Royal London Workplace Pension Provider Review

Independent review by Boring Money

30 June, 2025

Royal London is a well-respected, established firm offering decently priced pensions for employees with strong customer service. They’re a mutual - owned by their customers - so their structure genuinely has customers at its heart. The app provides intuitive access to key information without the razzmatazz of a newer fintech. They offer a quality service with a sustainable slant.

Key strengths

Investment performance

📈 Performance overview

We show the performance of the default investment for Royal London customers. This is the Balanced Lifestyle Strategy (Drawdown).

Recent performance:

Source: Lipper, bid to bid, Royal London, data correct as at 31 December 2025. All performance figures are gross of charges.

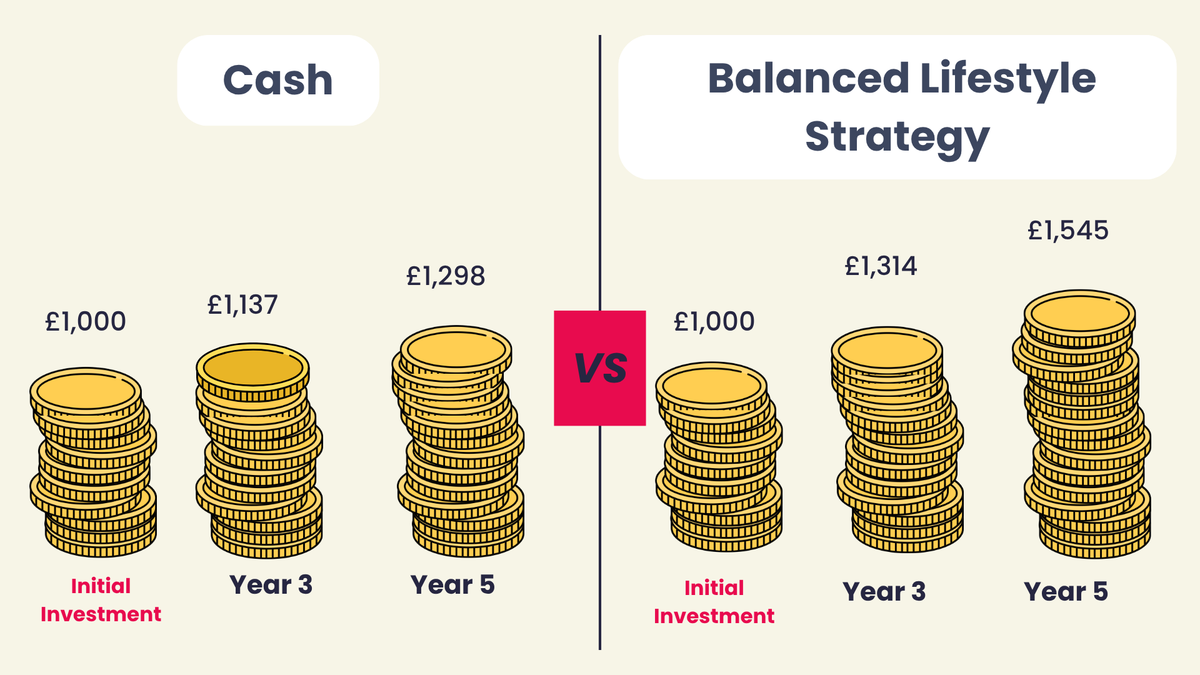

In £ terms:

Source: For Cash Comparison: FE FundInfo, Bank of England Base Rate. For Balanced Lifestyle Strategy: Lipper, bid to bid, Royal London, data correct as at 31 December 2025. All performance figures are calculated before fees have been deducted.

Performance* | 3 year performance | 5 year performance |

Balanced Lifestyle Strategy (Drawdown) | 36.6% | 49.7% |

*This performance data shows returns for members 15+ years from retirement.

Data correct as at 31 December, 2025

What our pension companies invest our money in under the bonnet will obviously impact returns. In the past, Royal London had less in shares than some competitors, which led to lower long-term returns than some (as well as less risky, volatile portfolios). They have since reviewed what they invest in, changed their default fund, will be investing more in shares in future, and we would expect their comparative performance to pick up as a result. One to watch.

For people who want more detail as of 21 July 2025, Royal London have changed the default fund within this strategy from GP Enhanced to GP Dynamic.You can read more specific performance information for all funds on their website.

Past performance is not a guide to the future. Prices can fall as well as rise, meaning a member may not get back the full amount of capital originally invested. Investment returns may fluctuate and are not guaranteed.

Fees and charges

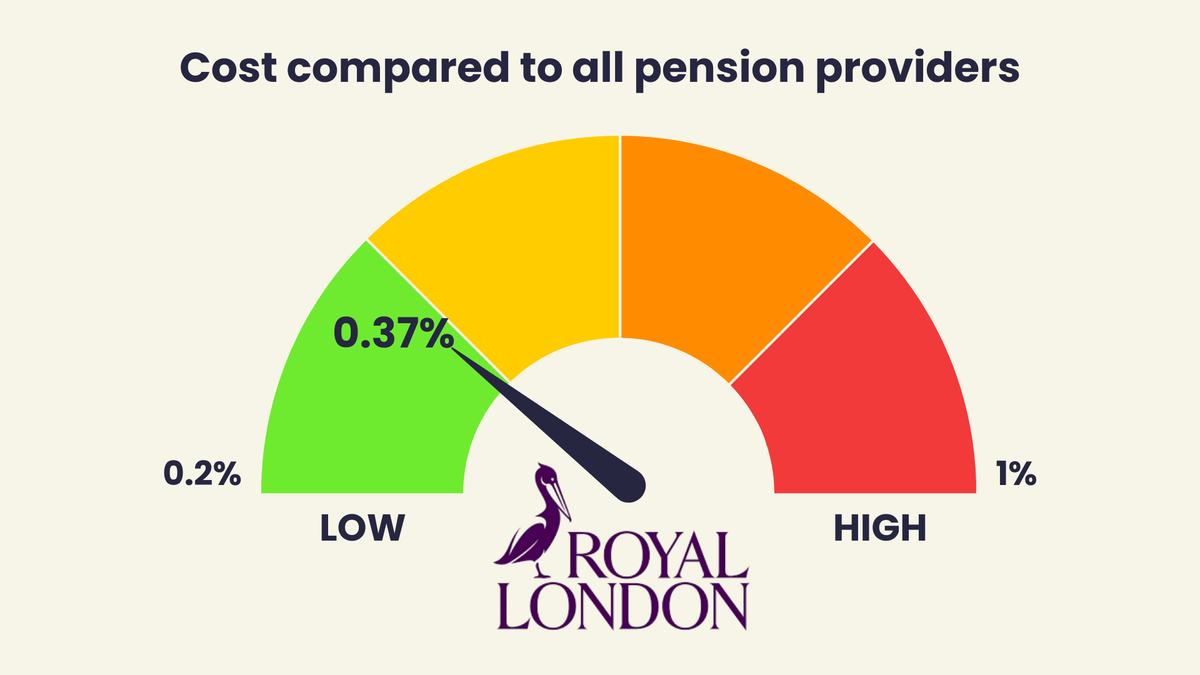

The average fee paid by Royal London workplace pension customers is 0.37%. The specific fee depends on the company you work for and you can find more information here.

Royal London is a mutual (owned by their customers) so they have a quirk. Every year they share a slice of any profits back with their customers, which has the impact of lowering the costs. This has been paid for the last 9 years and the regulator, in their value for money work, has signalled that Mutual profit sharing effectively reduces the charges paid. So the 0.37% includes this ‘Profit Share’ assumption.

Whilst the charges for most customers are relatively competitive, long-standing customers in old schemes could be paying higher charges and the last governance report also noted that some smaller accounts may be paying relatively high charges. Your statement will show precisely what you are paying.

Typical cost ranges for workplace pensions and online pensions you choose and set up yourself.

Don’t shoot the messenger, but pension charges can look complex. The fees differ by company, so it depends on who you work for. They will typically be more for companies with small numbers of employees, and more for companies who don’t make large pension payments.

As a rule of thumb, the average range of fees for a workplace pension is between 0.3% and 0.6% a year all-in, which is typically cheaper than a pension you might set up and run yourself.

Governed solutions overview

Your pension is typically invested in a mix of shares and other investments. Royal London's ready-made

solutions are collections of investments which are managed for you by the experts. They're diversified, actively managed, and regularly reviewed by a governance team.They include responsible investment considerations and are designed to adapt over time as markets change and you approach retirement. Essentially, it's professional portfolio management without you having to pick individual funds.

Customer service and support

📫 Communications

Royal London provides clear, supportive communications at key stages:

☎️ Customer service team

Royal London operates without traditional call centres, routing all customer calls directly to their office floor, where approximately 45 dedicated staff handle inquiries. Each scheme is assigned an ‘owner’ for direct support and specialised teams are available for complex needs, such as bereavement.

Royal London is committed to resolving customer queries in a single call whenever possible. The goal is to handle each query fully and efficiently, ensuring you get the answers you need without unnecessary follow-ups.

They prioritise service excellence and focus on client feedback and quality assurance for continuous improvement in customer satisfaction.

⭐ Customer satisfaction ratings

Trustpilot: 4.4 (from 3,151 reviews)

App Store: 4.7 (from 7,023 reviews)

Google Play: 4.9 (from 8,175 reviews)

Customers consistently praise Royal London for its helpful service, clear communication, and easy-to-use digital tools.

According to the regulator, there were 1.7 complaints for Royal London per 1,000 customers in the last reporting period. This is in the lower range of providers, so it looks reasonable to us.

Source: FCA, The data relates to the first half of 2025 (H1) and includes data from firms that report 500 or more complaints within this 6-month reporting period, or 1,000 or more for an annual reporting period.

Boring Money customer reviews

Help others by sharing your feedback!

04 January 2026

The website is really poor for such a major provider. hard to navigate, links don't take you directly to what you think they will etc.

19 December 2025

RL are my latest workplace pension provider and I only have a very small pension with them. Compared to my SIPP, which is with Aviva, the app is quite basic, but functional. I have been able to choose a more adventurous lifestyle option with them, which is useful.

15 August 2025

Consistently good performance over 30 years and readily active when I needed to transfer holding

Digital tools and features

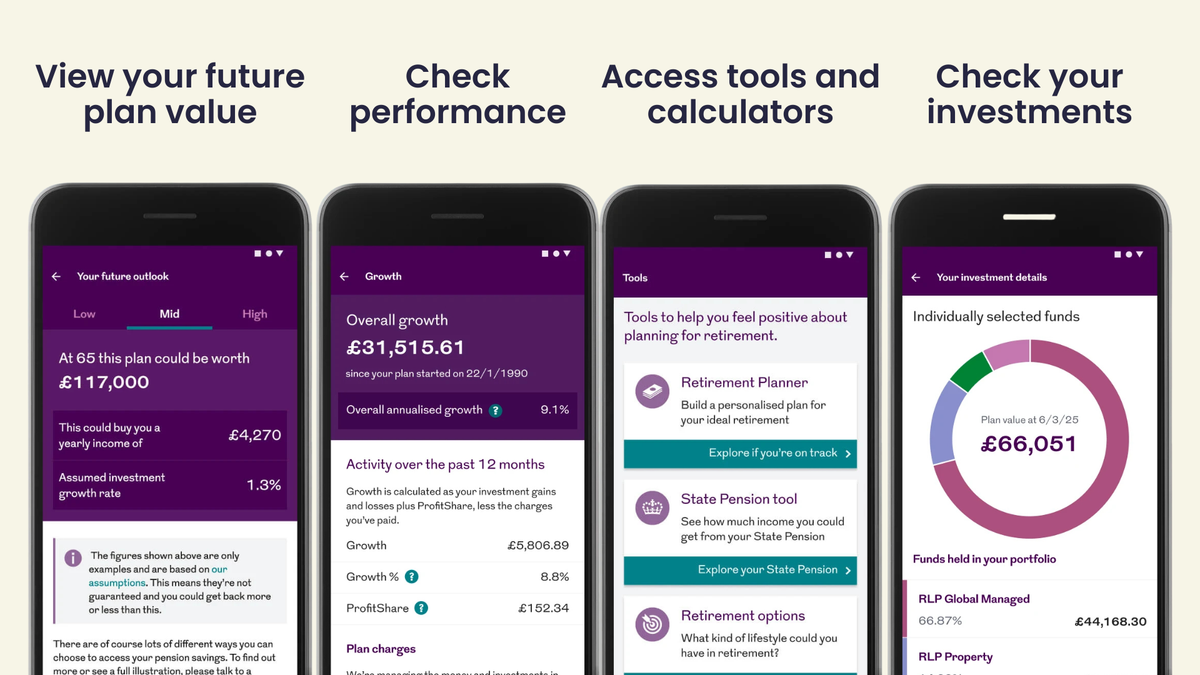

Royal London offers a robust suite of digital tools and support features:

💻 Digital experience

The app and website make it easy to manage your pension, change beneficiaries, update investment choices, and monitor your progress.

Royal London is a large, traditional pension firm. Their online and digital experience is decent for information, but will not rival a snappier competitor which makes its app and technology its main competitive advantage. The emphasis is on sensible communication rather than gamification.

You can access your account via:

The Member Portal: Grants you online account access, investment switching, contribution tracking, and retirement planning tools.

The Mobile App: A dedicated pension app with easy access to balances, beneficiaries, and investment options.

📚 Guidance and education

Royal London has built a toolkit of digital guidance and interactive tools to help you navigate financial decisions. Their two flagship offerings - the Financial Wellbeing Service and Retirement Planner - show they're serious about actually helping customers rather than just ticking boxes.

👩⚕️ Financial wellbeing service

This is Royal London's attempt at being your financial Swiss Army knife - covering 9 themes from "how not to be skint" to "how not to work until you're 90."

It's genuinely ambitious - they're trying to be the one place you go for financial help instead of bouncing between random websites and apps. You get everything from bill-cutting tips to first-time buyer guides, which is either brilliantly comprehensive or overwhelming, depending on your tolerance for choice.

The highlights include a financial health check that tells you what to do next, a "money mindset" quiz, and proper support for life's expensive moments like buying a house or having kids.

🎯 Retirement planner

For those starting to panic about retirement, this tool cuts through the noise. It doesn't just look at your pension pot - it factors in your house, ISAs, and whether you're planning to retire solo or as part of a couple.

It attempts to answer the questions keeping you awake at 3 am: "What kind of retirement am I heading for?" and "When can I actually afford to stop working?"

🧮 The rest of the toolkit

Feature | Purpose | Benefits |

Workplace pension contributions calculator | Find out if you could afford to contribute more into your workplace pension, and how this could impact your future retirement income. | See the benefit of larger pension contributions and find out what to do next if you want to pay more in. |

Pension Calculator | Find out if you’re on track for the lifestyle you want in retirement. | See how much you could get when you retire and explore your options. |

Retirement options calculator | Explore the ways you can access your pension savings when you retire. | Find a retirement option that’s right for you. |

Lump sum calculator | See how much you can withdraw from your pension and the impact on your tax bill and future retirement income. | Make a more informed lump sum withdrawal decision. |

Sustainability and ESG commitments

Royal London set themselves some fairly ambitious climate targets back in 2021, committing to halve their portfolio emissions by 2030 and be net zero on their own operations by 2030 and switch to 100% renewable energy by the end of 2025.

As part of Royal London’s commitment to responsible investing, a large portion of the funds within the Governed Range include a carbon-tilting approach, meaning they actively shift investments toward companies with lower carbon emissions and away from higher-emitting ones. The goal is to reduce climate-related risks while still seeking strong financial returns for its customers.

In 2024, they made decent headway on several fronts. Their investment portfolio’s carbon footprint for the largest asset classes dropped by 19% compared to 2023, which brings their total reduction to 35% since they started measuring in 2020. That's encouraging progress, though they'll need to keep up the pace to hit that 50% target by 2030.