A drama in the investment world

By Holly Mackay, Founder & CEO

17 Jan, 2025

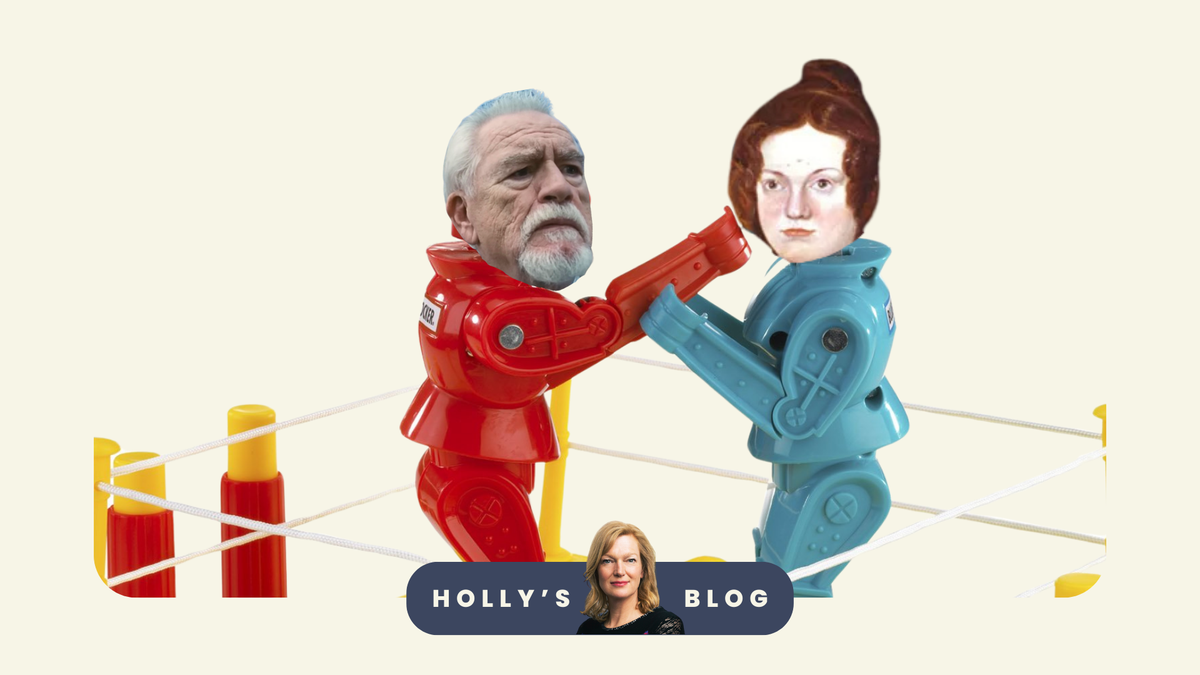

Sky Atlantic take note. There is a fight going on in the investment world reminiscent of what would happen if Succession met the Bronte sisters.

The lead character is the CEO of Saba Capital: hedge fund manager, derivates whizz and blackjack aficionado, Boaz Weinstein. His adversary is the UK investment trust community: a typically genteel, well-mannered bunch. One side writes with an ink pen, the other with a boxing glove. Make no mistake though – both sides are fiercely clever and there is a lot at stake.

Our story concerns Investment Trusts. An Investment Trust is a company which is set up to buy and manage a collection of shares. It has a Board, some of whom are independent. And they act on behalf of their investors, appointing managers to manage the money and generally calling the shots.

If I set up the Holly Investment Trust (pleasingly called HIT), I might appoint Fund Manager A to run it for me. They might buy 2 shares, 50% in Apple and 50% in Amazon. We spend £50 on each so the ‘net asset value’ or NAV of the HIT is £100. I might then divvy this up into parcels of 100 shares with a price of £1 each. We make the shares available to buy on the London Stock Exchange.

Because HIT is a rubbish Investment Trust, no-one really wants it, so the shares only trade at 90p each. Which means they're trading at a discount – you can buy the shares for less than the sum of the parts. “Goody!” you cry, “what a bargain!” Not so fast. Only a bargain if everyone else thinks this and piles in, pushing the price up OR you will be left holding them at a discount for a very long time.

What’s going on with Saba?

Saba has been building up positions in over 20 Investment Trusts in the UK, with an immediate focus on 7, rather callously referred to by some as the Miserable Seven. Any of us with sufficient money could instruct brokers to buy shares in these Investment Trusts for us, and as long as our holding remained less than 30% of the trust, we could do so fairly incognito until we had a significant holding, and with no rules or governance. However, we could stamp our feet and start to call some shots.

With a swift right hook, on 18th December, Saba ruined Christmas for seven Investment Trusts by announcing they were calling general meetings in the New Year with the aim of sacking the current Boards, replacing them with 2 Saba people, and having the new Boards appoint Saba to run the investments and agree its fees. Buying your way to power, rather than gradually earning it. This has sent shockwaves through the industry as one entity could potentially take control of multiple trusts, merge them, sack the managers, shove up the fees, change the strategies, and effectively do whatever they want.

Why?

Many participants in the Investment Trust space have been trading at bigger discounts than they’d like since 2021. One argument is that as cash has been so compelling, it’s harder to look appealing to investors. Saba think this is a flimsy argument and say trusts should have moved sooner to correct course, buying back their shares which can reduce the discounts. As Mr Weinstein said this week: “the managers did not listen to us when we told them to narrow discounts”.

Saba also cite their superior management skills, pointing to their ETF in the US (CEFS) which costs 1.1% a year and has posted annualised returns of around 11% over the last 5 years, according to their website. Which also indicates that it has underperformed the S&P 500 over this timeframe.

I’m not sure the argument about performance is entirely persuasive. Some of the investments held by these trusts also require specialist skills to manage – Edinburgh Worldwide famously has a big allocation to the unlisted SpaceX, for example – and so the jury is out on whether Saba has the specialist knowledge to manage some of the trusts.

This fight will be decided by us!

This story has a further twist. Roughly 30%-40% of these trusts are owned by people like us (Saba owns between 20% - 29% of them). Average Joes who buy through platforms such as Hargreaves Lansdown, ii, AJ Bell and the like. The outcome of this fight is largely up to us. Now, voting is boring. You have to log on to a platform and register your intent. Most of us don’t do it, but this time guys, it’s important. So which way should you go?

Saba has raised performance questions – which in part are valid. And frustration with discounts – also valid. Furthermore, they cite a lack of engagement from the trusts, which I suspect is cobblers. Karen Brade, chair of Keystone, tells me they reached out to Saba a number of times between September and December last year, and were ignored or stalled on the last three occasions. It’s not been a pretty fight.

The key question is can Saba do any better and in whose interests are they acting? I both admire and loathe hedge funds because they have no interest in value and a single-minded interest in price. Whatever the thing attached to the price is. In my opinion, they speak one language and that is making a quick buck, whilst seemingly less fussed about good governance, independent oversight and conflicts of interest.

Mr Weinstein has seen a bunch of Investment Trusts trading for too long at large discounts and has turned Investment Trusts into an asset class, seeing something trading at a discount, and he thinks he can get rid of these discounts and pump up the price.

Their detractors will say they're trying to take control of a company through the back door. Buy enough to have some clout, but not enough to have boring governance restrictions. Rely on the fact that people like you and I cannot be bothered to vote because financial admin is like watching paint dry. Take control. Put in a small number of their lieutenants. And potentially shove up the fees on a total pot of money worth about £4 billion.

Their supporters (few and far between amongst both the press and investment industry) will say that UK Investment Trusts have been trading at discounts for too long, and that boards were too slow to react to the impact of rising gilt yields, not taking charge of the problem, or fixing it. Leaving investors with long periods of underperformance, or holding investments they have lost faith in, but don’t want to sell because they're trading at a discount. “I hope that the UK wakes up,” said Mr Weinstein, talking on Merryn Somerset Webb’s podcast - which is worth a listen if you want to hear directly from the protagonist himself.

The trusts fear they could lose this fight if retail investors do not vote and we will end up with a apathy-fuelled coup. If you hold Herald Investment Trust, Baillie Gifford US Growth, Keystone Positive Change, CQS Natural Resources, Henderson Opportunities, European Smaller Companies or Edinburgh Worldwide, log on to your platform and cast your vote this weekend.

My personal view is that Saba’s DNA is that of a more short-term opportunist and I haven’t seen enough detail to understand how they will act in the best interests of the retail investor. However, I do think this is a wake-up call for Boards of Investment Trusts and a very public kick up the bum on how discounts are managed. Whatever your view, vote. This time it really matters.

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login