1 Oct, 2021

OK. Based on what you’ve told us, we think you should consider:

DIY Investment Platform Pension

These DIY pensions are quick to set up and give users control, choice and access. You will need to choose the individual investment funds or shares to put into your pension account once it’s set up.

You have said you favour a big brand – these providers are all large global or FTSE 100 players:

You have said you are confident and happy to DIY. Our Fund Filter tables may support your choices on what to include inside your pension account.

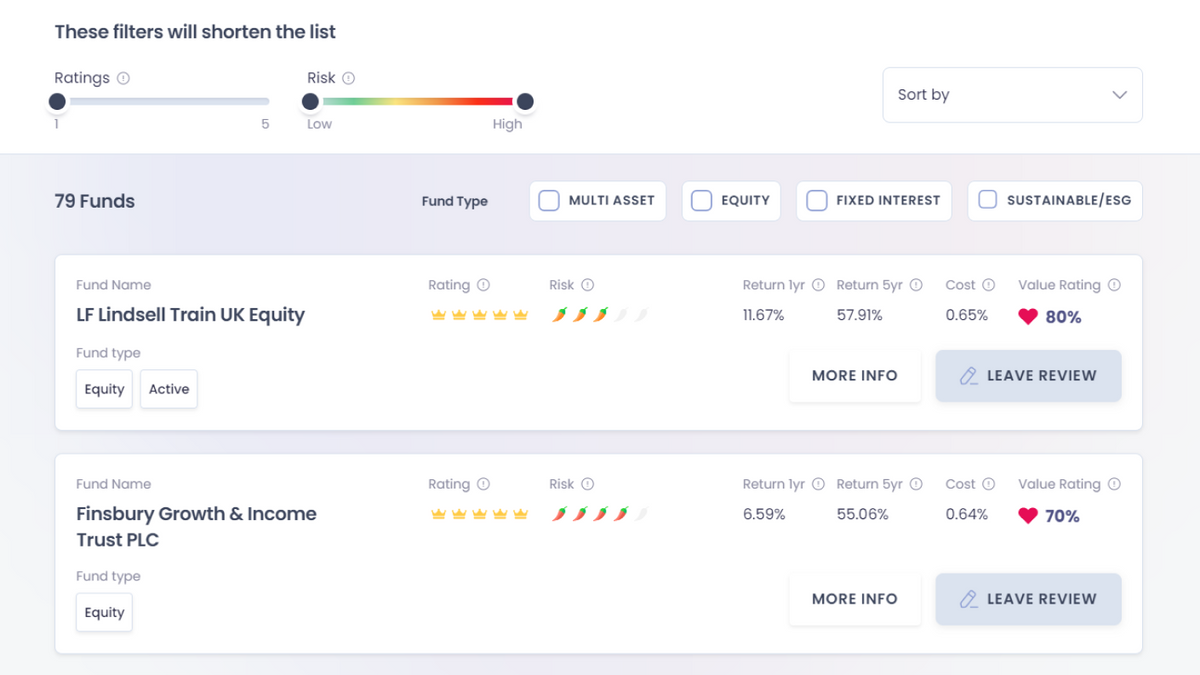

Fund Research Tables

With thousands of funds to sift through, it’s a potential full-time job. We have partnered with FE Fundinfo to create a shortlist of the UK’s most popular funds with professionals, investment platforms and retail investors.

5 tips based on your life stage

Sorting out our finances can be overwhelming and it's hard to know where to start.

Click on your top priority below for some helpful ideas on how to tackle this or to learn more.

Still feeling stuck?

Put your question to a helpful adviser - get some tips and pointers from an expert