Movement on metal pricing

Until recently, precious metals mining companies had not yet followed suit. However, these have bounced up significantly since the start of the year. The MSCI ACWI Select Gold Miners index is up 133% over the year to date[6], while the MSCI ACWI IMI Precious Metals and Minerals Index is up 199% over the same period[7].

This may give investors pause for thought on whether this is likely to continue. Precious metals prices have wobbled in the short-term as fears over the impact of the US government shutdown and trade tensions have ebbed, reducing demand for safe-haven assets.

However, Mark Smith, manager on the Amati Strategic Metals fund says that discipline from the mining companies is helping support the rally in the longer-term:

In previous cycles, what we’ve seen is that as the gold price rallies, the companies try and chase it by lowering the cut-off grade or increasing the gold price they use in their reserve mine planning. This time around, they’ve had quite a disciplined approach and haven’t increased their reserve price assumptions when planning their business. It means when the gold price increases, so have their profit margins.

He still sees a 20-25% discount

to the gold price in the valuations of the gold miners. This discount is even larger for smaller and mid-cap miners. He says this is typical in market rallies: investors start to invest in the large-cap gold producers and then redirect capital in smaller miners as the rally builds.Ned Naylor-Leyland, manager of the Jupiter Gold and Silver fund, also believes there could be further to go for the mining companies:

Rising profitability, strong balance sheets, and improving capital discipline potentially support the case for a further re-rating for the miners.

There is certainly a case that precious metals and the companies that mine them could go higher. However, they have seen significant gains, and bull markets are seldom linear. Precious metals can be ‘emotional’ investments, linked to the natural fear and greed of markets. If investors were to become less nervous about the Dollar or US debt, the sector may turn lower.

How to Invest in Precious Metals: 3 Ways to Get Exposure

👉Physical Gold and Precious Metals ETFs

You could buy a gold bar, but this may involve complex storage and insurance considerations. An easier option for many investors will be an ETF based on the price of the commodity. These trade on a stock exchange

and aim to replicate the price of the commodity exactly. Physical gold ETFs will invest directly in gold bullion, while other ETFs will use derivatives to replicate the price of the commodity.As well as gold ETFs, there are ETFs on the individual precious metals, including lesser-known commodities such as rhodium. There are also ETFs that offer a basket of commodities, such as the abrdn Physical Precious Metals Basket Shares ETF.

⛏️Precious Metals Mining ETFs

There are also ETFs that track an index of precious metal mining companies. It is important to note that these will not track commodity prices directly. Options include the Shares MSCI Global Silver and Metals Miners ETF, SPDR Gold Shares or Amundi Global Gold Mines. These funds usually track indices such as the MSCI ACWI Select Gold Miners index or the MSCI ACWI IMI Precious Metals and Minerals Index. These funds may include significant emerging market exposure.

🧐Active Precious Metals Funds

There are a number of specialist active funds focused on precious metals. These include the Jupiter Gold & Silver fund. Funds such as BlackRock World Mining fund, Baker Steel Resources Trust and Amati Strategic Metals funds also have a significant holding in gold and some exposure to other precious metals. Active funds have the flexibility to move between different precious metals at different points in the cycle.

Overall, previous metals can be a good option for a rainy day. They tend to do well when the chips are down and other asset classes look wobbly. That said, they have seen some very strong gains in 2025, which may dent their appeal as an insurance policy for many investors.

---------------

[1] Goldprice

[2] FiscalData

[5] Trading Economics, October 2025

[6] MSCI Gold Miners