What's everyone else up to?

By Holly Mackay, Founder & CEO

14 July, 2023

Before I dive into a nose about what everyone else is up to, I want to start by paying tribute to Nick Hungerford. Nick founded the robo adviser Nutmeg, and sadly died this week aged 43 after a battle with bone cancer.

I met Nick about 12 years ago and he enthusiastically described his vision to bring online investment portfolios to the mainstream, and out of the stuffy, mahogany boardrooms of private banks. And he did it, eventually selling the business to global giant JP Morgan. He leaves a wife and a young daughter – Elizabeth – and in his last months founded a charity to support children who have lost parents. RIP Nick, you were a powerhouse and I admired you greatly.

This has been another difficult news week, dominated by economic woes, s3xting and media meddling. I write s3xting like that not because I am coy but because my blog once set off a profanity alert at the Financial Conduct Authority when I wrote about the bottom of the market, so y’know, don’t want to give them a hernia 😉

This week it was not the market’s bottom bothering us, but we did digest the news from the Bank of England that a million households will pay about £500 a month more on their mortgages by 2026. At the same time, the UK economy shrank by 0.1%, which is blamed on the endless May bank holidays and Coronation cavorting. And inflation still has the UK economy in its vice-like grip.

What are investors up to?

Every month we produce lists of the bestselling funds and trusts across major platforms. In June we saw the usual suspects of big global funds, lots of US exposure and some perennial investor favourites like City of London investment trust (old, solid, big on dividends) and Fundsmith Equity (lots of consumer brands and US exposure).

This week’s blog sponsors Invesco share some info on their “All World” fund which has over 4,000 companies across 49 different countries in this single product – an example of a growing trend for low-cost, one-stop solutions for those wanting a single way to access a huge batch of investments, and then forget about it.

However, it’s not just these broad brush global things which are popular. Fidelity's global technology fund makes an entrance, with top holdings in usual suspects Microsoft, Apple, Amazon and Alphabet. And AI dominates. Amongst the bestselling ETFs on Hargreaves Lansdown is the Global Robotics and AI ETF, which has 44 holdings from across the sector, and interestingly a large chunk in resurgent Japan as well as the US.

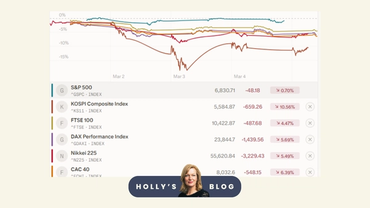

Many commentators have discussed the largely unexpected rally in US tech stocks in the first 6 months of the year. And now everything looks overdone, overpriced and over-AI-ed. Will global attentions migrate to Japan and Europe? Will the US rally turn into recession? And is deflation around the corner?

The investment equivalent of The Rock on tequila

Some of those who think the US looks overcooked are backing the Wisdom Tree Nasdaq 100 3x Daily Short product. Reader alert - This is one of the most hairy-@rsed products a retail investor could get. It is the investment equivalent of The Rock downing tequilas before a wrestling bout. (I think I should get a job in compliance. Imagine how much fun you could have writing proper risk warnings which actually meant something to people!)

Here’s what the company says it does: “WisdomTree NASDAQ 100 3x Daily Short is a fully collateralised, UCITS eligible ETP designed to provide investors with a leveraged short exposure to the NASDAQ 100.“ Huh!?!

In real English, you are taking out a bet, and betting that a collection of 100 leading US tech companies will go down in value. And if you bet £100, for every 1% that this collection of 100 shares falls in value on any one day, the value of your stake goes up by 3%. So your stake goes to £103, if the Nasdaq falls by 1% that day.

Oooh, lovely! But here’s the rub. For every 1% it goes up, the value of your stake goes down by 3%. Ouch! And the ‘clock’ is effectively re-set every morning and the calculations start again every day. Not for the faint-hearted.

You can read the full list of bestselling funds and trusts in June here, for more insights on what everyone else is up to.

Have a great weekend everyone. I am sitting in Devon in the middle of a rain cloud. Don’t you just love the Great British Summer!

Holly

Want to get Holly's weekly blog straight to your inbox?

Already have an account? Login