Here comes Blighty?

By Holly Mackay, Founder & CEO

5 April, 2024

Tick tock people, this is the last day of the tax year. Look down the back of the sofa, raid the kids’ piggybanks, make any last-minute transfers and do what you can to keep your tax bills a bit lower.

Many (but not all) providers will keep accepting contributions until midnight, but don’t be that person shouting at their computer glitching at 11.55 pm tonight. If you want to pay into a Stocks & Shares ISA but are procrastinating, our 2024 ISA Best Buys are a good starting point. And ditto for our 2024 Best Buy pensions.

Here’s a final reminder of how pensions are good news (if you can afford to set that money aside until you are 55+). For every £80 you pay in, this is automatically beefed up to £100, just like that. This is for basic rate taxpayers in the UK. And if you’re a higher rate taxpayer, when you do your tax return next January, you tell them about the £80 contribution and they say “Oh well done Holly, saving for your retirement so you don’t rely on us, take £20 off the amount of tax you owe us for being such a good girl.” This is effectively a refund of the higher rate band of tax you paid on that £80 of income.

I think this is often misunderstood so forgive me labouring the point. But any higher rate taxpayer who can shove anything in today will get a frisson of triumph in the cold dark days of next January as you see how much less tax you have to cough up. It’s much more rewarding than any dry January nonsense!

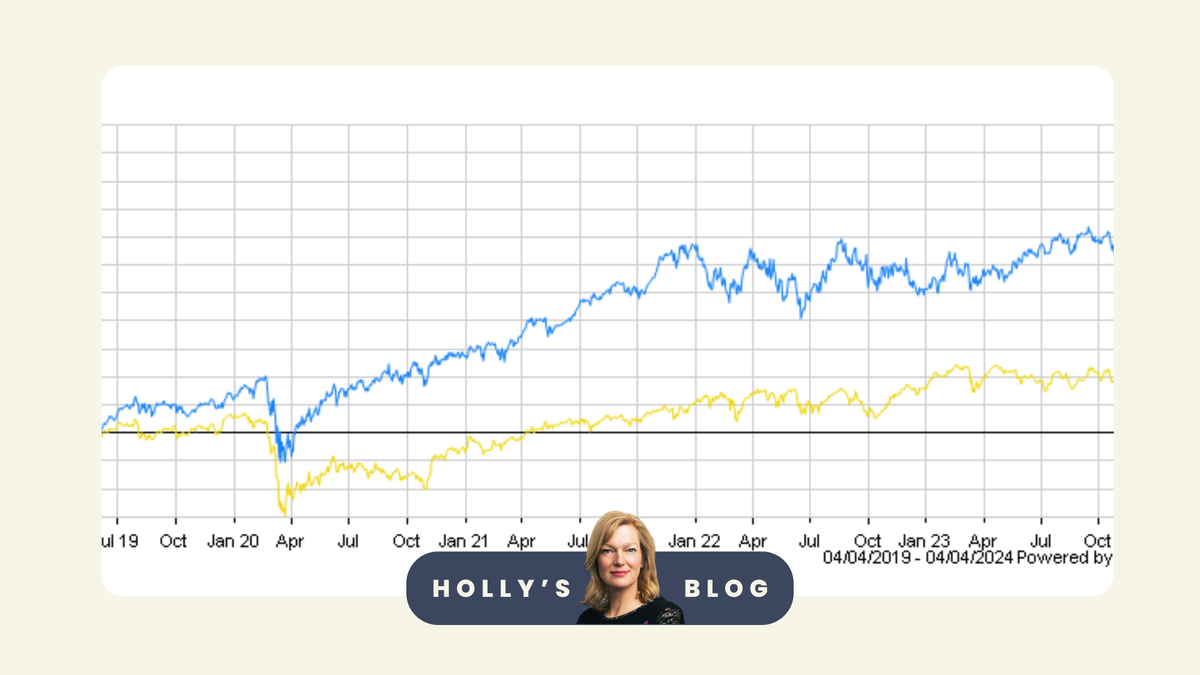

Tax aside. What else is going on? The unloved FTSE 100 is having a moment on the dancefloor, belting out “I Will Survive”. After a long time in the shadows of his shinier American cousin (the blog image shows the 5 year performance of both, the FTSE is the yellow line), the FTSE 100 has risen 5% in the last month, compared to the S&P 500 rising just over 0.5%. Here’s a bit of a compare and contrast of these two.

The S&P 500 is obviously in $ (unless you buy a ‘hedged’ version to remove currency risk). This means that your overall returns will benefit from a strong dollar. If you fancy removing currency from the equation, consider something like the iShares S&P 500 GBP Hedged ETF (this is an Exchange Traded Fund which is a cheap, easy way to get a whole index in one single wrapped up product). Or if you like your investments cleaner and greener, there’s the Invesco S&P 500 ESG ETF which has a lower 303 holdings in, with the ‘dodgies’ screened out.

The S&P also has a very heavy weighting to tech stocks whereas the FTSE is more ‘old skool’ – think energy, industrials and financial stocks. Apple, Microsoft and Amazon are the top dogs over the Atlantic, whereas we have Shell, AstraZeneca, Unilever and HSBC.

This make-up impacts the ‘dividend yield’ of both. Dividends are when cash-rich companies share some of the spoils with investors, paying out regular dollops of cash known as dividends. And tech companies in the main are not cash rich, so the S&P only pays out around 1% compared to the FTSE 100 which pays out just under 4%. So if you're retired and you want an income from your investments, the FTSE 100 will be more appealing. For example, Vanguard’s FTSE 100 Index fund has a historic yield of 3.7%.

As well as high dividends, the FTSE 100 is relatively cheap. The average valuation of its companies is around 11x what they earn. (This is called the Price Earnings ratio, or P/E ratio, and is a way of seeing how expensive a business is. It makes sense. For example, if a bakery earned £50,000 a year and they wanted you to pay £100,000 to buy it, that would be a P/E ratio of 2. You would consider it. If they asked for a P/E ratio of 10 – £500,000 – you’d tell them to sling their hook.) If we compare the FTSE 100 P/E ratio of circa 11x to the States, where the P/E ratio of the S&P 500 is around 27 times earnings, you can see why people start to wince.

So in theory the FTSE 100 is cheap, it pays nice dividends out and it’s potentially gaining strength when the US market is looking a touch overcooked. But as always, trying to identify the precise pivot on the ‘which market will do better seesaw’ is impossible, so I just have a bit of both! I also use ETFs to get exposure to these giant, well-researched markets.

Over and out for this week, folks. If you’re scrabbling around for something to watch, I’m enjoying The Dropout on BBC. It shares the story of Elizabeth Holmes who founded Theranos, raised hundreds of millions at a P/E ratio of about one squillion and is currently serving 10 years for fraud. I have no idea how much is poetic licence and how much is accurate, but it makes me feel both very boring and very honest as a founder of a business! I might start rocking the Steve Jobs turtleneck look and dig out my red lippy though...

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login