Investment Focus: Industrials

Growth drivers, investment opportunities, and structural trends

By Boring Money

23 Jan, 2025

The industrial sector - a diverse cornerstone of global markets spanning aerospace, engineering, and transportation - represents 10.6% of global market capitalisation. While traditionally viewed as cyclical, the sector is being transformed by supply chain shifts, green energy transition, and AI adoption, creating new opportunities across capital goods, business services, and transportation segments as we move into 2025.

Setting the scene

The industrials sector is broad. It incorporates global titans, such as aerospace manufacturers and machinery companies, as well as small, domestic engineering companies, making crucial widgets for industrial use. It covers construction and transportation, as well as emerging industries such as data centres.

This diversity means it is difficult to generalise about its characteristics. Nevertheless, it is often seen as a cyclical sector, with performance tied to economic growth. Certainly, companies are more likely to invest in new plants and machinery, and governments in infrastructure and development, when there is more capital sloshing round in the economy.

Along with the levels of global demand, the health of industrial companies will also be influenced by the ease of transporting goods around the world. The share prices of industrial companies suffered disproportionately during the pandemic, for example, when supply chains were gummed up and long-term demand was unclear.

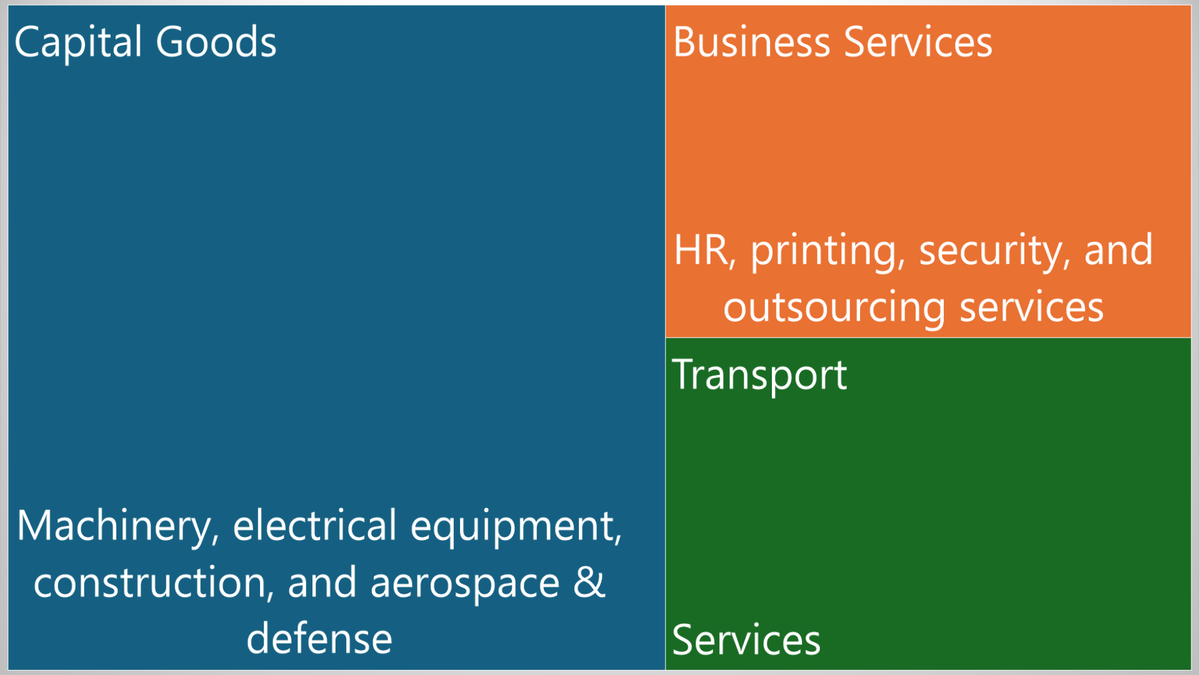

Guinness Global Investors identifies three main groupings in the industrials sector: companies making capital goods (goods used to produce other goods - such as machinery, electrical equipment, and construction and aerospace products, including defence); companies that provide services to businesses (such as human resources, printing, security and outsourcing); and transport companies.[1]

Investing in industrial companies

Dr Ian Mortimer, manager of the Guinness Global Equity Income fund, says:

Industrials are noted for being a cyclical sector, impacted by broader macroeconomic cycles, but also affected by smaller cycles of extended and retracted demand based on inventory levels, company investment, and monetary policy.

Industrials usually do well when the economy is buoyant, but also when there are more localised pockets of demand. It is also true that many industrial companies will be tapped into long-term, structural trends in the global economy, such as reshoring, the energy transition and digitalisation.

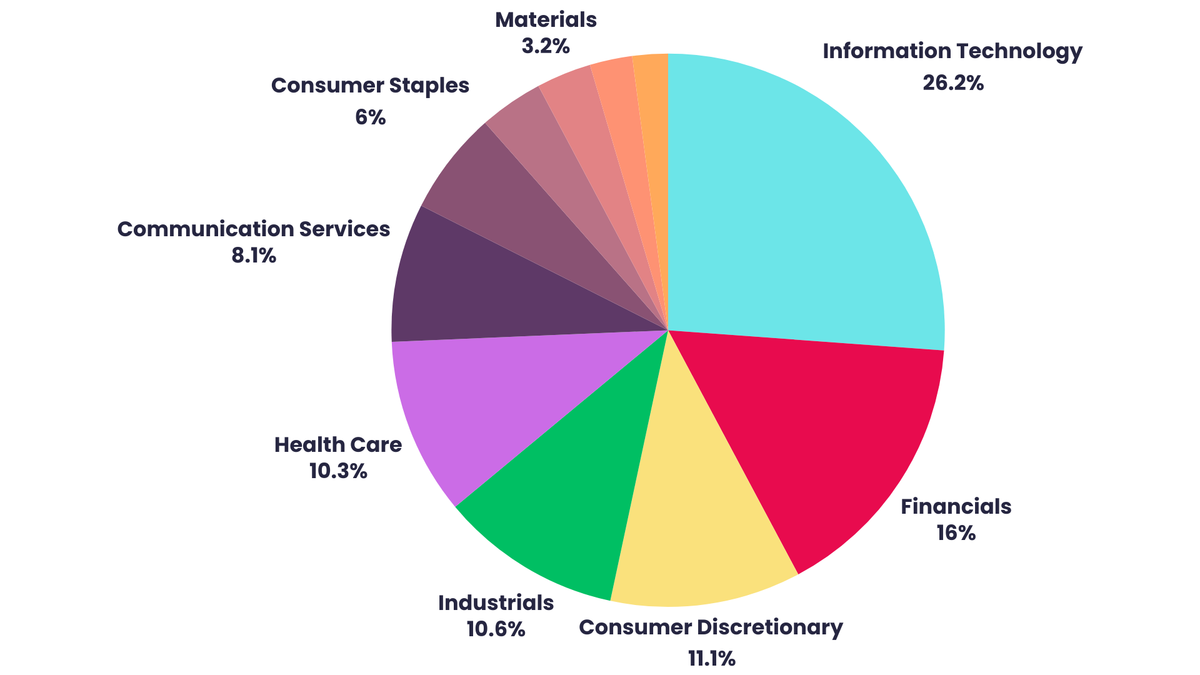

Industrials are the fourth largest sector in the MSCI World Index (after the technology, financials and consumer discretionary sectors), comprising around 10.6% of global market capitalisation. Most countries have their industrial giants. In the US, it might be GE Aerospace or Caterpillar; in Europe, it will be Siemens or Schneider Electric; in the UK, it would be Rolls-Royce or BAE Systems.

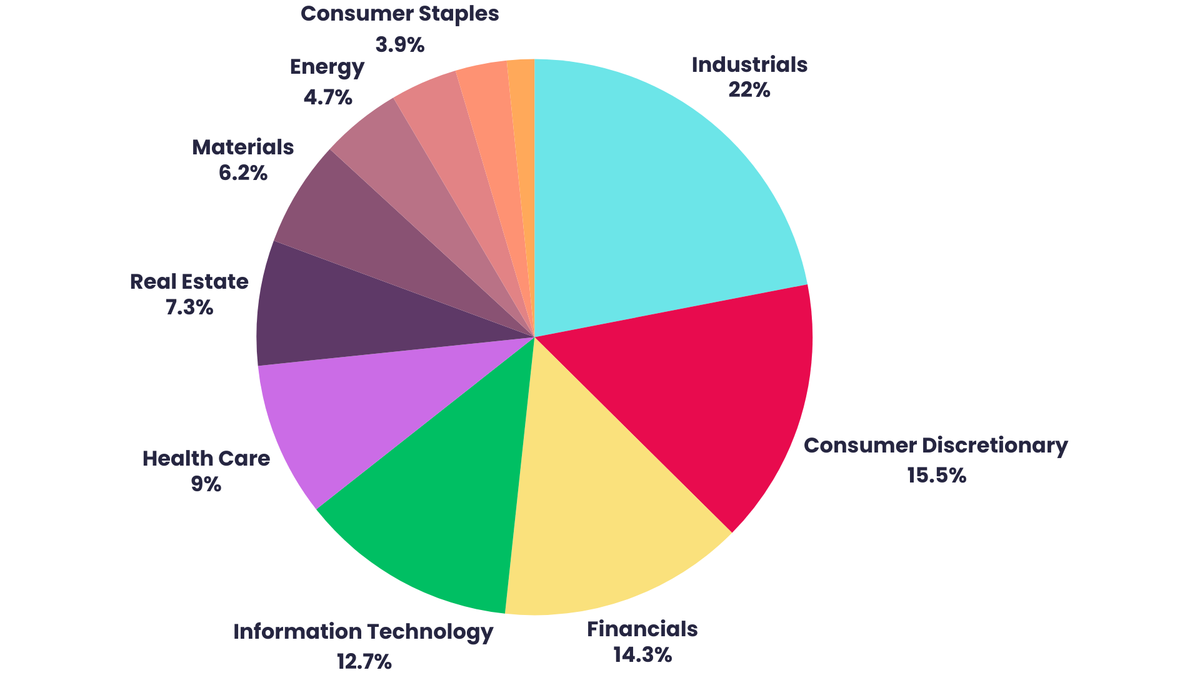

However, while these global giants will be more familiar, industrials are also an important part of many small cap indices. Industrial goods and services are the largest sector in the FTSE Global Small Cap index, for example.[2]

Simon Moon, manager of the Unicorn UK Income portfolio, points out there are a lot of industrials to be found in the UK. The UK has real specialism in precision engineering, for example.

We have a significant overweight to industrials across the funds we run. That’s not a sector call per se, it is the quality of the companies. Industrial companies demonstrate the quality characteristics we’re seeking.

He says that industrials will often be exposed to growth trends, such as decarbonisation. Among its many business lines, Birmingham-based Castings manufactures the parts that join offshore wind turbines to power cables, for example, while Ashtead Technology is also participating in the development of the global offshore energy sector.

The reality is that industrials are not necessarily one type of investment or another. They can be cyclical, defensive, high growth, or dividend paying. It is a sector that lends itself to stockpicking and will have something to suit different environments.

Structural trends driving industrial companies

Onshoring

The pandemic exposed the fragility of many supply chains. A multi-decade vogue for locating manufacturing in the cheapest possible areas had seen supply chains become unwieldy and vulnerable. In particular, China’s lengthy shutdown showed businesses it was not necessarily a reliable partner. It coincided with a re-set in trade relations during Donald Trump’s first term. The Ukraine crisis exacerbated geopolitical tensions and made managing global supply chains even more difficult.

This has prompted global companies to re-examine their supply chains, moving manufacturing closer to home, or to friendlier jurisdictions. There has been an effort to reduce supply chain complexity and limit over-reliance on foreign manufacturing. Mortimer says that while this investment has been costly and time consuming, it has caused a sustained increase in demand for capital goods and broader industrial products and services. This remains an important driver for the industrial sector.

Electrification

The energy transition is a vast multi-decade global project, designed to decarbonise the world economy. The switch to low-carbon fuels requires a reshaping of the energy infrastructure, and investment in new technologies. This provides huge source of demand for industrial companies with the right products. These will include areas such as energy storage or transportation.

The UK’s ‘Great Grid Upgrade’, for example, launched in 2024 by National Grid, includes 17 major infrastructure projects designed to scale up the grid, update existing networks and prepare for the increase in electricity as a result of the energy transition. The electric car charging network is also being expanded. As many as 900,000 public charging points are being installed each year.[3] Industrial companies are at the heart of these projects.

Infrastructure

Mortimer says governments across the world are supporting large-scale industrial transformation through so-called ‘megaprojects’. These are projects that cost over $1bn from start to finish. He says that this is particularly evident in the US, where landmark spending acts such as the Inflation Reduction Act (IRA), the Infrastructure Investment and Jobs Act (IIJA), and the Creating Helpful Incentives to Produce Semiconductors Act (CHIPS) all present a substantial tailwind for industrial companies.

Europe is also committing capital to significant infrastructure projects, with around $500bn of large-scale project orders across the region as well. Industrialisation and urbanisation in emerging markets are also creating significant demand for industrial products.

Digitisation and AI

While industrial companies can seem at odds with the technology sector, in reality, each needs the other to thrive. Artificial intelligence, for example, cannot deliver its insights without the data storage and analytics capacity provided by data centres. Industrial companies are important in building data centres.

Industrial companies will also be making use of AI to become more efficient. Rolls-Royce, for example, uses AI to gather data from jet engines after planes land, allowing it to predict maintenance and accurately schedule engine care. It also uses robots to perform quality checks on critical components in its manufacturing centres.[4]

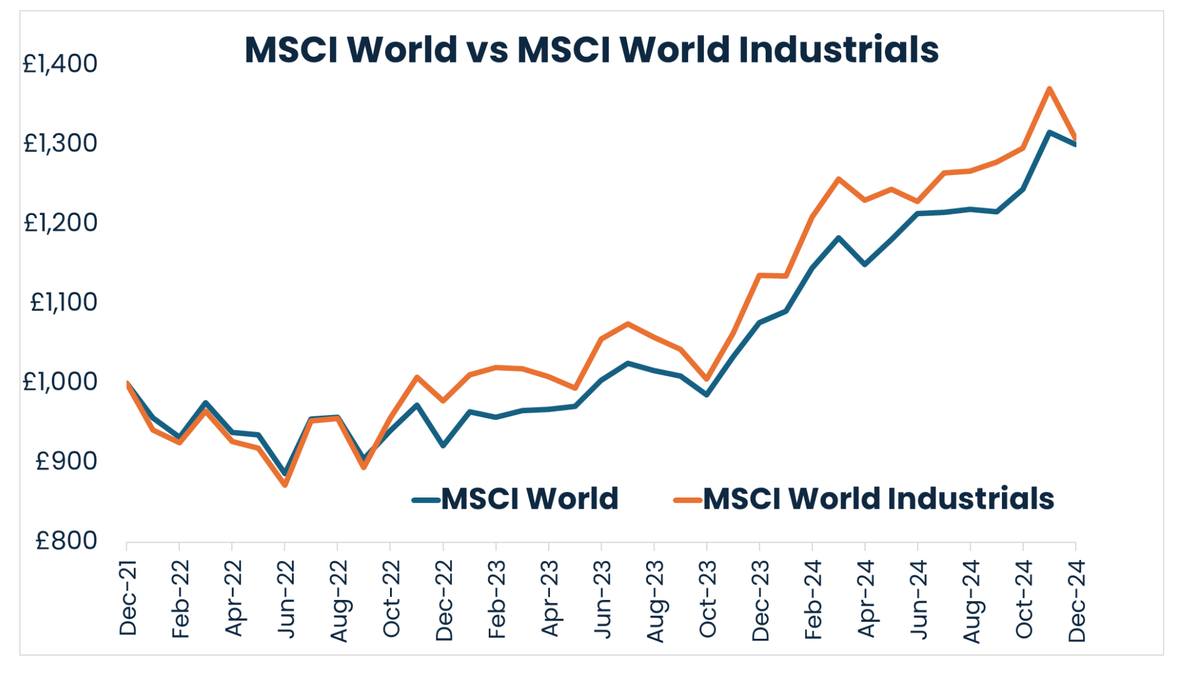

The stock market trajectory

The technology giants have been tough to beat in recent years. Nevertheless, the industrials sector has turned in a relatively strong performance. The MSCI World Industrials index was up 21.33% in 2024, compared to 15.7% for the wider MSCI World index.

The sector is well-diversified, with the largest stock – GE Aerospace – just 2.4% of the index. Other major names in the index include Caterpillar, Honeywell International, RTX and Siemens. This compares to a weighting of over 5% for largest company Apple in the MSCI World index. The industrials sector also has a better geographical spread; the US is still dominant, but only makes up 58% of the overall index, compared to 74% of the MSCI World index.[5][6]

It is also well-diversified across industries. The largest weighting is aerospace and defence, at 17.99%, with industrial machinery, electrical components and equipment also having relatively high weightings.

Looking to the future

Onshoring of supply chains, increased government spending on infrastructure, and an energy transition should all support demand for industrial companies. Fund managers continue to back the sector. Mortimer invests in nine US and European industrial stocks:

ABB, Otis, Emerson, Atlas Copco, Schneider Electrics, Assa Abloy, Eaton, ITW & Paychex. We view the Industrials sector favourably due to a range of attractive characteristics and emerging secular growth drivers.

Jonathan Curtis, chief investment officer at Franklin Equity Group, believes the incoming Trump administration’s desire to achieve "energy dominance" could be a driver for the sector:

Energy infrastructure development holds significant strategic importance, aligning closely with the interests of Trump's tech and industrial-focused supporters. We expect the administration to prioritize expanding electricity and energy capacity across oil, coal, natural gas, nuclear and interstate transmission, as well as to update and expand electric generating capacity, enhance grid reliability and encourage energy storage technologies, such as batteries.

Ben Leyland, manager of the JO Hambro Global Opportunities fund, says the pendulum may swing back to “real world companies” in 2025, away from the technology giants that have dominated in 2024. He adds:

This would include companies in the infrastructure, renewables, or capital expenditure sectors, such as materials, utilities and industrials.

His view is that many of these companies have seen demand artificially depressed from the pandemic and subsequent supply chain disruption. As this resolves, these companies should benefit, and the relatively low valuations given to them by the market should adjust. He adds:

There are very interesting opportunities in those disrupted sectors. We have some exposure and are debating whether to add more.

The big risk for the year ahead may be Trump tariffs. This could affect the movement of capital goods around the world and the industrial sector could be on the front line. That said, in many cases, lower valuations already reflect the risks.

Opportunities for investors

If investors are interested in industrials, they have a number of options to get exposure in their portfolios. For dedicated exposure, they will need to look at a specialist ETF. These will often be focused on the largest industrial firms. The iShares S&P 500 Industrials sector ETF, for example, has GE Aerospace, Caterpillar and RTX Corporation as its largest holdings. Vanguard also has an industrials ETF, which tracks the MSCI US Investable Market Industrials 25/50 Index. For European industrial exposure, investors could try the iShares MSCI Europe Industrials Sector ETF.

There are relatively few active industrials-focused funds. The exception is the Fidelity Global Industrials fund, which has Exxon Mobil, Teledyne Technologies and Rolls-Royce in its top ten. Otherwise, investors will have to look for active managers that favour industrial companies. These may be global funds such as the Guinness Global Equity Income fund or JO Hambro Global Opportunities fund mentioned above. They may also be smaller company-focused funds, such as Unicorn UK Smaller Companies fund, where managers have a stated preference for industrial companies.

---

[1] Guinness Global Investors, September 2024

[2] FTSE Russell, Global Small Cap Index Factsheet

[3] iea, April 2023

[4] Rolls Royce, September 2020